Axtman is a undergraduate student for Medill on the Hill, a program of Northwestern University in which students serve as mobile journalists reporting on events in and around Washington, D.C.

The Biden administration has taken aim at the for-profit college industry with a new rule to help prevent students from being saddled with massive debts. The fate of the program, however, could lie in who occupies the White House in 2025.

In September, the Department of Education announced its final Gainful Employment Rule (GER), which compels for-profit institutions and certificate programs to demonstrate that students who attend their schools fare better than if they had not attended.

Experts say the rule will save taxpayer dollars and hold for-profit institutions accountable. The Biden administration predicts the plan will protect approximately 700,000 students; however, the plan has not garnered support from both sides of the political aisle.

The GER, which was first enacted by the Obama administration in 2014, limits a student’s debt based on the borrower’s income, but the Trump administration abandoned this rule.

The Biden administration reinstated the rule and added a new provision requiring half of the graduates of the college programs to have higher earnings than someone who only has a high school diploma, which is about $25,000 nationally, but varies by state.

If a school fails these measures twice in a three-year period, it lose federal aid eligibility, which is a serious blow to their profits. According to estimates from the Brookings Institution, all for-profit colleges generate at least 70 percent of revenue from federal sources.

“The idea is that students will probably be less likely to enroll in those programs because they will no longer have access to the aid that they need to afford them, which will redirect students into programs that are more affordable and have better outcomes,” said Lydia Franz, a policy associate for the Institute for College Access & Success, a nonprofit that advocates for students to receive affordable and quality higher education.

Unlike nonprofit universities, for-profit institutions are not required to invest students’ tuition back into the school. They function as a business, meaning investors and stakeholders can make financial gains from the school. As a result, for-profit institutions are often more expensive.

Representatives of the for-profit sector say the gainful employment regulation unfairly targets their industry. Jason Altmire is president of Career Education College and Universities, a national association representing over 1,100 campuses. He said several programs at public and nonprofit colleges do not yield high wages after graduation, yet they are not subject to the same rules.

Plus, he said some research does not acknowledge the nuances in the for-profit industry, like the outcomes of students from four-year, primarily online for-profit schools and shorter programs offered by career-oriented for-profit schools. It’s not comparing “apples to apples,” he said.

“The problem with the gainful employment regulations is they apply almost exclusively only to for-profit schools,” Altmire said. “We believe that accountability measures should apply to all schools in all sectors, every type of school so that all students can have the benefit of those protections.”

Because the rule is set to take effect July 1, 2024, the earliest a college program will lose federal aid is 2026.

This comes at a time where many institutions in the sector are already facing slumping enrollments, state and federal lawsuits, and bankruptcy. Cazenovia College, Holy Names University and Living Arts College, which all closed in the spring, are among the for-profit institutions that have shut their doors.

College closures often come unexpectedly and have damaging effects on students, causing many to end their pursuit of a college degree, according to a 2022 report from the State Higher Education Executive Officers Association. Of the 467 closed institutions the report examined, 50 percent were private, for-profit, two-year colleges, and 28 percent were private, for-profit, four-year colleges.

Harry Holzer, a public policy professor at Georgetown University, said experts can disagree on specific measures used to regulate the for-profit college industry, but there should be legislation in place.

“It's reasonable for the federal government to say, ‘You want this public money, you better have at least some minimal level of results and not stick unknowing consumers with the defaults and debts,’” he said.

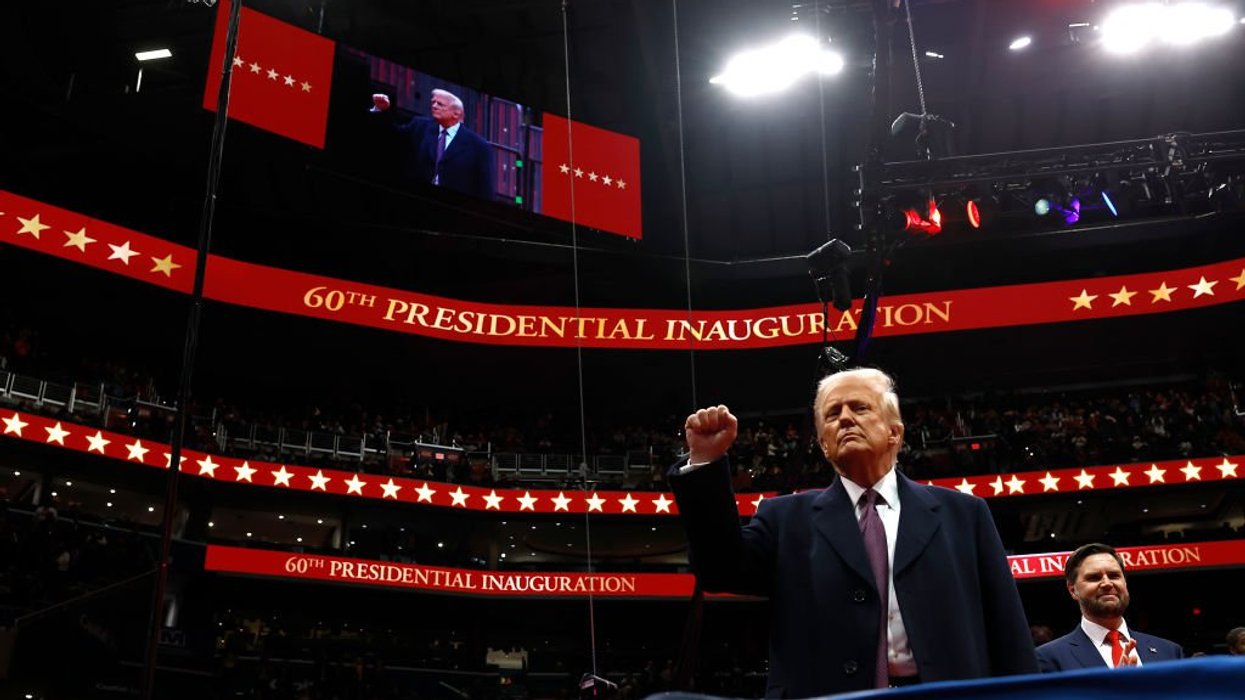

However, regulatory action will depend on who wins the 2024 presidential election.

Former President Donald Trump, who has a huge lead in Republican primary polling, did away with the rule during his term, and other leading voices in the party share his view.

In an open letter, Rep. Virginia Foxx (R-N.C.), chairwoman of the Education and the Workforce Committee, and Rep. Burgess Owens (R-Utah), chairman of the Higher Education and Workforce subcommittee on development, wrote the rule uses “arbitrary metrics” and “overly burdensome and unnecessary requirements.”

Both lawmakers also receive the highest contributions from the for-profit industry, with Foxx bringing in $125,650 and Burgess accepting $29,754 during the 2021-2022 election cycle, according to data from OpenSecrets.

“I welcome accountability and transparency in postsecondary education,” Foxx wrote in a press release. “It is desperately needed. But this regulatory package is simply the same witch hunt we’ve seen the Biden administration carry out over the last two years to undercut an entire sector of institutions that serves the needs of veterans, minorities, and other disadvantaged students that Democrats claim they care about.”

However, Franz said for-profit institutions often hurt rather than help these populations. She said the for-profit sector warrants stricter regulations due to its clear history of leaving students with worse outcomes.

Other institutions that serve minority populations, like Historically Black Colleges and Universities and community colleges, do not produce these same results, she said. Their students graduate and are able to pay off their debts at higher rates.

“There is bipartisan acknowledgement that the rule will have a significant impact, but those views vary widely across constituencies,” Franz said, who identified common themes in the thousands of public comments the Education Department received about the new gainful employment policy.

The previous rule already had a significant effect on the sector, said Sandy Baum, a nonresident senior fellow at the Urban Institute’s Center on Education Data and Policy. In 2010, 1.7 million students attended a for-profit institution as compared to about 800,000 in 2021, according to the National Center for Education Statistics.

Baum ascribes that decrease, in part at least, to for-profit institutions trying to improve and become more responsible.

“[Before] they were enrolling anybody who would sign on the dotted line,” she said, noting that she was describing a widespread – but not universal – practice. “They would go to homeless shelters and recruit people because all they wanted was their money, and it didn't matter if they dropped out quickly.”

Despite the topic not being inherently political, she said gainful employment has become divisive due to powerful lobbying groups. When the Obama administration first tried to introduce policy on gainful employment, it faced legal disputes for four years before the final rule was published.

Altmire, who served three terms in the House of Representatives, said there will likely be a new lawsuit to protest Biden’s updated rule.

In the meantime, Altmire fears the effects of this rule could go even further regardless of who serves in the White House.

“If you look at a different president, maybe a Republican president, who doesn't hold community colleges or public universities or elite universities in high regard, these same types of rules could very easily be weaponized against those kinds of schools,” Altmire said.