The Fulcrum strives to approach news stories with an open mind and skepticism, striving to present our readers with a broad spectrum of viewpoints through diligent research and critical thinking. As best we can, we remove personal bias from our reporting and seek a variety of perspectives in both our news gathering and selection of opinion pieces. However, before our readers can analyze varying viewpoints, they must have the facts.

As presently proposed, how much will be cut from Medicaid in the ‘Big, Beautiful Bill’?

The proposed "One Big Beautiful Bill" includes $880 billion in cuts to Medicaid over the next decade. These cuts would result in an estimated 10.3 million people losing Medicaid coverage by 2034 and 7.6 million becoming uninsured. The bill imposes work requirements for childless adults aged 19 to 64, penalizes states that provide Medicaid to undocumented immigrants, and ends certain tax practices that states use to fund their Medicaid programs.

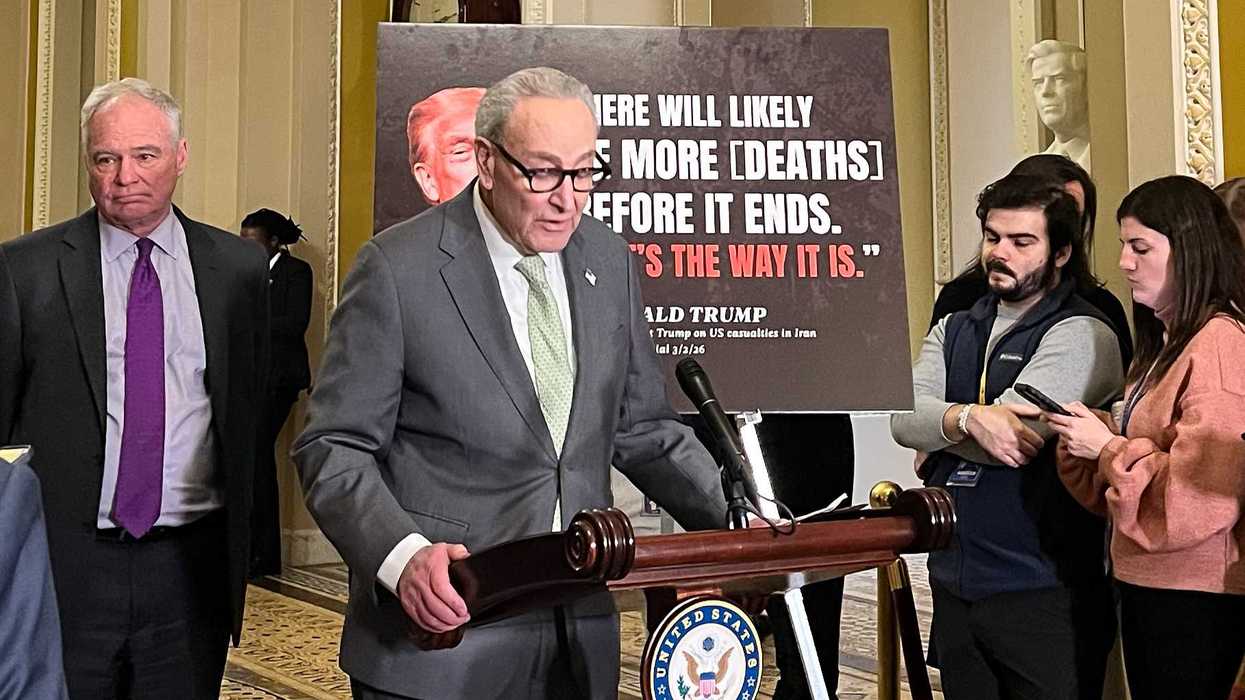

Republicans argue that these changes will reduce waste, fraud, and abuse, while Democrats warn that millions will lose access to essential healthcare. The bill is currently advancing through Congress, with Speaker Mike Johnson pushing for its passage by Memorial Day.

Who would be most impacted by the Medicaid cuts?

The proposed Medicaid cuts could have major consequences for several vulnerable groups:

- Low-Income Adults: The bill introduces work requirements for childless adults aged 19 to 64, requiring 80 hours per month of work, education, or volunteering to maintain coverage. Many individuals with irregular employment or disabilities that don’t qualify for exemptions could lose coverage.

- Elderly & Disabled Individuals: Medicaid funds long-term care for millions of seniors and people with disabilities. The cuts could reduce nursing home funding, forcing some facilities to close or limit services.

- Children & Pregnant Women: Medicaid covers 4 in 10 children in the U.S. and provides prenatal care for low-income mothers. The proposed changes could increase co-pays for certain services, making it harder for families to afford care.

- Rural Communities: Many rural hospitals rely on Medicaid funding. The cuts could force hundreds of hospitals to close, particularly in states like Kansas, Oklahoma, and Alabama. This would leave many communities without emergency care or specialist services.

- Undocumented Immigrants: The bill penalizes states that provide Medicaid to undocumented immigrants by reducing federal funding. This could lead to coverage losses in states like California and New York.

- General Healthcare Access: The bill eliminates provider taxes, which states use to fund Medicaid. This could reduce payments to hospitals and doctors, leading to staff layoffs and longer wait times for care.

Is the ‘Big, Beautiful Bill’ as presently constructed revenue neutral?

The present version of the bill is not revenue neutral. The current framework is expected to increase the deficit by around $6 trillion over the next decade. The bill includes trillions in tax cuts, particularly making the 2017 Trump tax cuts permanent, while also introducing deep spending cuts to programs like Medicaid and food assistance (SNAP).

House Republicans have set a $4.5 trillion cap on tax cuts but only if $1.7 trillion in spending cuts are achieved. If spending reductions fall short, the tax cut cap will be lowered accordingly. Some lawmakers are pushing for state-specific exemptions, which could further impact the bill’s fiscal balance.

How do Republican deficit hawks justify voting for it?

Republican deficit hawks justify voting for the “Big, Beautiful Bill” by arguing that the tax cuts will spur economic growth, generating additional revenue to offset the deficit increase. They claim that extending the 2017 Trump tax cuts will lead to higher GDP, increased investment, and job creation, which will ultimately reduce the long-term deficit.

However, some fiscal conservatives are demanding at least $2 trillion in spending cuts to balance the tax reductions. Speaker Mike Johnson has promised $1.5 trillion in cuts over the next decade, but some lawmakers are pushing for $500 billion more in reductions or a narrowing of the tax cuts.

At the same time, moderate Republicans are resisting deep cuts to Medicaid and food assistance, arguing that such reductions would be politically damaging. This has led to internal GOP conflicts, with different factions setting red lines that may be difficult to reconcile.

Are there any specific quotes from Republican members of Congress expressing concerns about the deficit and the bill?

- Rep. Lloyd Smucker (R-PA) led a letter signed by over 30 Republicans, stating: "Under the House’s framework, the reconciliation bill must not add to the deficit. The House budget resolution assumes that enacting President Trump’s agenda, including extending the 2017 tax cuts, will generate $2.5 trillion in additional revenue through economic growth. This means that all additional tax cuts or increases in spending above this level must be offset."

- Rep. Chip Roy (R-TX) voiced his concerns, saying: "This bill falls profoundly short. I am a 'no' on this bill unless serious reforms are made."

What is the breakdown of how different tax provisions, if passed, will contribute to the estimated revenue?

- Individual Tax Rate Reductions: Extending the 2017 Tax Cuts and Jobs Act (TCJA) individual tax rate reductions would reduce federal revenue by $2.16 trillion over the next decade.

- Corporate Tax Provisions: Maintaining the 21% corporate tax rate and extending bonus depreciation would cost $551 billion but could boost investment and productivity.

- Child Tax Credit Expansion: Keeping the expanded Child Tax Credit would reduce revenue by $735 billion but provide relief to families.

- Alternative Minimum Tax (AMT) Exemption: Continuing the higher AMT exemption would cost $1.36 trillion, benefiting high-income earners.

- Standard Deduction Increase: Preserving the higher standard deduction would reduce revenue by $1.25 trillion, simplifying tax filing for many Americans.

Overall, the bill is projected to reduce federal tax revenue by $4.1 trillion over the next decade on a conventional basis. However, when accounting for economic growth, the actual reduction in tax revenue might change.

How are different states or regions impacted?

The proposed Medicaid cuts will impact states differently based on their Medicaid expansion status, budget flexibility, and healthcare infrastructure. Here’s how some states are expected to be affected:

- Expansion States (California, New York, Washington, etc.): These states expanded Medicaid under the Affordable Care Act (ACA) and will face higher financial burdens to maintain coverage. If they don’t compensate for federal cuts, millions could lose coverage.

- Southern States (Louisiana, Kentucky, Montana): These states will see state spending increase by 18-20% to maintain Medicaid expansion. If they drop coverage, hundreds of thousands could lose insurance.

- Rural States (Kansas, Oklahoma, Alabama): Many rural hospitals rely on Medicaid funding. The cuts could force closures, leaving communities without emergency care.

- States Funding Coverage for Undocumented Immigrants (California, New York, Illinois): The bill penalizes states that provide Medicaid to undocumented immigrants by reducing federal funding. This could lead to coverage losses in these states.

- States with High Medicaid Enrollment (Texas, Florida, Pennsylvania): These states have large Medicaid populations and will need to increase taxes or cut benefits to offset federal reductions.

David Nevins is co-publisher of the Fulcrum and co-founder and board chairman of the Bridge Alliance Education Fund.