Early Thursday morning the House passed H.R. 1: One Big Beautiful Bill Act — yes, that’s it’s official title — a 1,100+ page bill with large cuts to both spending and taxes. We know the big picture but little about the details because it hasn’t been available for long enough for anyone to actually read it.

This is the “reconciliation” bill, the first signature legislation moved by Republicans in Congress and President Trump. This bill has special rules that make it immune to the Senate filibuster, so it can pass the Senate if a simple majority vote for it.

Here’s the bottom line: The bill has very large cuts to federal government spending, but it has even greater cuts to taxes. So overall, it’s projected to increase the yearly federal deficit by around $230 billion or 10%. (That’s so large that the global bond market has begun to reassess U.S. bonds, making the national debt even more expensive to keep up interest payments.) The last provision of the bill increases the statutory limit to the national debt by $4 trillion.

Some of the biggest cuts are in the low income food assistance program SNAP and medical assistance program Medicaid, in part through cuts and in part by making it harder for Americans to get the assistance.

But about half of those savings to the federal government are offset by increased funding for the military, border barriers (presumably on the border with Mexico), immigration enforcement, and immigration detention facilities, based on the latest Congressional Budget Office (CBO) estimate.

The biggest change is to taxes: higher for low-income earners and lower for high-income earners. CBO estimated that “household resources,” meaning mostly household income but also federal benefits, would decrease by around 4% for the lowest earners and increase by the same amount for the highest earning households. That includes a higher “SALT” tax deduction, which benefits high income earners in high-tax states, restoring it to roughly how it was before President Trump’s 2017 tax cuts. The tax cuts are the main reason the bill adds to the deficit.

Other changes include repeals of laws and funding for green energy, bans on transgender care (originally limited to minors, then expanded to all people) and abortion. The bill also includes a provision limiting the enforcement of court orders against the government (see text in bill).

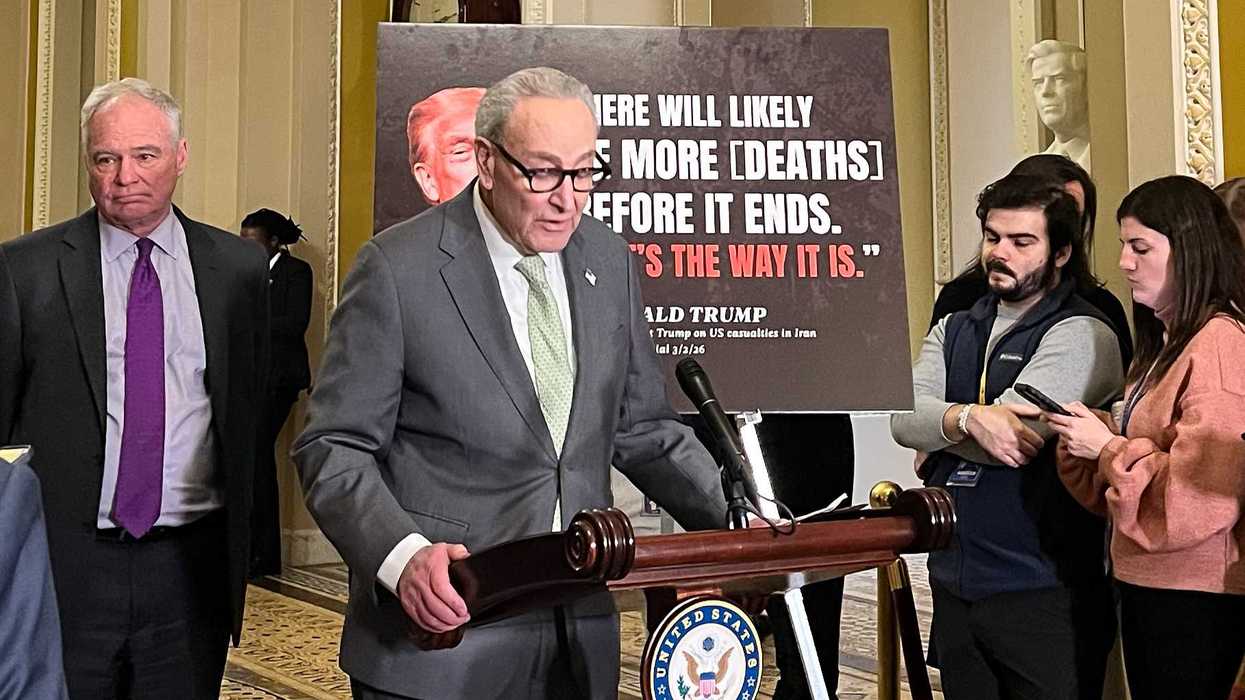

The Senate filibuster doesn’t apply to this bill if the Senate limits the bill to changes in taxes and spending, and not broad policy changes, at least according to the reconciliation rules. In the past, the Senate Parliamentarian had the last word on what’s allowed. But there’s some indication the Senate may change the rules to pass broader policy changes: The Senate passed some “Congressional Review Act (CRA)” bills this week in contravention of the ruling of the Parliamentarian related to CRA’s rules. While the situation is a little complicated, it suggests that if the Senate majority doesn’t like the Parliamentarian’s ruling on what counts as spending or taxes, they may quash a filibuster on H.R. 1 anyway, or fire the Parliamentarian. This would be a significant change to Senate practice.

The text of H.R.1 on GovTrack is out of date. The “ manager’s amendment ” to H.R. 1, the result of the House Rules Committee meeting held at 1 a.m. Wednesday morning ( yes, that’s 1 a.m.), was published only around 9 p.m. Wednesday night (less than 12 hours before the House began voting on the bill around 4 a.m. Thursday). The amendment is 42 pages long and contains some significant changes to the original text.

There will probably be time to read it before the Senate begins its debate.

H.R. 1 passed the House 215-214, with two Republicans and all Democrats voting against.

Editor's Notes: House passes 1,100-page spending and tax bill, raising debt by up to $4 trillion, was first published by GOVTRACK.us

Joshua Tauberer is the founder of GovTrack.us and created the site initially as a hobby in 2004.

Amy West has been the GovTrack research and communications manager since February 2017.