In February, the House of Representatives narrowly passed a Republican budget resolution, delivering a key victory for Speaker Mike Johnson (R-La.) and President Donald Trump—but at what cost? The 217-215 vote advanced a plan that calls for $1.5 trillion to $2 trillion in spending cuts over the next decade while extending and expanding the first Trump tax cuts to the tune of $4 trillion to $4.5 trillion. The contrast is stark: sweeping reductions in government programs that help middle- and low-income families, with Medicaid, SNAP, Pell Grants, and Social Security on the chopping block, to finance permanent tax breaks that disproportionately benefit corporations and high-income earners.

The GOP is betting that voters will reward them for cutting taxes and trimming government spending. But because economic insecurity remains high and healthcare costs continue to rise, slashing safety nets like Medicaid could prove politically toxic—especially among working-class and elderly voters in red states who rely on these programs.

The numbers paint a dismal picture. The GOP budget proposes a 20% reduction in the Supplemental Nutrition Assistance Program (SNAP), which over 42 million Americans depend on to combat starvation. The proposed Medicaid cuts are even more severe. Over 90 million Americans, including 37.6 million children, are enrolled in Medicaid or the Children's Health Insurance Program (CHIP). Slashing these funds would leave millions of Americans with reduced access to healthcare. Representative Brittany Pettersen (D-Colo.) returned to the House floor for her first vote since giving birth, bringing her newborn along as a statement against the proposal. “These cuts will devastate families,” she warned.

Under attack is not just healthcare and nutrition programs. The GOP also aims to scale back Pell Grants, a vital program that helps low-income students afford college. Reducing these grants will disproportionately affect students who rely on them to break the cycle of poverty and access higher education. Meanwhile, Social Security changes in the House proposal would force many Americans to work longer for less, impacting approximately 257 million people, or three in four Americans.

Why target these programs? The answer lies in the $4 trillion to $4.5 trillion in tax cuts that the budget aims to retain and extend. These cuts overwhelmingly benefit corporations and high-income households, widening the economic divide. Even some Republicans have voiced concerns. Rep. Thomas Massie (R-Ky.), the lone GOP defector in the House vote, bluntly stated that the plan “will increase budget deficits” because the tax breaks and new spending exceed the proposed cuts by trillions.

Republican leaders counter that their tax plan will generate enough economic growth to offset the deficit. However, this trickle-down promise has repeatedly failed in the past, most notably with the 2017 Tax Cuts and Jobs Act, which ballooned the deficit while delivering limited economic benefits to middle- and lower-income Americans. If Republicans were serious about balancing tax cuts with spending reductions, they could have taken a different approach—one that did not disproportionately harm the poor and working class while protecting corporate and wealthy interests.

Instead of slashing Medicaid, food assistance, and Pell Grants, Congress could have targeted wasteful spending, corporate handouts, and tax breaks for the super-rich. Closing corporate tax loopholes and eliminating the carried interest loophole could generate $1.8 trillion over a decade while ending fossil fuel subsidies would free up another $200 billion. A 5% reduction in the Pentagon’s $880 billion budget—targeting wasteful projects like the $ 1.7 trillion F-35 program —could offset cuts to social programs. Adjusting Medicare and Social Security benefits for the wealthiest retirees would save $400 billion, ensuring middle- and lower-income seniors remain protected.

Additional reforms could further ease fiscal strain while protecting the vulnerable. Eliminating corporate farm subsidies ($25 billion annually) and consolidating redundant federal programs identified by the GAO ($200 billion in savings) could shrink the deficit without harming essential services. Strengthening Medicare and Medicaid fraud detection could recover $100 billion annually while selling 77,000+ unused federal properties could save $1.7 billion per year. These targeted cuts and efficiency measures would help reduce the deficit without forcing low-income families, seniors, and students to bear the brunt of the burden.

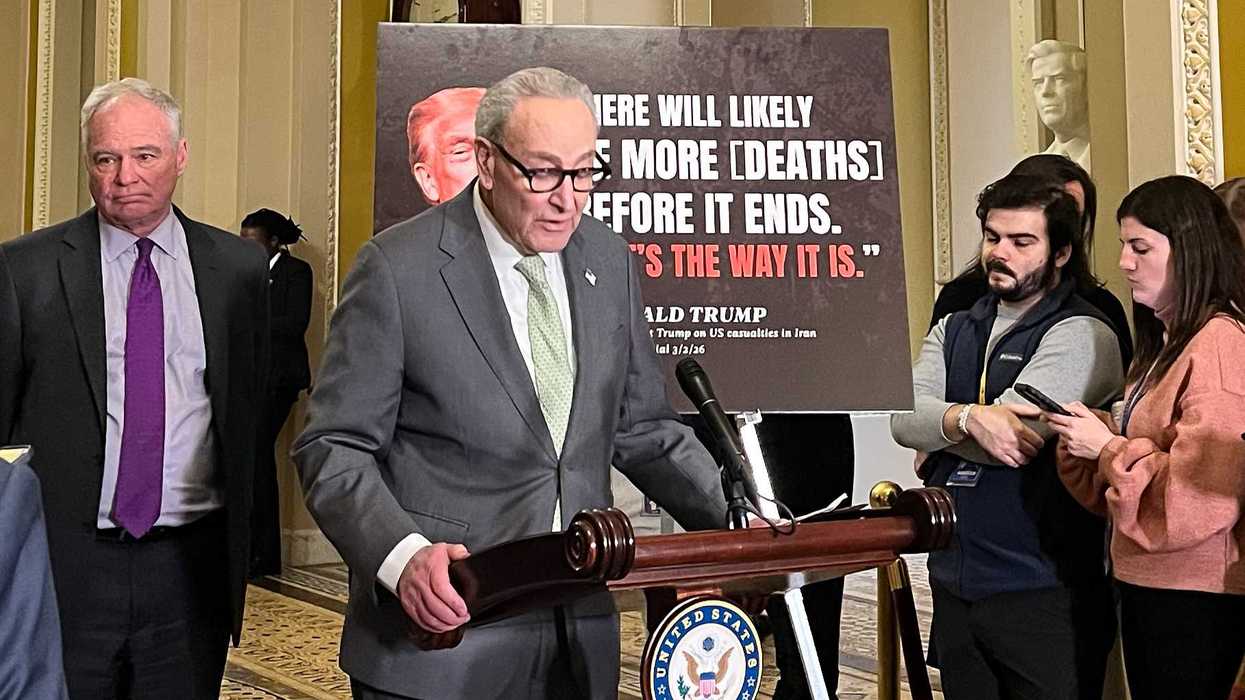

Even with the House GOP’s victory, the fight is far from over. The budget plan now heads to the Senate, where Republicans favor even deeper tax cuts but are also expressing unease over the House’s proposed cuts to Medicaid and other social programs. Senate Majority Leader John Thune has already signaled that substantial revisions will be necessary, making it unlikely the House version will pass without major changes. Some Senate Republicans are pushing to make the 2017 tax cuts permanent, which would further increase the cost of the plan, but they remain wary of slashing vital social safety nets to pay for them. The Senate’s skepticism underscores the GOP's deepening divide over balancing tax cuts with fiscal responsibility.

With the 2026 midterms looming, the GOP’s budget plan poses a massive gamble. While Republican leaders hope voters will focus on tax cuts, gouging deep holes in programs like Medicaid and SNAP could alienate key constituencies, including low-income families, the elderly, and working-class voters in battleground states. If history is any guide, prioritizing tax cuts for the wealthy at the expense of the most vulnerable is not just bad policy—it’s bad politics.

The House GOP’s budget resolution represents a significant inflection point in American politics. By proposing deep cuts to essential programs to fund tax breaks for the wealthy, Republicans are making a clear statement about their priorities. But it raises the most important question: Will voters accept these trade-offs, or will the backlash prove too great?

Robert Cropf is a professor of political science at Saint Louis University.