Sturner is the author of “ Fairness Matters ” and managing partner of Entourage Effect Capital.

This is the fifth entry in the “Fairness Matters” series, examining structural problems with the current political systems, critical policies issues that are going unaddressed and the state of the 2024 election.

Let me start by saying that I’m a capitalist whose study of economics was forged in business school in the early 1980s, grounded in Milton Friedman’s view of neoliberalism and an embrace of the free market. But, as any good student of Friedman will tell you, we don’t actually live in a free market economy, because our markets are distorted by the hand of the government.

But that’s just the starting point for this discussion. If you’re like me, and you too vote with your wallet, then it’s important to understand how narratives used by the politics industry distort reality and influence public opinion.

Who’s to blame for inflation?

If you buy into the GOP’s narrative, then you blame the Biden administration for the current inflationary environment. The GOP consistently cites the $1.9 trillion American Rescue Plan Act of 2021 as the main culprit of our current economic climate. While that certainly has been a factor, the perception is increasingly tied to ideology rather than data. So, is the American Rescue Plan truly the main culprit or is that political theater? To answer that question we need to understand that inflation has been a constant under almost every administration over the last 100 years. So, are there other factors in play? The simple answer is: Yes!

First and foremost, the printing of money is ground zero when analyzing what creates inflation. Once you acknowledge that inflation is caused by the monetary supply, you quickly realize that it’s how corporations and governments react to the increase that ultimately creates price increases. Make sense?

Beyond the money supply, if you zoom out you see that our current inflationary situation is a result of many factors including supply chain issues resulting from Donald Trump’s handling of the pandemic as well as Joe Biden’s reaction to it upon taking office. More recently, the Russian invasion of Ukraine, surging demand, production costs and swaths of relief funds all have played a role, as does the central banks’ fractional reserve policies. And we can not ignore corporate greed, which is a significant driver of inflation across many sectors, from oil and gas to groceries.

It's hard to overstate the implications of this. Interest rates soared — meaning things like mortgages got more expensive — while prices of consumer goods went up, too. And those price hikes hit middle- and lower-class Americans the hardest. One tool used to resolve inflation (raising interest rates) drives up costs and unemployment. So we're losing out in every direction, all while corporations cash in.

Debunking the economic narrative

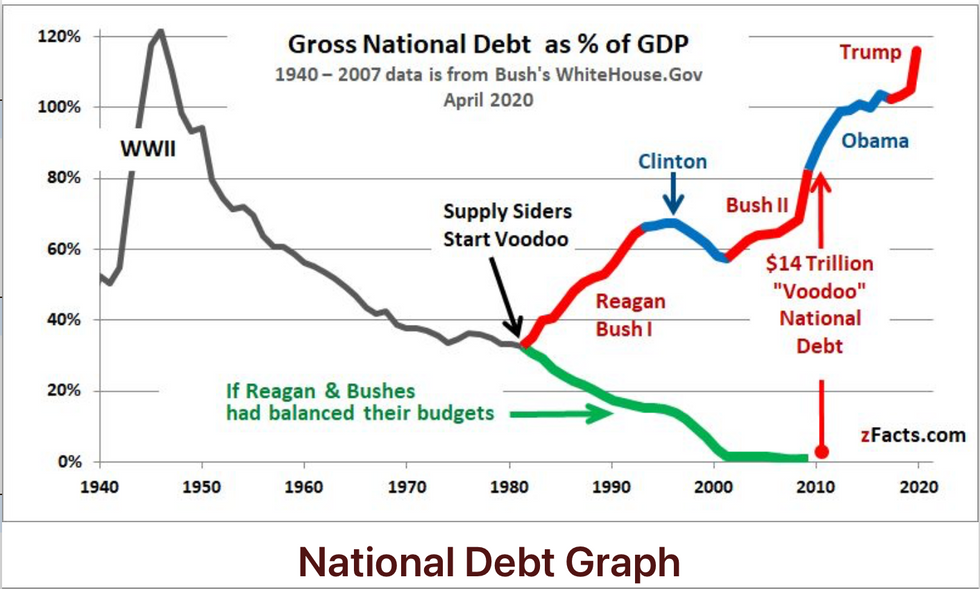

For much of the last four decades, the Republican Party has grounded its economic priorities in Reaganesque “ trickle down ” economics. While it is hard to argue that Ronald Reagan’s policies helped the economy recover in the aftermath of the Jimmy Carter years, does that mean that the GOP’s economic policies are preferable? And if so, to whom?

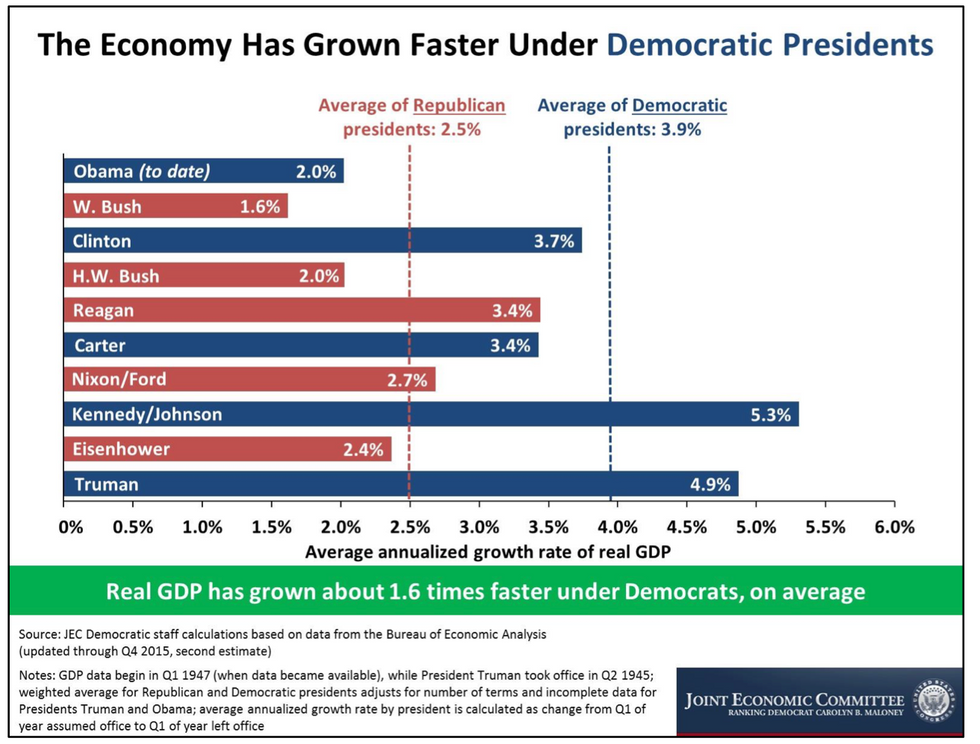

A 2016 bipartisan report of the Joint Economic Committee of Congress concluded: “The Republican Party claims to be ‘the party of maximum economic freedom and the prosperity that freedom makes possible.’ However, an analysis of economic performance since World War II under Democratic versus Republican presidents strongly suggests that claims that Republicans are better at managing the economy are simply not true.” The committee’s research asserts that if you look at every administration dating back to the 1970s, you’ll see that each Republican White House — except Reagan’s — has tanked the economy and every time it was the succeeding Democratic administration that helped pull us out.

According to those findings, and others, the U.S. economy has performed better on average under the administration of Democratic presidents than Republicans since World War II.

The reasons for this are debatable but the observation applies to economic variables including job creation, GDP growth, stock market returns, personal income growth and corporate profits. Ten of the 11 U.S. recessions between 1953 and 2020 began under Republican presidents. Red states are actually a drain on the American public, while blue states are economic engines that subsidize the federal government. The unemployment rate has fallen on average under Democratic presidents, while it has risen on average under Republican presidents. Budget deficits relative to the size of the economy were lower on average for Democratic presidents. And then there’s the stock market.

Since 1945, the S&P 500 has averaged an annual gain of 11.2 percent during years when Democrats controlled the White House. That’s well ahead of the 6.9 percent average gain under Republicans. “The market does do better under Democratic presidential control,” said Sam Stovall, chief investment strategist at CFRA Research.

Or maybe it’s just luck. Either way, I believe that adherence to Reaganomics has not served our country. And, as I explored previously in Fairness Matters, the net effect of GOP tax cuts has been the gutting of the middle class and the hollowing out of the American dream. And it’s important to note that economists caution that if Trump is re-elected, his proposed policies could cause a sharp rise in inflation. I firmly believe we must reject the dogma that the GOP’s policies are objectively better for the economy, while opening our minds to the fact that voting for a Democrat will not invariably lead to socialism. Only then can we begin to have a common sense conversation about how to bring fiscal responsibility to the heart of our political discourse. Which we must prioritize before it’s too late.

Both parties ignore the most important foundational aspect of Friedman's neoliberalism: austerity.

Consider data from the right-leaning National Review, which found that both Barack Obama and Trump, despite criticizing their predecessors’ spending habits, ran up the national debt. And the Biden administration hasn’t changed course. Our national debt now stands at an historic $34 trillion, threatening all of our futures or is it $65 trillion.

Scott Galloway, on his "The Prof G Pod" podcast, poignantly — and accurately, in my opinion — stated when giving his prediction for 2024:

“The American dream has become a hallucination. Medium home prices continue to vastly accelerate well beyond the pace of median household incomes. The only way you could bring housing back to affordable levels is if you saw a 35 percent correction, a 4 percent decline in interest rates, or 55 percent growth in income. Which basically means, we're in for a long road here in terms of affordability. It's unlikely any of those three things would happen.”

Sadly, I find it hard to imagine, given where our culture is today, that a politician will ever get elected by telling the American public that it’s time for austerity and to start making sacrifices for our children and grandchildren. Instead, we get rhetoric and finger-pointing and no common sense solutions. The only objective conclusion we can draw from the data is that neither party really cares about fiscal responsibility.

This is why the duopoly isn't working for us. As such, we have to find a way to come together and stop blaming one party or the other for the economic reality that the duopoly has wrought.

From left to right: Gabriel Cardona-Fox, Bud Branch, Joe Concienne

From left to right: Gabriel Cardona-Fox, Bud Branch, Joe Concienne

Trump & Hegseth gave Mark Kelly a huge 2028 gift