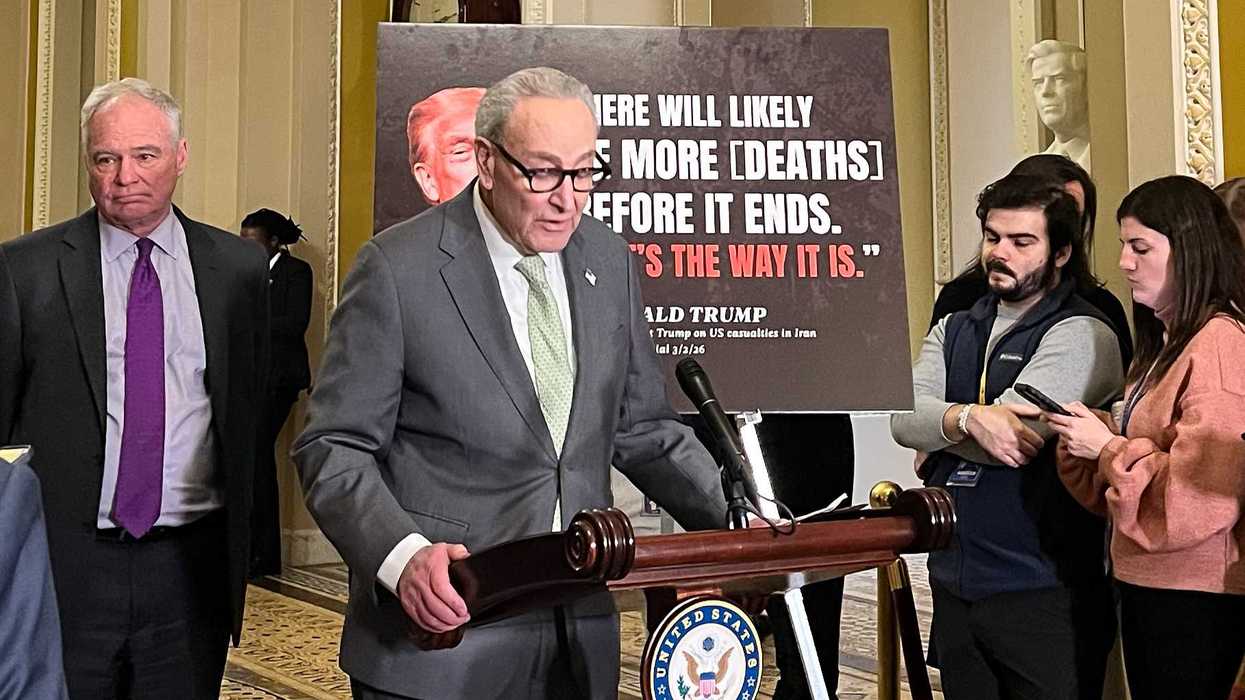

Schuman is policy director for Demand Progress. Olive is a writer and research assistant for the organization.

Last year, 57 members of Congress and 182 senior-level congressional staffers violated the law requiring them to disclose their financial conflicts of interest, according to painstaking reporting from Business Insider. When first asked about the violations, Speaker of the House Nancy Pelosi pooh-poohed the idea of prohibiting members from trading individual stocks, saying, “We are a free-market economy. [Members] should be able to participate in that.” In the months since, Pelosi has changed her public tune, asking one of her lieutenants to develop reform ideas behind closed doors.

What caused the turnaround? A mounting number of lawmakers endorsed various proposals to stop members of Congress from using the privileged information they regularly receive to make outsized gains playing the market. Pelosi, whose husband’s trades in tech stocks have earned their family millions and who has long been reluctant to move forward these kinds of reforms, was the perfect vessel to spark public outrage at the perfect time.

The world’s wealthiest cashed in on the pandemic; apparently, so did some members of Congress. Sen. Richard Burr is one of the more obvious exemplars. He offloaded millions of dollars of stocks after a briefing on the developing Covid-19 pandemic, apparently anticipating the March 2020 market crash. Burr is under investigation by the SEC and the FBI, and he has stepped down as chair of the Intelligence Committee — but has not seen any consequences from the Ethics Committee. (The Justice Department ultimately did not file charges against Burr, although one can imagine the DOJ must have considered the difficulty in proving such a case and possessed a reluctance to go after high-ranking politicians.)

In light of the pushback from members, and heaps of bad press, the speaker backpedaled. New bills to regulate or ban stock trading poured in; a bipartisan coalition called on Pelosi to bring legislation banning members from trading stocks to the House floor; and the House Administration Committee scheduled a hearing for Wednesday, March 16, to discuss the merits of the different proposals. The congressional rank and file, and the American people, oppose members personally profiting off information they receive as part of their public duties. Lest you think we are being unfair to Pelosi, many others in leadership of both parties and in both chambers have been reluctant to go down this path.

Making money public at the public’s expense is far from the only unethical, self-serving behavior in Congress. Banning congressional stock trading — if indeed Congress goes that far — is best understood as a small part of a suite of broader reforms that must address the perverse incentives warping how Congress functions and whom it serves. Reform must mean creating structural barriers to avoid temptation for members and staff, empowering congressional watchdogs to investigate instances of possible wrongdoing, and promptly holding wrongdoers accountable.

Currently, the House’s independent watchdog, the Office of Congressional Ethics, lacks subpoena power and is at times undercut by the House Ethics Committee, which is composed of members of Congress. The situation in the “upper” chamber is more dire: the Senate has no independent watchdog (although it should), and 2020 marked the 14th year in a row that the Senate Ethics Committee hadn’t recommended a single disciplinary action for misconduct — not even for the aforementioned Burr.

The STOCK Act, which was an attempt to place disclosure requirements on congressional stock transactions and was undermined before it fully went into effect, itself was a narrow reaction to a larger scandal. That law resulted from a big ethics scandal kicked off in large part by “ A Family Affair,” a report by Citizens for Responsibility and Ethics in Washington that was the basis for a “60 Minutes” report. In addition to apparent insider trading, the report exposed other unethical behaviors, including the misuse of campaign and political action committee funds and sweetheart deals for lawmakers’ family members who are lobbyists, contractors or “campaign employees.” The STOCK Act addressed the trading of stocks while other more encompassing legislation, such as the MERIT Act, went nowhere.

A decade later, it’s time we close the ethics loopholes exposed in 2012 by enacting stricter stock trading laws for members of Congress and outlawing other forms of self-dealing. That means passing one or more of the many bills banning members from owning individual stocks — anything less can be easily worked around. It also means going beyond stock trading and passing other legislation addressing long-standing ethics problems. Dozens of such bills have been introduced in the 117th Congress, including several bills regulating PACs and many restricting or prohibiting foreign funding of election activities.

However, as we learned from the STOCK Act saga, stricter regulations are just the start. Not even the best among the considered rules changes will have much effect without ensuring public transparency and addressing enforcement problems in the House and the Senate. That’s because Congress is effectively authorized to regulate itself. Unless the public has a window into Congress’ potential conflicts of interest and an external watchdog is empowered to investigate wrongdoing and hold violators accountable, Members will continue to act with little regard for the rules, with little reason to think there might be consequences for their actions.

Instead of an appetite for reform, we have seen efforts in both chambers to undermine the independent ethics process — the House tried to kill off OCE just a few years back, an effort we at Demand Progress beat back. Dozens of reform efforts are stalled in both chambers.

The House and Senate have to work for the American people and not for any particular interest. When the incentives of those who work in the engine of our democracy are turned towards fending for themselves — especially when fending for themselves is built upon deriving wealth from the success of giant corporate interests — the people’s business takes a backseat to the business of business. We can do better.