IVN is joined by Nate Allen, founder and Executive Director of Utah Approves, to discuss Approval Voting and his perspective on changing the incentives of our elections.

Podcast: Seeking approval in Utah

IVN is joined by Nate Allen, founder and Executive Director of Utah Approves, to discuss Approval Voting and his perspective on changing the incentives of our elections.

This week the House has cut its session to just Weds-Thurs while the Senate has its standard Monday evening - Thursday schedule.

There's the usual mix in the House of some bills likely to pass with large majorities and and a couple that will probably be party-line or close to.

A moderate number of committee meetings are scheduled across both the House and Senate.

But what will likely be occupying most legislators' minds is the war launched against Iran this weekend.

As we've discussed in past posts, if one is abiding by the constitution, then Congress must be consulted on, and agree to, a war.

Instead, the Trump Administration has launched this war without consulting Congress. Thus, this week we're expecting votes in both chambers on whether to approve the war that's already ongoing or not. The House resolution, according to Punchbowl might pass while the Senate one is unlikely to do so.

Even if one or both of bills made it through both chambers, the President could simply veto any bill limiting his actions knowing that successful veto overrides are extremely rare.

If enough members of Congress support the attack on Iran to preclude a successful veto override, do the members who oppose it have any other options?

Yes they do, although you'd not know it from the comments many legislators are making today. For example, earlier today, Rep. Jeffries (D-NY8) was on CNN suggesting that the administration had chosen to buy weapons at the expense of programs for the US population. But as Aaron Reichlin-Melnick pointed out, "'The administration' didn’t find billions for bombs, Congress gave the U.S. military billions for bombs. Trump is just using them up."

And that's where Congress's real power potentially lies: in appropriations. Our colleagues at the First Branch Forecast discuss this in detail.

The bottom line is that this, like tariffs, is an area where Congress has ceded its own authority to the Executive Branch.

Another area where Republican legislators are looking to cede their authority is with respect to the SAVE America Act. This bill has proven controversial due to the barriers it would create for US citizens who want to register to vote. So, today, Semafor reports that some Senate Republicans are saying they'd like to see the President bypass Congress entirely. That may seem odd on its face; why would someone say out loud on the record that they'd really like to be rendered even more irrelevant? The answer is that this way, if it goes poorly, the president takes the blame and the members can dodge accountability for policies that they support.

With the attack on Iran introducing considerable uncertainty into the week, we'll see you all on Friday to find out what Congress decided to spend their time on.

What War Powers? was originally published on GovTrack.us and is republished with permission.

Amy West is the GovTrack research and communications manager.

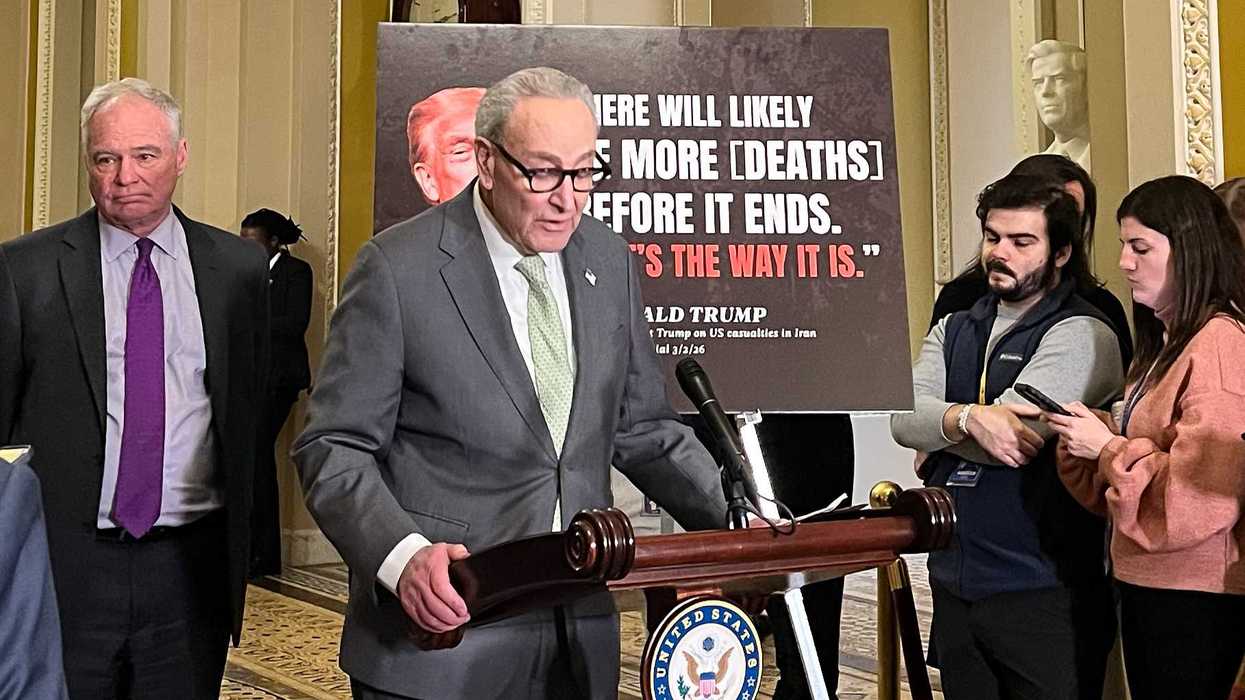

Sen. Chuck Schumer criticized the Iran War on Tuesday. Republicans and Democrats are mostly split along party lines in support and criticism of the war.

WASHINGTON — Senators seemed split along party lines over future military action in the Middle East after a classified intelligence briefing on Tuesday afternoon. Democrats called for increased clarity on the objectives and justifications for attacks, while Republicans supported the Trump administration’s current plan.

The conflicting reactions came as both the House and the Senate are scheduled to vote on a war powers resolution on Wednesday and Thursday, respectively. If passed, the resolution would limit further military actions in Iran without congressional approval.

Most Republicans criticized the measure and said that Congress should not take authority away from the president.

“We don’t need 535 commanders-in-chief,” Sen. Markwayne Mullin, R-Okla., told reporters in the Capitol on Tuesday. “The commander in chief is the president of the United States, and he has a duty in Article Two to be able to protect American interests, and he is initiating that and doing that with great authority and great effect.”

Democrats criticized the president for striking without congressional approval.

The Constitution grants Congress the sole power to declare war, but dictates that the president is the commander-in-chief of the armed forces.

“Nobody gets to hide and give the President an easy pass or an end run around the Constitution,” Sen. Tim Kaine, D-Va., said regarding the war powers resolution. “Everybody's got to declare whether they're for this war or against it.”

President Donald Trump launched strikes on Iran early Saturday morning. As of Wednesday morning, over 1000 people, including six U.S. service members, have been killed in the conflict, reported CBS News. Trump and members of his administration, including Secretary of State Marco Rubio, offered conflicting justifications for the war and different estimates of how long it might last.

Democrats expressed worry over the lack of clarity from the Trump administration.

“They have shifting goals, different goals all the time, different answers every day,” Senate Minority Leader Chuck Schumer, D-N.Y., told reporters Tuesday. “And I'm truly worried about the mission. There's no set plan being here day after day. ‘We're going to do this, this, this and this,’ and these are the reasons why you end up with an endless war.”

Schumer added that the answers given during Tuesday’s intelligence briefing were "unsatisfying."

Sen. Richard Blumenthal, D-Conn., echoed Schumer’s concerns about the unclear objectives.

“I am more fearful than ever after that briefing that we may be putting boots on the ground and that troops in the United States may be necessary to accomplish objectives that the administration seems to have,” said Blumenthal. “But I also am no more clear on what priorities are going to be of the administration going forward, whether it is destroying the nuclear capacity of the missiles or regime change or stopping terrorist activities.”

Blumenthal added that the “administration owes it” to the American people to release information about the Iran war.

Republicans came out of Tuesday’s briefing praising the administration and its objectives.

“They want to make sure that the ability for them to strike us anywhere at any time is gone,” said Mullin. “No way they'll be able to make a nuclear weapon or enrich uranium again. To take out their navy so they can't disrupt commerce in the shipping lanes, and to take out their ability to restock and rebuild their missiles and drones. That's the objective here.”

Mullin added that the U.S is “going to eliminate the threat that’s been threatening us for 47 years,” which “no other president was willing to stand up against Iran and eliminate it like President Trump.”

Others, like Sen. Lindsey Graham, R-S.C., expressed similar confidence in the U.S. military's power.

“Who’s going to win a war between the Iranian regime and the United States? We are. We’re going to win this conflict,” Graham said.

Marissa Fernandez covers politics for Medill on the Hill.

Wisconsin Gov. Tony Evers will call special sessions to ban partisan gerrymandering via constitutional amendment, as national redistricting battles intensify.

MADISON, Wis. - In his final State of the State address, Wisconsin Gov. Tony Evers announced that he plans to call a special legislative session in the Spring to put an end to partisan gerrymandering “once and for all.”

And he will keep calling lawmakers into session until happens.

- YouTube youtu.be

“There’s one thing that we should all be able to agree on, which is that politics should stay out of redistricting from start to finish,” he said.

He noted that while political differences may get in the way of creating a nonpartisan redistricting commission, state lawmakers and officials can still work together to ban partisan gerrymandering.

And so, he is going to call a special session so that the legislature can adopt a constitutional amendment to make the practice illegal. He also said he was willing to keep calling the legislature into session until they pass the amendment.

“I won’t hesitate to bring the Legislature into special session later this year in August. Or September. Or October,” he remarked. “Heck, I’m old enough to remember when the legislature was willing to meet in December!

- YouTube youtu.be

Evers’ announcement fell under the radar nationally at a time when officials in other states are still trying to push new congressional maps on voters and candidates – like in Virginia and Maryland.

Additionally, 5 states have implemented new maps passed by their legislature in 2025, including Texas, California (which voters approved under Prop 50), Missouri, North Carolina, and Ohio.

Utah will also use a new congressional map under court order.

Evers said the current chaos created by this bipartisan gerrymandering fight started with President Donald Trump, which is true. But then he added, “Democratic Legislatures have been put in the unthinkable position of having to respond by trying to restore balance to our elections.”

This suggests that Democratic-controlled states like Illinois, New Mexico, and Maryland didn’t already have egregiously gerrymandered maps – and that what started with Trump was not also an opportunity for Democrats.

In California, for example, Democrats tossed out an independent congressional map approved unanimously by the state’s redistricting commission for a map that gives their party an advantage in 92% of the state’s US House districts.

On the same day California Prop 50 passed, Maryland Governor Wes Moore called for the creation of a redistricting committee to come up with a new map that would hand the Democratic Party all of the state’s congressional districts.

Moore is getting pushback in the Maryland Legislature.

This is why independent reformers do not refer to the “you take our seats, we will take yours” mentality as “rebalancing.” They call it a race to the bottom, because when officials "fight fire with fire" everyone inevitably gets burned.

While Evers may not be willing to hold his own party accountable for its role in escalation, he wants no part of the power grab.

“Compared to all of the chaos, dysfunction, and recklessness in Washington, here in Wisconsin, we’ve worked to lead by example. And a big part of that is the fact that, today, lawmakers are elected under the fair maps I signed into law,” he said.

“But here’s the problem, Wisconsin: new maps are redrawn every ten years. While we have fair maps today, we still don’t have a nonpartisan redistricting process in place. That means there’s no guarantee Wisconsinites will still have fair maps after the next US Census.”

In 2024, Evers signed into law new legislative maps that he initially submitted to the state Supreme Court for consideration. The Republican-controlled Legislature passed his maps with bipartisan support.

The maps enacted for state House and Senate have been given A grades by the Princeton Gerrymandering Project. However, the state’s congressional map still has an F, failing in partisan fairness in particular.

Evers previously pledged to push for an independent redistricting process that takes map drawing out of the hands of legislators. His remarks at the 2026 State of the State signal his skepticism that it will happen under the current political environment.

So, for now, the proposed constitutional amendment will have to do – if the legislature gets on board. In order to amend the state constitution, a proposed amendment needs to clear the legislature in two consecutive legislative sessions.

Tony Evers’ Final Mission as Governor: End Partisan Gerrymandering for Good was originally published by Independent Voter News and is republished with permission.

What's happening in our country? Americans are living through a political transformation we did not vote for, did not debate, and did not consent to — and it is happening in real time. [NPR]

America was built on a radical idea: that a diverse people could govern themselves, that power would be shared, and that no leader could ever place himself above the law. The framers designed a Constitution that divided authority, checked ambition, and protected the voices of ordinary citizens. They feared concentrated power. They feared silence. They feared exactly what we are witnessing today.

We were promised a participatory democracy — a nation where the government listens, responds, and protects. Yet Renee Good, a mother of three, was killed by an ICE agent in her own community. [Family Equality] And people like Alex Pretti — shot nine times in Minnesota just seventeen days later — reveal how far the government has drifted from its basic duty to protect life. [TIME]

The truth is, we did not vote or legislate for this.

What we are watching unfold is not the result of public debate or democratic choice. It is the result of strategic decisions made by a small circle of operatives and loyalists who have been reshaping our institutions while Americans were focused on survival — food, shelter, healthcare, safety. [NPR]

And this is what makes the moment so dangerous. People came to this country for freedom of thought, belief, and freedom from government control. Many fled nations where political values were imposed on them by force or fear. Now, in the country built to protect individual liberty, we are watching a movement determined to force its political values on everyone else, even when those values contradict the Constitution they claim to defend.

This is the contradiction at the heart of our crisis: a free country cannot survive when one faction insists on imposing its worldview on the entire nation. That is not democracy. That is not constitutional governance. That is the beginning of authoritarian rule.

Our democracy feels as if it is on pause. Congress has gone quiet. [NPR] The Supreme Court has stepped back from its role as a check. The Department of Justice appears aligned with the president’s priorities [NPR], and court orders are ignored or delayed. [The Hill]

When one branch expands while the others retreat, the balance the framers designed collapses — and the people lose the protections only a fully functioning democracy can provide.

Americans are not unhappy because they dislike democracy. They are unhappy because no one is listening — and because a government that does not listen cannot be participatory, responsive, or truly democratic. While families struggled with food prices, housing costs, medical bills, and the pressure of staying afloat, the people elected to represent them were focused elsewhere.

As Americans fight to survive, a small circle of political operatives and loyalists is quietly reshaping the government — infiltrating agencies, weakening institutions, and concentrating power in ways the framers feared. [POLITICO]

None of this is happening by accident. The people now driving federal policy include many of the same operatives, strategists, and former officials who helped design or promote Project 2025. [Newsweek] Their return to government has allowed the blueprint to be implemented through appointments, agency directives, and enforcement priorities — all without public debate or legislative approval.

Many of the authoritarian features we are now witnessing — the consolidation of executive power, the sidelining of independent agencies, and the use of government to punish political opponents — mirror the strategies outlined in Project 2025’s own planning documents. [TIME]

At the same time, ethics watchdogs have documented that the president has financially benefited from government spending at his private properties, raising serious concerns about conflicts of interest and the use of public funds. [CREW]

These patterns — loyalists in key positions, policy shaped by a private blueprint, and personal financial gain intertwined with public office — are hallmarks of a system shifting away from democratic accountability and toward concentrated, self‑reinforcing power.[NPR]

This did not happen overnight. The erosion of our democracy has been slow, deliberate, and strategic. Project 2025 did not wait for 2025; it began taking shape in 2023, quietly guiding appointments, agency priorities, and enforcement strategies before most Americans had even heard its name.

And perhaps the most painful contradiction is this: even as the administration targets immigrants with cruelty and suspicion, many of its own leaders — including the president’s own family — are the direct beneficiaries of America’s immigrant promise.

As the late Congressman John Lewis — a lifelong champion of civil rights and democratic courage — reminded us: “Democracy is not a state. It is an act.” [Democracy Journal]

Authoritarians depend on exhaustion. They depend on cynicism. They depend on people believing that nothing they do matters. As Rep. Alexandria Ocasio‑Cortez has warned, cynics and defeatists end up telling the same story authoritarians need us to believe — that hope is naïve, that resistance is futile. But that story is false. And we cannot afford to fall for it.[Alexandria Ocasio-Cortez | Facebook]

Americans must reclaim the democracy the framers designed — not by wishing for it, but by acting for it.

To restore balance, protect the vulnerable, and ensure that Congress once again serves as a check — not a chorus — we must vote in every election, at every level, local, state, and federal. We must pay attention. That means researching, staying informed, and following the votes cast in Congress, because votes reveal priorities, expose loyalties, and show us who is serving the people and who is serving a private agenda. And we must support leaders working to protect democracy—and vote out those who are not.

We must strengthen the civic infrastructure that authoritarian systems depend on weakening. That means joining or donating to civic organizations, civil rights groups, watchdog nonprofits, and community coalitions that defend democratic norms and hold leaders accountable.

We must also peacefully protest. The First Amendment was written for moments like this — when government power grows unaccountable, and citizens must make themselves visible. We must continue using our phone cameras to document what is happening in our streets, because evidence matters. Our current system protects abusers and labels victims as threats or terrorists.

And we must confront another painful truth: the federal government has not been cooperating with state governments — especially those led by officials who refuse to align with the president’s agenda. Blue states appear to be targeted with punitive policies, withheld resources, and public hostility — a direct violation of the constitutional principle that the federal government serves all Americans. This is not how a constitutional democracy behaves — and Americans must insist that the federal government stop targeting states for political punishment. What is missing is compassion, empathy, and the moral grounding that should guide public service.

We rebuild habits of participation. We talk to neighbors. We show up. We organize.

The government we value will fade if we let it. Authoritarianism is taking root in real time only if we refuse to pull it out by the roots. And democracy — as John Lewis reminded us — is not a state; it is an act. This is our act: to vote, to research, to pay attention, to join, to donate, to protest peacefully, to organize — together — to insist that the United States remain a nation where power is shared, rights are protected, and government answers to the people, not the other way around. Democracy can still be saved, but only if we act. And now it is our turn to perform it.

_____________________________________________________________________________

Carolyn Goode is a retired educational leader and national advocate for ethical leadership, government accountability, and civic renewal. She writes about constitutional responsibility, institutional integrity, and the urgent need for public‑centered governance.