In 1974, Linda Taylor, a 47-year-old woman in Chicago, was indicted on 31 counts of fraud involving welfare, medical assistance, food stamps, and Social Security benefits. Though few knew her name, many came to know her as the “welfare queen”—a label first coined in a Rochester, New York newspaper and later amplified by Ronald Reagan on the campaign trail in 1976. Without naming her, Reagan described a woman who used 80 aliases to collect government benefits, claiming she earned $150,000 tax-free annually. The crowd gasped. Taylor became the symbol of a racialized myth: that Black women were exploiting government handouts.

Reagan never mentioned Taylor’s race, but he didn’t need to. As Bryce Covert of The New Republic explains, the image of a fur-wearing woman in a Cadillac was unmistakably Black to many White Americans. Though 60% of AFDC (Aid to Families with Dependent Children) recipients were non-Black, media portrayals had racialized poverty. Taylor became a proxy for resentment toward Black Americans and public assistance. The stereotype mirrored that of affirmative action: the idea that Black people were gaming the system, prompting policies that harmed all poor families.

After Reagan’s election, Congress slashed $25 billion from programs aiding the poor, cutting over 400,000 households from AFDC. In 1974, 12% of Americans lived in poverty, surviving on just over $5,000 a year for a family of four. AFDC offered only $3,456 annually—an amount untouched for years despite inflation. Ironically, while poor White families were the majority of welfare recipients, they too bought into the myth. The real exploiters of the system weren’t the recipients—they were the architects.

Fast forward to the COVID-19 pandemic: the CARES Act, designed to provide relief, became another example of systemic exploitation. Before Biden’s presidency, lobbyists tied to the Trump administration helped clients secure over $10 billion in targeted assistance. More than $273 million went to companies owned by major Trump donors, with ethics waivers shielding conflicts of interest.

The Paycheck Protection Program (PPP), intended to support small businesses, disproportionately benefited large corporations. Forbes reported that 25 companies linked to Trump and Jared Kushner received over $4 million each. While most small businesses received less than $150,000, the parents of Press Secretary Kayleigh McEnany received up to $2 million. The administration tried to conceal these records, forcing media outlets to sue for access. Meanwhile, Tom Brady’s wellness company received nearly $1 million in PPP funds—while he signed a $50 million NFL contract. Representative Marjorie Taylor Greene had $183,504 in loans forgiven. Yet the narrative persisted: Black women were the ones abusing the system.

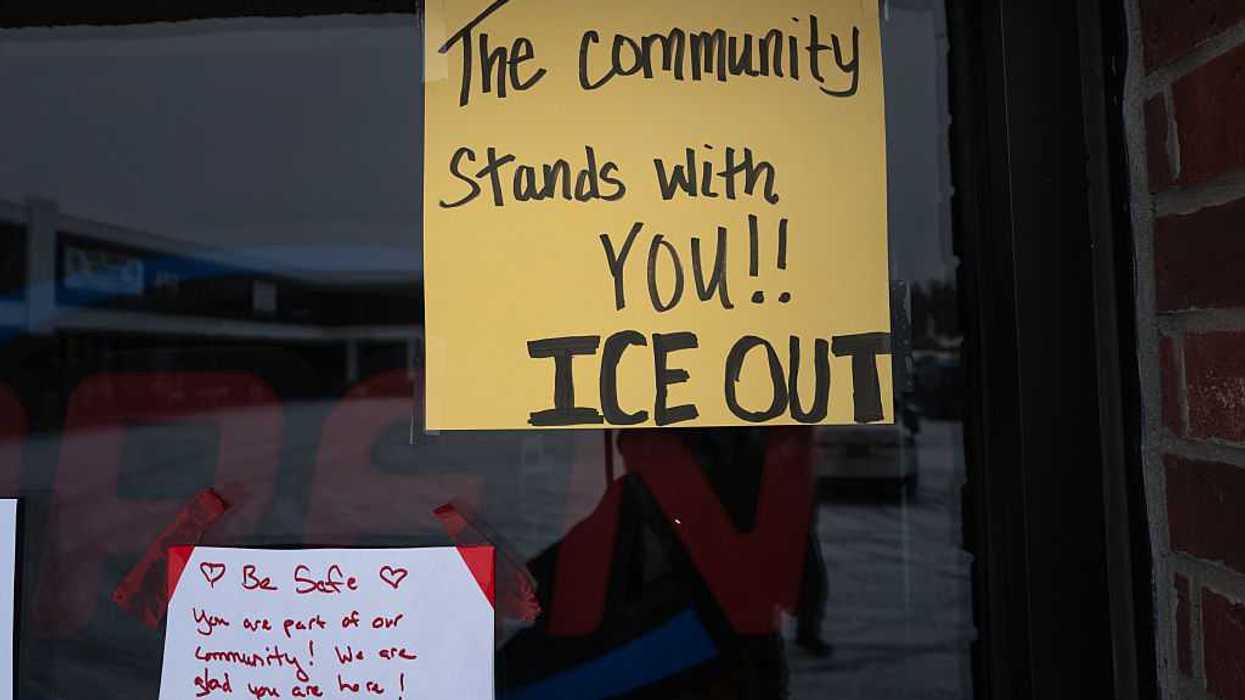

In 2025, this myth continues through SNAP (Supplemental Nutritional Assistance Program). The Trump administration has pushed policies that cut assistance for low-income Americans—from Medicaid rollbacks to government shutdowns that halted food subsidies. Internationally, the closure of USAID has left hundreds of thousands starving. Domestically, the face of hunger is still portrayed as a Black woman.

Using OpenAI’s SORA platform, viral videos have emerged of AI-generated Black women claiming to exploit SNAP benefits. FOX News ran these videos as real, later changing the headline without apology. Influencers like Brett Cooper shared them, amplifying false quotes like “I get over $2,500 a month in stamps. I sell ’em for cash,” or “It’s the taxpayers’ responsibility to feed my kids.” These videos, though fake, reignite the Linda Taylor stereotype. Despite the fact that most SNAP recipients are White, the AI-generated faces are exclusively Black women.

Mainstream media has also contributed. CNN and other outlets have been criticized for disproportionately featuring Black women in stories about food assistance. The myth endures: the welfare queen is alive and well, even as the real beneficiaries of taxpayer money live lavishly.

While Trump’s administration redecorates White House bathrooms, hosts Mar-a-Lago parties, and flies officials on private jets, the scapegoat remains the same. Homeland Security head Kristi Noem spent nearly $200 million on planes. FBI head Kash Patel used a government jet to visit his country singer girlfriend. Officials like Stephen Miller and Marco Rubio moved onto military bases funded by taxpayers. Yet the image of the person draining public resources is still a poor Black woman.

Linda Taylor herself defied easy categorization. Labeled White on the 1930 census, born Martha Miller, she had darker skin and hair. One husband said she could pass for Asian; she claimed Native American ancestry and once posed as Jewish. She could have been seen as many things—but after Reagan’s speech, she had to be Black.

Taylor’s crimes went beyond fraud. According to Josh Levin’s book The Queen, she was suspected of murder and kidnapping, but never tried for those charges. Prosecutors focused on welfare fraud because it was cheaper and more politically useful. As Levin writes, “She was the fall guy for everyone who’d lost his job, or had a hefty tax bill, or was angry about his lot in life…She was someone it felt good to punish.”

Today, despite overwhelming evidence of systemic exploitation by the powerful, America still seeks that Black woman to blame. The myth persists—not because it’s true, but because it’s useful.

Dr. Omekongo Dibinga is a trilingual poet, motivational speaker, rapper, and professor of intercultural communication at American University. A self-described “UPstander,” he inspires global audiences to confront injustice through education, performance, and activism. He is the author of the bestselling book Lies About Black People: how to combat racist stereotypes and why it matters.

Trump & Hegseth gave Mark Kelly a huge 2028 gift