Reports of the Trump administration considering taxing wealthy Americans to pay for mass deportations and other priorities come on the heels of a new study showing how the move could generate significant revenues without slowing economic growth.

Mary Eschelbach Hansen, associate professor of economics at American University and the report's co-author, said raising tax rates for people who earn more than $609,000 a year to 44% would add 3% to the nation's tax coffers, enough to stave off cuts to popular programs serving low-income Coloradans.

"In current budget proportions, that's about enough to pay for some of the biggest, most important programs like food stamps SNAP, Children's Health Insurance Program, and also Temporary Assistance for Needy Families," Eschelbach Hansen outlined.

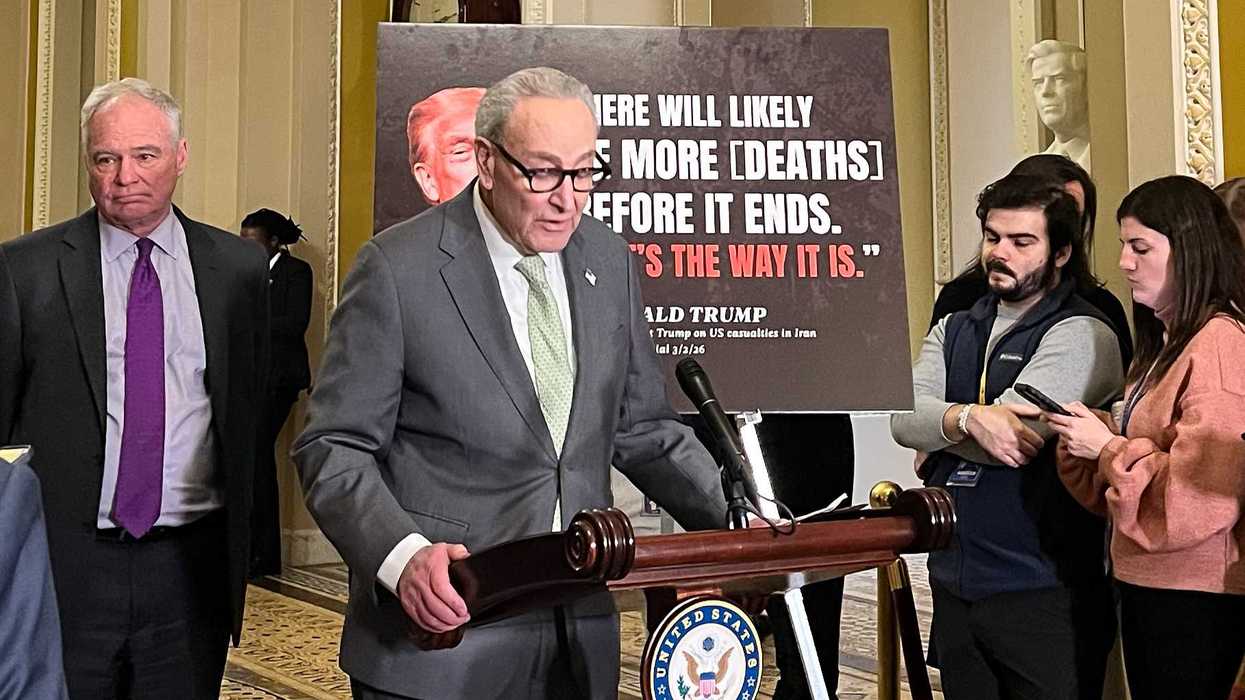

While 44% may seem high compared to today's top rate of 37%, it is a lot less than the 92% paid by people who earned more than $400,000 a year under Republican President Dwight D. Eisenhower. Republicans have long argued tax cuts create economic benefits for all, and leaders in Congress, including Rep. Mike Johnson, R-La., the House Speaker, have said they would oppose any tax hikes.

Eschelbach Hansen argued raising the top tax rate would also increase how much of the national income pie most Americans get to keep, compared to how much the wealthiest get, by about 2%. She added years of trickle-down economics have shown only the wealthy benefit from low tax rates.

"If lowering top tax rates was going to trickle down, then you and I would be much richer than we are now," Eschelbach Hansen pointed out. "Because we have had an era of low top tax rates for decades."

Eschelbach Hansen stressed higher personal tax rates have virtually no impact on long-term economic growth, and lower personal tax rates lead to less economic growth, because people tend to take advantage of the lower rate by moving their income.

"Instead of reinvesting it in your business, where it will grow your business and grow the economy, you'll be more likely to just take it as personal income, which is not going to stimulate growth," Eschelbach Hansen explained.

Taxing the Rich To Pay for Trump Priorities Wouldn’t Slow Economic Growth was originally published by the Public News Service and is shared with permission.

Eric Galatas is a Producer at the Public News Service.