Kevin Frazier will join the Crump College of Law at St. Thomas University as an Assistant Professor starting this Fall. He currently is a clerk on the Montana Supreme Court.

My fiancé and I were exhausted when the movers told us that, upon further review, it would actually cost twice their initial estimate to move our stuff from Helena to Miami.

The number shocked us and our bank accounts. But we were captive customers. The moving crew had already sealed, wrapped, and trapped everything we counted on joining us in Florida. With those pieces of our lives held hostage, we lacked any option other than to acquiesce.

This expense, though unwelcome and undergoing a challenge (I’m a lawyer, after all), caught us off guard but didn’t sink our finances.

Others wouldn’t be so lucky. These sorts of financial tsunamis can appear out of nowhere and unmoor the 22 percent of Americans with no emergency savings—detaching them from whatever had previously provided stability in their lives. Unexpected financial swells don’t just disturb those furthest from the shore. About 30 percent of Americans might be able to withstand the first waves of financial instability, but only have enough savings to stay afloat for three months, according to a June survey by Bankrate.

More Americans need access to the financial anchor required to survive a calamity. Specifically, every American undergoing a period of financial instability should have access to a one-time, no-questions-asked grant of $5,000—to be deducted from any future Social Security earnings or donated by an individual with more financial stability (more on this in a second). The cruel irony is that though some would denounce this as a politically unacceptable “gift,” a one-time grant would actually save society money and act as an investment in those most in need of a heavier anchor.

When individuals become financially adrift, society pays a hefty and, at least in some cases, avoidable cost of trying to bring them back to shore. For example, according to the Urban Institute, the Miami community collectively paid $6 million to $14 million in 2019 as a result of the costs incurred by residents with unstable finances being evicted, and failing to pay their property taxes and utility bills.

Consider that in some cases a few hundred dollars would have allowed individuals to stay in their homes and retain all of the security, stability, and opportunity that comes with it. That’s precisely why Miami created the Eviction Prevention Program. Qualifying residents could receive up to $7,000 (one-time) towards the rental arrears. Established in response to COVID-19, the program demonstrated the community’s interest in preventing any resident from getting too far from the shores of financial stability as well as the value of early and low-cost interventions. Funding for the program has since dried up, though the need for financial assistance remains.

Now’s the time for the community to fill the gap left by governments that, due to crass politics or leaky budgets, refuse to lend the bootstraps folks need to regain their financial footing. For the Warren Buffets of the world—those who claim that they’d welcome paying higher taxes—the creation of a No Questions Asked (NQA) fund is akin to getting into pickleball because it would require little work and only a basic understanding of the rules.

Emergency relief funds such as the NQA fund succeed because they don’t get mired in the costly, biased, and bureaucratized process of trying to decide who is worthy of relief. Eligibility for such funds should hinge on two factors: any demonstration of financial instability and evidence that the recipient experienced an unexpected financial calamity.

Think back to a time when you felt the surge of panic brought on by a swell of financial instability—did it seem like you could wait for relief? Did you consider drastic and potentially dangerous ways to rebuild your financial foundation? Did the panic and anxiety impact your mental and physical health? My hunch is that the answer is yes to each of those questions. My expectation is that if such a fund existed then people would donate—as the tangibility of an “ask” goes up, so does the willingness of someone to give. There are few asks more tangible than helping a family stay in their apartment, a parent cover their child’s medical expenses, or a neighbor recovering from being duped by a deceptive company.

I know that versions of No Questions Asked funds exist around the country. If you know of one, tell me about it and let’s spread the word. Few things are more fundamental to the American ethos than encouraging people to pull themselves up by their bootstraps, but let’s not forget that sometimes even bootstraps are unaffordable—that’s a problem we can collectively solve.

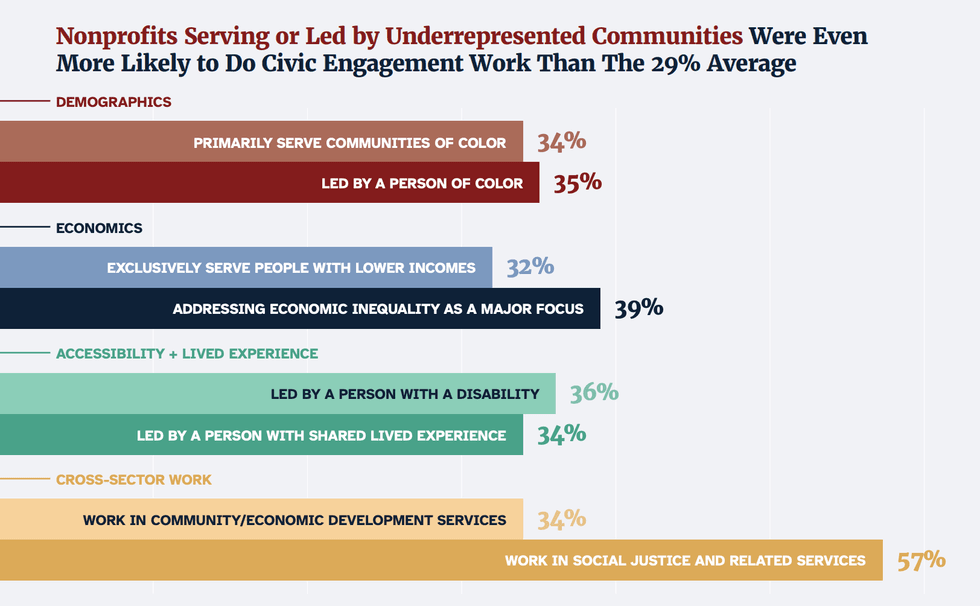

"On the Frontlines of Democracy" by Nonprofit Vote,

"On the Frontlines of Democracy" by Nonprofit Vote,

Trump & Hegseth gave Mark Kelly a huge 2028 gift