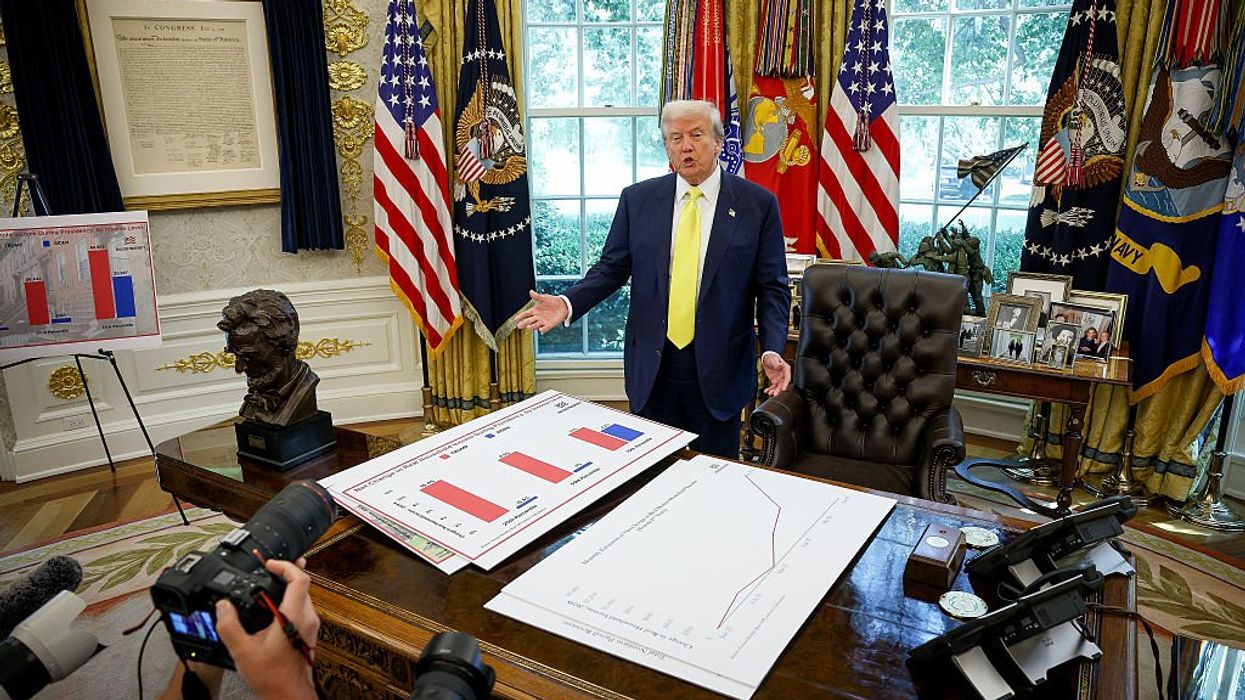

President Donald Trump likes to brand himself a business genius. But for average Americans staring at flat paychecks, shrinking opportunities, and higher grocery bills, his “Art of the Deal” looks more like a private equity raid: strip the assets, juice the numbers, and leave someone else holding the bag.

Economic policymaking under Trump is chaos in action: fire the head of the Bureau of Labor Statistics for weak jobs numbers? Done. Call tariffs the “greatest tax cut in history” while quietly carving out exemptions for firms that manufacture in the U.S. That too. In Trump’s America, numbers bend to politics, and if you don’t like it, good luck finding reliable data.

A Two-Speed America

Job growth has stalled—only 597,000 jobs added in the first seven months of the year, a 44 percent drop from 2024. By contrast, during the same period in President Joe Biden’s final year, the economy added over 1 million jobs—nearly double today’s pace. Manufacturing has shed 37,000 jobs since Trump’s self-declared “Liberation Day” tariff spree, reversing gains made under Biden’s CHIPS Act. Wages? Up a paltry 0.1 percent last month. Translation: people are working harder for less while prices climb.

Companies are expected to repurchase more than $1 trillion worth of their own stock in 2025, a trend that's propping up asset prices even as earnings remain flat, according to Reuters. AI-driven sectors may be growing, but they come with a price tag too: local utility bills from massive data centers are spiking. Communities are pushing back against hosting them.

That divide is what analyst Meredith Whitney calls a bifurcated economy—one where affluent households buttress markets even as most Americans face stagnation.

Meanwhile, in Philadelphia, food bank demand spiked by 120 percent after federal aid cuts in early 2022, with monthly distributions skyrocketing. Advocates say the strain has only deepened—an unmistakable sign that household budgets remain under siege.

Manufactured Inflation, Manufactured Excuses

Trump insists tariffs are making America rich. Reality check: imports make up only 11 percent of GDP, and the weighted tariff rate is about nine percent. But the spectacle gives corporations cover to jack up prices. As former Treasury official Kitty Richards put it, companies are “padding profit margins while pretending their hands are tied.”

The Producer Price Index shows margins at a three-year high. Corporations aren’t merely enduring Trump’s chaos—they’re cashing in on it. Consumers notice that grocery bills are climbing, with staples like eggs and milk up double digits. Small businesses say raw material costs and supply-chain volatility make planning nearly impossible.

This isn’t scarcity-driven inflation—it’s strategic markups. The result: households cut back, demand weakens, but prices stay high because companies know they can get away with it.

Crisis by Design

None of this is accidental. Trump thrives on volatility. A stable economy requires boring things like consistent rules, reliable data, and bipartisan budgeting. Trump—and a willing GOP Congress—prefer shortcuts. Instead of budgets, they rely on continuing resolutions: temporary patches that give the president wide leeway to cut, delay, or redirect funds.

The pattern is clear: Trump governs by disruption. He rules through executive orders, purges career officials, and dismantles the regulatory guardrails that markets depend on for predictability. The effect isn’t just political—it’s economic. When rules change overnight, businesses freeze investment, small firms shelve hiring, and households lose confidence that tomorrow will look like today. What was once steady ground becomes quicksand: paychecks stagnate, credit tightens, and the costs of uncertainty ripple through the entire economy.

Unlike past presidents who sought stability to encourage growth, Trump’s governing style makes uncertainty a feature, not a bug. Add in menace to entitlements: White House spokespeople say they’ll “love and cherish” Social Security, Medicare, and Medicaid—but funding cuts are mounting.

What Congress Should Do

It doesn’t have to be this way. Congress could steady the ship by passing real budgets, restoring ACA subsidies, cracking down on corporate profiteering, and expanding student debt relief. Predictability—not presidential whim—would give families and businesses room to breathe. But today’s GOP-led Congress shows little interest in governing; instead, it seems content to hand the president a blank check and hope voters don’t notice who’s really steering the ship.

Lawmakers could also revisit tax reform, strengthen labor protections, and fund infrastructure that creates middle-class jobs. Just as important, they must reassert their constitutional authority: oversight should not be an afterthought but a central function. Expanding stabilizers like unemployment insurance and nutrition assistance would give households a true safety net, insulating them from political manipulation of crisis conditions. Without these steps, Congress risks becoming little more than a spectator in its own arena.

The Real Cost

Yes, Wall Street is near record highs. But millions of Americans aren’t fooled. Food insecurity is climbing, and health premiums are projected to jump 18 percent next year. Meanwhile, household debt is ballooning—further fuel for despair.

Health care access is also at risk. Trump’s tax-and-spending law threatens to trigger $491 billion in automatic Medicare cuts if Congress doesn’t act, according to the nonpartisan Congressional Budget Office (CBO).

And while benefit amounts have remained nominally intact, Social Security administration staffing and field-office cuts are hurting service delivery—calls and visits are delayed, and local offices are vanishing.

Trump inherited a strong economy. Now, he’s treating it like a distressed asset to be stripped for parts—delivering short-term spoils for shareholders and allies while leaving ordinary Americans to foot the bill.

This isn’t “America First.” It’s America in foreclosure.

Robert Cropf is a professor of political science at Saint Louis University.

Marco Rubio is the only adult left in the room