The balance of power, which is central to a functional democracy, just got nudged a little bit further out of alignment.

Congress does not have a clear or immediate right to see President Trump's tax or financial records, the Supreme Court ruled Thursday. The 7-2 decision sent the case back to the lower courts for more work, but it opened the door wide for an eventual additional weakening of the legislative branch's already atrophied leverage over the executive branch.

The halfway ruling in that case and a separate decision clearing the way for prosecutors in New York to review Trump's tax returns, but not right away, have an obviously important political consequence: delaying until after the election any harmful public revelations about Trump's business dealings.

For those more focused on the long-term aspiration of a governing system that works better and inspires more public confidence, the decisions offered more muddled reasons for both worry and hope.

All nine justices agreed that presidents do not have an absolute constitutional shield from congressional subpoenas, rejecting Trump's emphatic argument that he does and preserving the bedrock principle that no government official is above the law.

But, writing for a majority of seven, Chief Justice John Roberts said that the reasoning from the three House committees in this case may not have been sufficient.

Lawmakers maintain Congress has broad authority under the Constitution to compel testimony and obtain records, and that details of the president's business practices are needed to conduct adequate oversight and contemplate new legislation. Trump's personal lawyers say that's a subterfuge for the real reason: Democrats only want to harass the Republican president as he stands for re-election.

The lower court ruling upholding the congressional demands, Roberts said, "fails to take adequate account of the significant separation of powers concerns raised by congressional subpoenas for the president's information."

He said there was a need for a "balanced approach" in this dispute and that a trial court judge should "carefully assess whether the asserted legislative purpose warrants the significant step of involving the president and his papers."

The majority also said Congress had been overly broad in its paperwork demands and the committees had failed to adequately explain why they needed Trump's records to do their work. "It is impossible to conclude that a subpoena is designed to advance a valid legislative purpose unless Congress adequately identifies its aims and explains why the president's information will advance its consideration of the possible legislation," Roberts wrote.

Soon after the Democrats took over the House of Representatives last year, the Financial Services, Intelligence and Government Oversight committees issued a series of expansive subpoenas — demanding Trump's accountants at Mazars USA provide records back to 2010 on Trump's personal and family finances, and that Deutsche Bank and Capitol One turn over all tax documents and other records connected to their extensive loan-makings to Trump and his businesses.

Lawyers for the House said the demands were justified because shining a light on Trump's business dealings could reveal potential conflicts of interest, including financial obligations in Russia — and learning the details could shape legislation to curb international money laundering or tighten the laws regulating presidential ethics.

That rationale was not persuasive to seven justices, from across the ideological spectrum.

The ruling, while not final, suggests they are ready to depart from years of precedent. Until now, the Supreme Court has generally agreed that any interest in government oversight and the possibility of changing the law are enough to justify congressional subpoenas.

"This decision could empower a president to delay congressional scrutiny, and it's unclear how the lower courts will apply the court's criteria on a case-by-case basis," said Sarah Turberville of the Project On Government Oversight, a nonpartisan watchdog. "While this fight remains in the courts, Congress can and must find ways to bolster its subpoena powers."

Nonetheless, Speaker Nancy Pelosi maintained that a "careful reading" of the decision "is not good news" for the president because "the court has reaffirmed the Congress's authority to conduct oversight on behalf of the American people, as it asks for further information from the Congress."

She said the House would press its case anew in the lower courts.

Had the House won outright on Thursday, the financial files would almost surely have been made available to the public during the campaign. Given the slow timetable for the new review by the lower courts, the next time the case might get back to the Supreme Court is way beyond November — at which point, if Joe Biden has been elected president, the House's interest in the tax returns may evaporate and the balance-of-powers showdown will be put off for another time.

Thursday's other decision opened the door for District Attorney Cyrus Vance to obtain eight years of tax returns to show a Manhattan grand jury, which appears to be investigating Trump's New York-based real estate empire and his alleged hush money payments to two women who claimed to have had sex with him.

The decision in favor of the power to subpoena a sitting president, while still asking lower courts to get involved again, was a much more emphatic limiting of executive power — echoing landmark rulings that made President Richard Nixon turn over tapes of Oval Office conversations and compelled President Bill Clinton to provide evidence in a sexual harassment suit.

"No citizen, not even the president, is categorically above the common duty to produce evidence when called upon in a criminal proceeding," Roberts said.

The Nixon and Clinton decisions were unanimous, however, while Thursday's were not. Still, given the highly partisan and polarized nature of every aspect of the government these days, it was still a notable if modest reaffirmation of the judiciary's potential for independence that the two results were decisively lopsided — with both Trump nominees, Neil Gorsuch and Brett Kavanaugh, voting with the majorities. The dissenters in both cases were conservatives Clarence Thomas and Samuel Alito.

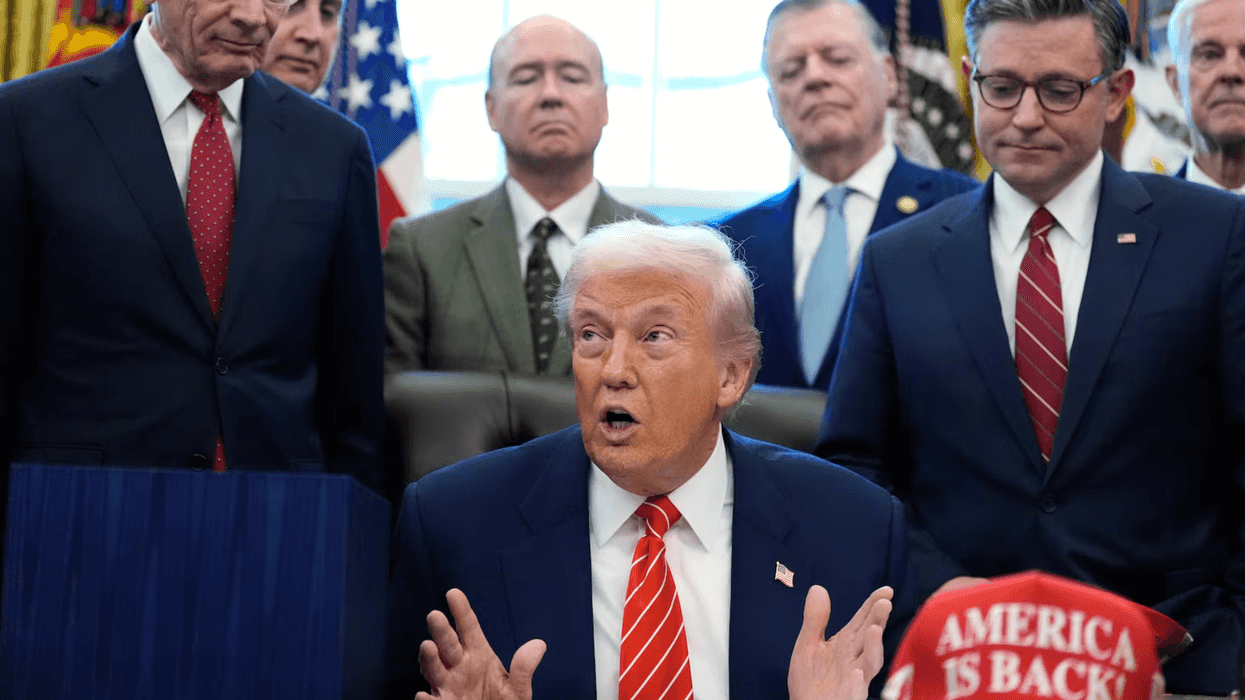

Trump immediately attacked the outcome on Twitter. "This is all a political prosecution," he said, adding incorrectly that "Courts in the past have given 'broad deference'. BUT NOT ME!"

The banks and accounting firm have indicated they will comply with the court's ruling.

Unlike all other presidential nominees (or White House occupants) since Watergate almost half a century ago, Trump has refused to disclose his tax returns since launching his campaign in 2015.

The decisions were the last of the term, which ended after the Fourth of July for the first time since 1986 — a consequence of the coronavirus pandemic, which put the court in limbo for several weeks this spring. The justices conducted oral arguments in the Trump cases in an elaborate conference call eight weeks ago. The rulings were released online, without any of the customary ceremonial reading of opinions from the bench.

Marco Rubio is the only adult left in the room