Biffle is a podcast host and contributor at BillTrack50.

This is part of a series offering a nonpartisan counter to Project 2025, a conservative guideline to reforming government and policymaking during the first 180 days of a second Trump administration. The Fulcrum's cross partisan analysis of Project 2025 relies on unbiased critical thinking, reexamines outdated assumptions, and uses reason, scientific evidence, and data in analyzing and critiquing Project 2025.

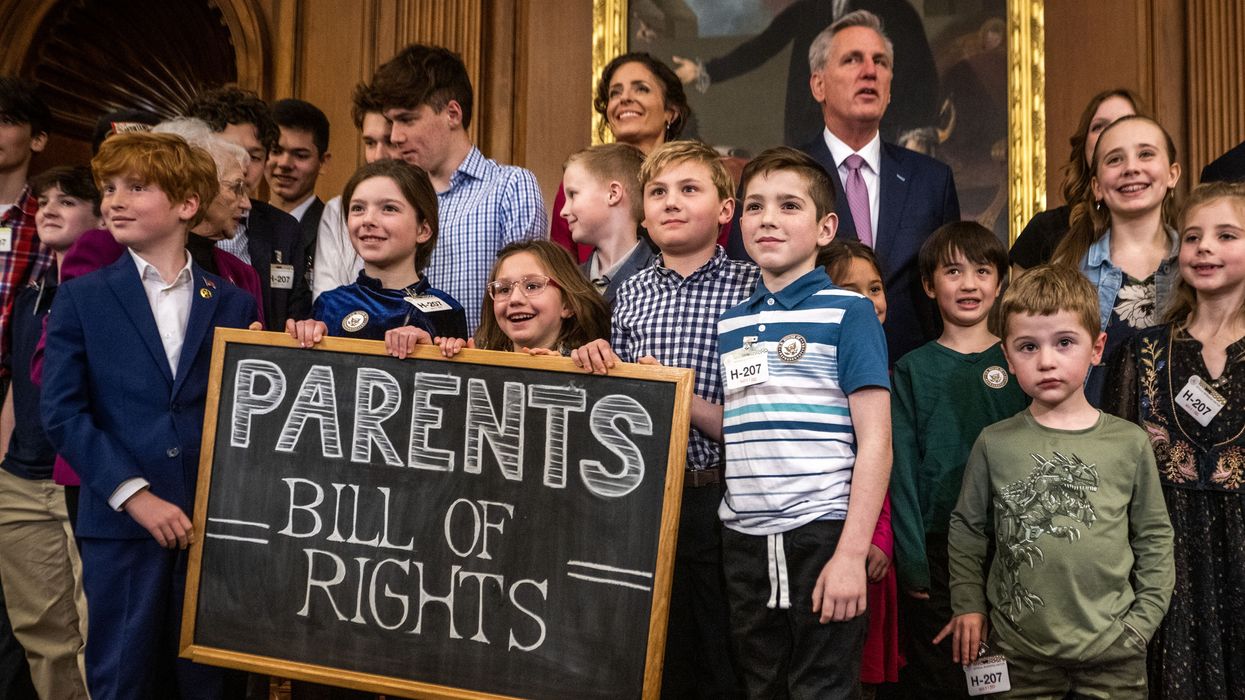

Project 2025, the conservative Heritage Foundation’s blueprint for a second Trump administration, includes an outline for a Parents' Bill of Rights, cementing parental considerations as a “top tier” right.

The proposal calls for passing legislation to ensure families have a "fair hearing in court when the federal government enforces policies that undermine their rights to raise, educate, and care for their children." Further, “the law would require the government to satisfy ‘strict scrutiny’ — the highest standard of judicial review — when the government infringes parental rights.”

So far, the heavy legislating has happened at the state level, with a number introducing legislation aimed at increasing parental involvement, transparency and accountability. There is a growing movement for parents to have more control over and insight into their children's education. Proponents believe greater parental involvement can lead to better educational outcomes. Most laws proposed by states purport to center around increasing transparency in educational systems, ensuring parents are informed about what their children are being taught, how schools are run, and how decisions are made.

These legislative efforts are often a response to our broader social and political movements, driving for increased parental involvement and oversight in schools. For instance, conservative groups have been particularly vocal about lessons around critical race theory and gender education, pushing for more parental control to adjust school curricula to align with their personal views and values.

What states have passed a parental bill of rights?

Such laws generally outline specific rights for parents regarding their control and influence over their children’s upbringing, primarily in the context of education. Arizona’s House Bill 2732 in 2010 was the first in the current effort to define parental rights concerning children's education, upbringing, and health care. The law specifically includes a parent's right to direct their child's education, access school records and be informed about the curriculum.

Utah passed Parental Rights in Public Education in 2014, specifying certain rights of a parent or guardian of a student enrolled in a public school. Florida’s 2021 Parental Rights in Education gave parents control over their child's education, health care decisions and moral upbringing, including provisions for greater transparency in educational materials and school policies.

Texas enacted two bills in 2023: The first allows parents to access and review instructional materials; the second prohibits public school systems from possessing, acquiring and purchasing “harmful library material that is sexually explicit, pervasively vulgar, or educationally unsuitable.”

Many other states have proposed and enacted similar bills over the last decade.

What are the drawbacks to this movement?

Excessive interference in curriculum can undermine the expertise of educators and educational institutions, resulting in a fragmented educational experience for students, especially if parents with diverse views impose conflicting demands on schools. Schools will face increased administrative burdens to comply with the proposed transparency, find a middle ground and fulfill reporting requirements. This diverts time and resources away from direct educational activities, impacting overall school function.

Further, there is an argument that this type of legislation can lead to censorship of educational materials, particularly those related to controversial or sensitive topics such as sex education, race and gender identity. This can limit students' exposure to diverse perspectives and critical thinking opportunities. Allowing parents to opt their children out of certain lessons or activities can lead to inconsistencies in educational standards and experiences, affecting the overall quality and cohesiveness of student's education.

What would be the impact of Project 2025’s proposed federal Parental Bill of Rights?

The focus on parental rights could prioritize voices of more vocal or organized groups, potentially neglecting the needs and rights of minority or marginalized students and families. The federal legislation will likely result in increased legal disputes between parents and schools, which are costly and time-consuming, draining already limited school resources. Also, the implementation of these laws can exacerbate social and political divisions, particularly in communities with diverse views, leading to conflicts between parents, educators, and school boards, creating a contentious educational environment.

Balancing parental rights with the needs and expertise of educators is crucial to address these concerns effectively. While Project 2025’s initiative reflects a growing trend across the United States to formalize and expand parental rights in the context of education and child welfare, careful consideration is needed to ensure these rights do not hinder the educational process and overall student welfare.

More articles about Project 2025

- A cross-partisan approach

- An Introduction

- Rumors of Project 2025’s Demise are Greatly Exaggerated

- Department of Education

- Managing the bureaucracy

- Department of Defense

- Department of Energy

- The Environmental Protection Agency

- Education Savings Accounts

- Department of Veterans Affairs

- The Department of Homeland Security

- U.S. Agency for International Development

- Affirmative action

- A federal Parents' Bill of Rights

- Department of Labor

- Intelligence community

- Department of State

- Department of the Interior

- Federal Communications Commission

- A perspective from Europe

- Department of Health and Human Services

- Voting Rights Act

- Another look at the Federal Communications Commission

Trump & Hegseth gave Mark Kelly a huge 2028 gift