The Las Vegas Golden Knights have been taking advantage of a salary cap loophole to get the upper hand in they playoffs.

Becvar is co-publisher of The Fulcrum and executive director of the Bridge Alliance Education Fund.

A connection between the National Hockey League and American democracy may seem fairly weak. But with the Stanley Cup playoffs underway, I've been thinking about a similarity between the two.

In the NHL, a particular controversy arises around the use of the salary cap loophole during the playoffs. Teams are limited in their total player salaries to a strict ceiling but can exceed this cap to cover a player put on long-term injured reserve. While the team must comply with the cap once the player returns during the regular season, the cap restrictions vanish during the playoffs. This creates an opportunity for strategic manipulation: A key player injured in the regular season can be sidelined until the playoffs, allowing the team to bolster its roster temporarily and reintroduce the player just in time for the playoffs.

For example, this season, the Vegas Golden Knights leveraged this rule, bringing back their team captain in the playoffs after a long-term injury absence during which they added significant talent. This tactic isn't new; multiple teams have used the loophole. The focus is so clearly on the Golden Knights because this is the third year they've done it — with the same player. While technically within the rules, such strategies have stirred debates about fairness and the spirit of competition for years.

Sign up for The Fulcrum newsletter

Although there have been some discussions about reforms, there are challenges. Proposals to close the loophole, such as maintaining the salary cap during playoffs or restricting playoff eligibility based on status at the end of the season, face pushback. And that is where this begins to feel familiar.

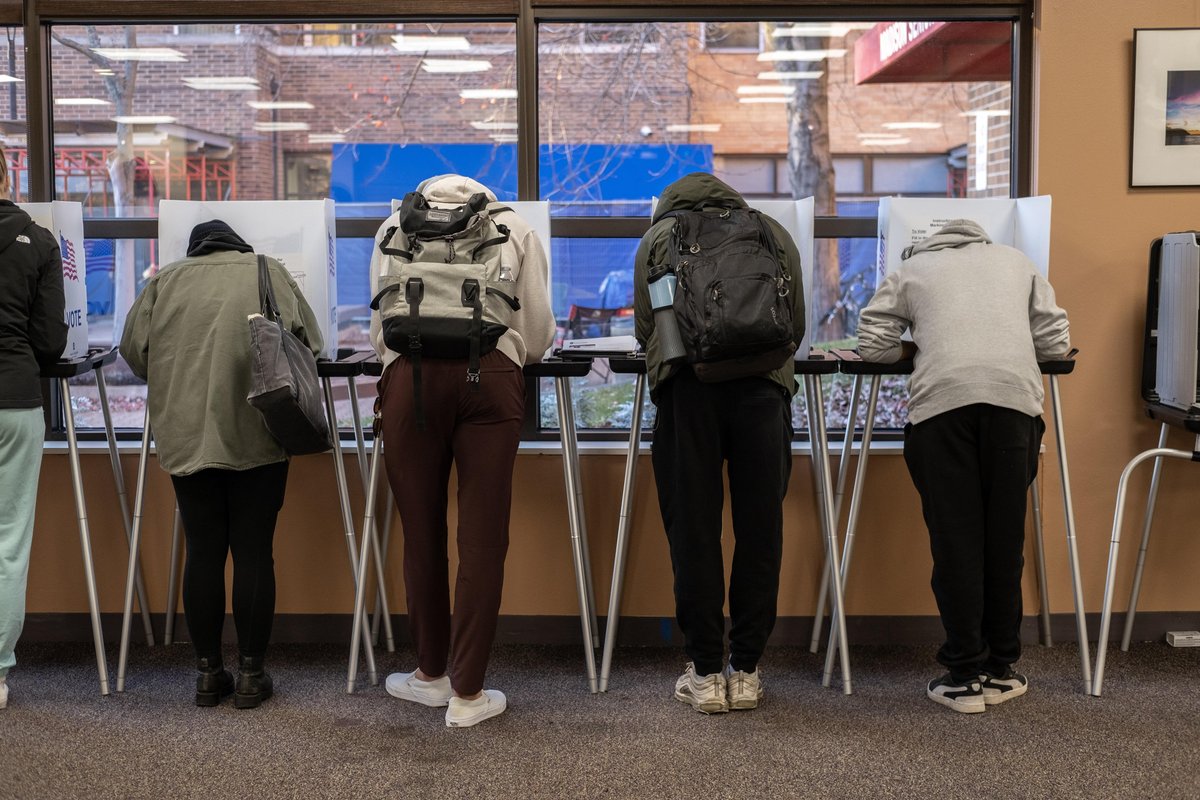

American democracy is frequently manipulated through gerrymandering, lobbying and the disproportionate influence of money in politics. While technically permitted, the use of these practices in our electoral processes sways outcomes and prompts calls for reform. We propose solutions to the problem but receive pushback. Familiarity comes into play when considering the way — and the times — we collectively respond to the calls for reforms.

In a tribal environment, exemplified by the culture surrounding sports teams, we really want our team to win. We can justify the use of creative workarounds when they benefit our end goals. Everyone complains about this loophole until it benefits their team — then, they're only too happy to point out how other teams do the same thing. Full disclosure requires me to point out that as a Chicago Blackhawks fan, I didn't complain about the rule when my team used the loophole in 2015. But I was ruminating enough this year that it inspired this entire thought process. We can see a similar phenomenon in our electoral politics when our chosen team does or does not benefit from a particular advantage.

At the core, both hockey fans and citizens crave a fair contest. Closing the NHL's salary cap loophole would ensure teams compete based on skill, strategy and teamwork rather than financial maneuvering. Similarly, fortifying laws around campaign finance, lobbying and voting processes is crucial to restoring and maintaining the integrity of our political system.

Yet, the stakes in these two fields are vastly different. While the integrity of sports leagues affects entertainment and regional pride, the consequences of democratic manipulation ripple through society, affecting governance, public trust and the fabric of our civic life.

Engaging in this dialogue is essential, not just for the love of hockey or politics, but for the love of fairness and integrity. We must center the discussion about reforms around what we need to do for the entire system to function more effectively — not just when it benefits our team.