A new public consultation survey finds significant bipartisan support for major Social Security proposals — including ideas to increase revenue and cut benefits — that would reduce the program’s long-term shortfall by 78 percent and extend the program’s longevity for decades.

Without any reforms to revenues or benefits, the Social Security Trust Fund will be depleted by 2033, and benefits will be cut for all retirees.

This survey, run by the University of Maryland’s Program for Public Consultation, is the sixth in the Swing Six Issue Surveys series being conducted in the run-up to the November election in six swing states and nationally. Unlike standard polling, respondents went through an interactive online “policymaking simulation” in which they learned about and then evaluated pro and con arguments for proposed reforms. The survey content was reviewed by experts on different sides of the debate.

(All Americans are invited to go through the same policymaking simulation as the survey sample.)

Revenue increases

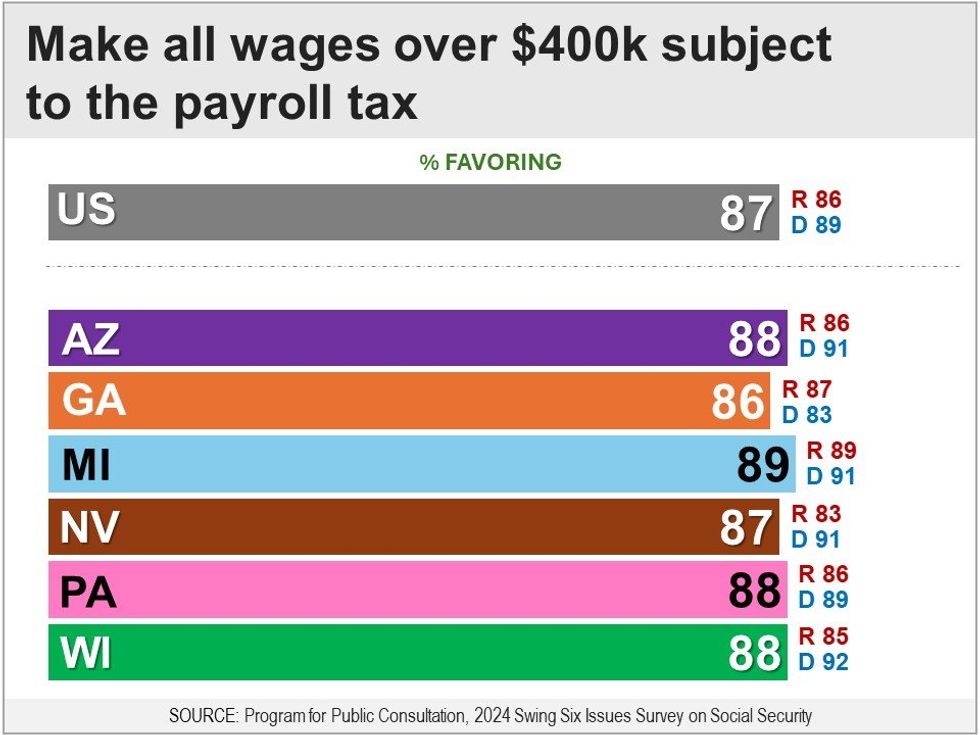

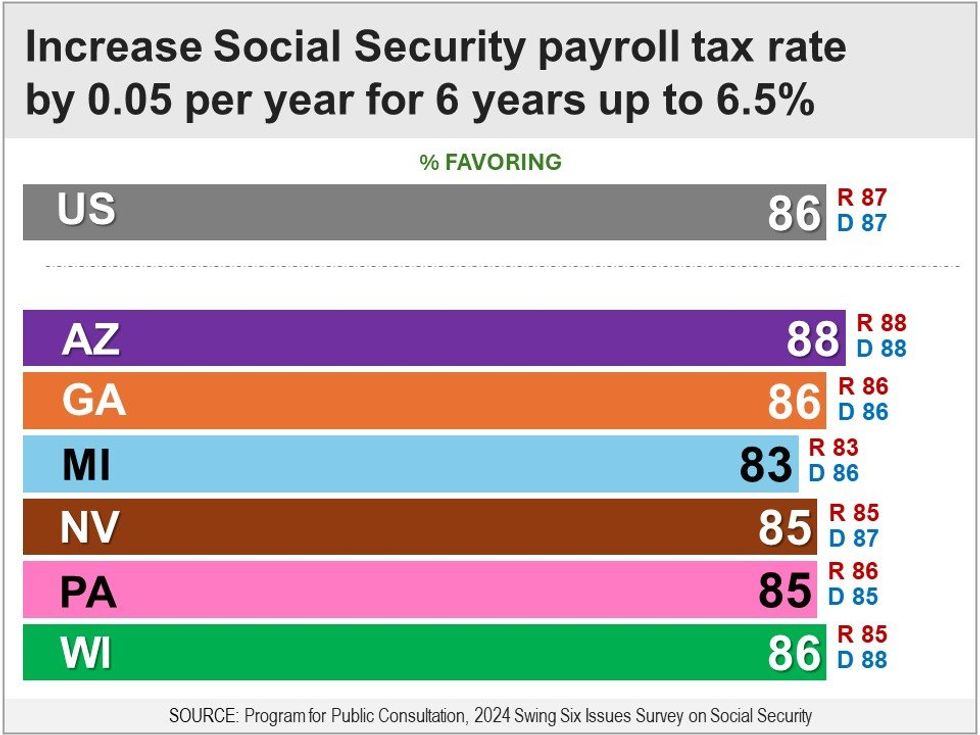

Overwhelming majorities of Democrats and Republicans support two proposals to increase revenues that would cover three-quarters of the Social Security shortfall.

- Subjecting wages over $400,000 to the payroll tax: Currently, wages subject to the payroll tax are capped at $169,000. A proposal to make all wages over $400,000 subject to the payroll tax, which would eliminate 60 percent of the shortfall, is supported by an overwhelming 86 percent to 89 percent in the swing states. This includes large majorities of Republicans (83 percent to 89 percent) and Democrats (83 percent to 92 percent). Nationally, 87 percent are in support.

- Increasing the payroll tax: Respondents were given the option of gradually increasing the payroll tax over several years, from 6.2 percent to 6.5 percent by 2030, 6.9 percent by 2038 or 7.2 percent by 2044, or not raise it. Increasing the payroll tax to at least 6.5 percent, which would eliminate 15 percent of the shortfall, is supported by 83 percent to 88 percent in the swing states. This includes majorities of Republicans (83 percent to 88 percent) and Democrats (85 percent to 88 percent). Nationally, 86 percent are in support.

Benefit reductions

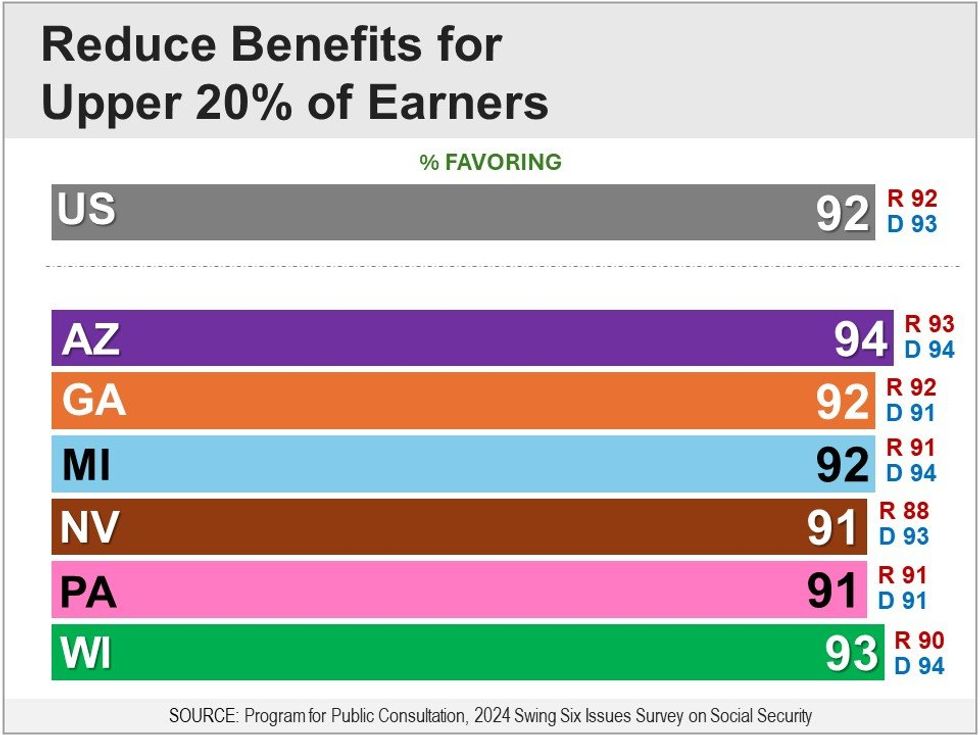

Two benefit reductions, which would cover a quarter of the Social Security shortfall, also have robust bipartisan support.

- Reducing benefits for high-income earners: Respondents were given the options of reducing benefits for the top 20 percent of earners, the top 40 percent or the top 50 percent, or they could not choose any of those options. Reducing benefits for the top 20 percent of income earners, which would eliminate 11 percent of the shortfall, is supported by an overwhelming 91 percent to 94 percent in the swing states. This includes majorities of Republicans (88 percent to 93 percent) and Democrats (91 percent to 94 percent). Nationally, 92 percent are in support.

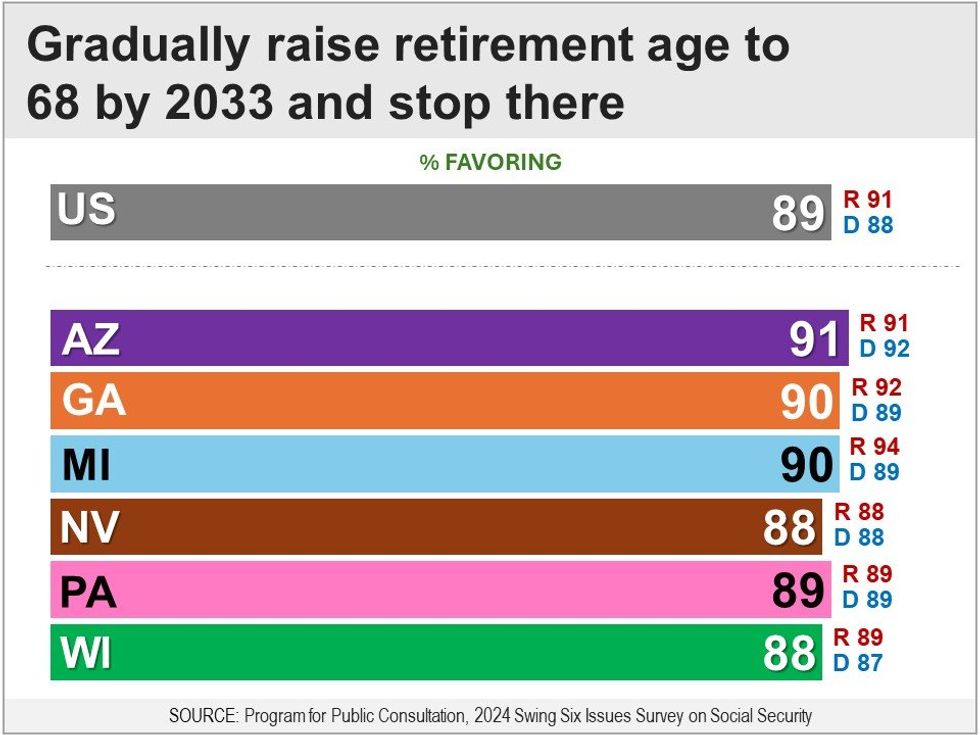

- Raising the retirement age: Respondents were given options to gradually raise the full retirement age, which is currently set at 67 years old: to 68 by 2033, to 69 by 2041 or to 70 by 2064, or they could not choose any of those options. Raising the retirement age to at least 68, which would eliminate 15 percent of the shortfall, is supported by an overwhelming 88 percent to 91 percent in the swing states. This includes majorities of Republicans (88 percent to 94 percent) and Democrats (87 percent to 92 percent). Nationally, 89 percent are in support

“While some of these proposals — such as raising the retirement age or raising payroll taxes — are not popular in themselves, when Americans consider the full picture, large bipartisan majorities support taking tough steps to secure the Social Security program,” said Steven Kull, director of PPC. “We were struck by how similar the Republican and Democrats are on all these questions.”

Raising benefits

The four reforms endorsed by majorities would eliminate 101 percent of the shortfall. However, majorities also favor benefit increases that grow the shortfall by 23 percent. Combined, all of these proposals would reduce the shortfall by 78 percent.

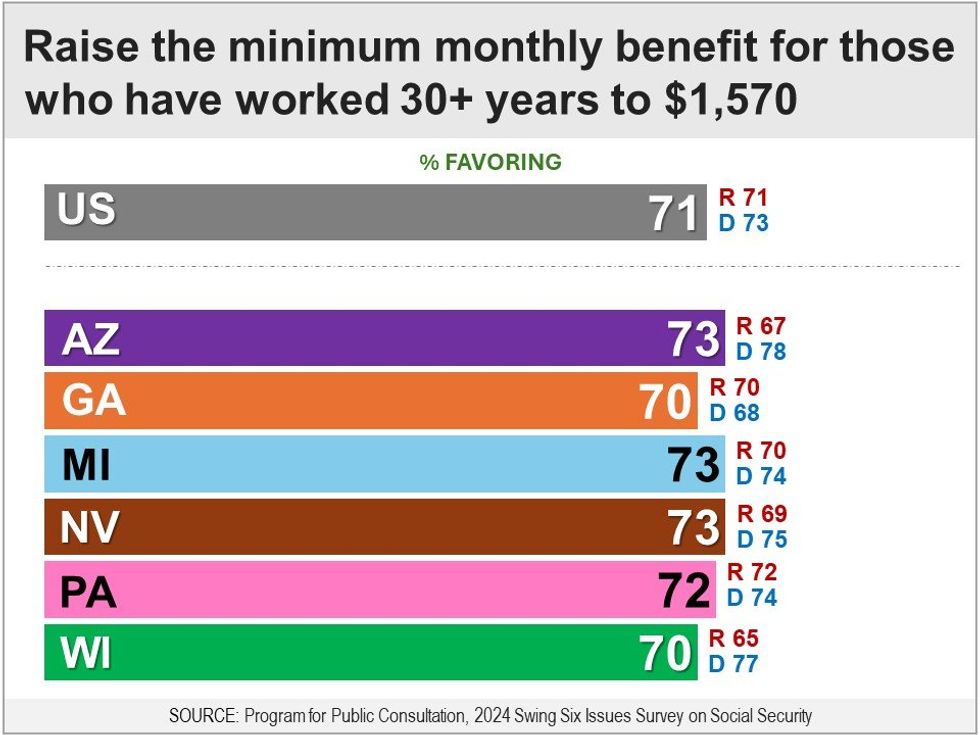

- Raising the minimum benefit: Increasing the minimum monthly benefit for someone who worked 30 years from $1,066 to $1,570, which would increase the shortfall by 7 percent, is supported by 70 percent to 73 percent in the swing states. This includes majorities of Republicans (65 percent to 72 percent) and Democrats (68 percent to 78 percent). Nationally, 71 percent are in support. The minimum benefit would rise with inflation, and always be set at 125 percent of the federal poverty line.

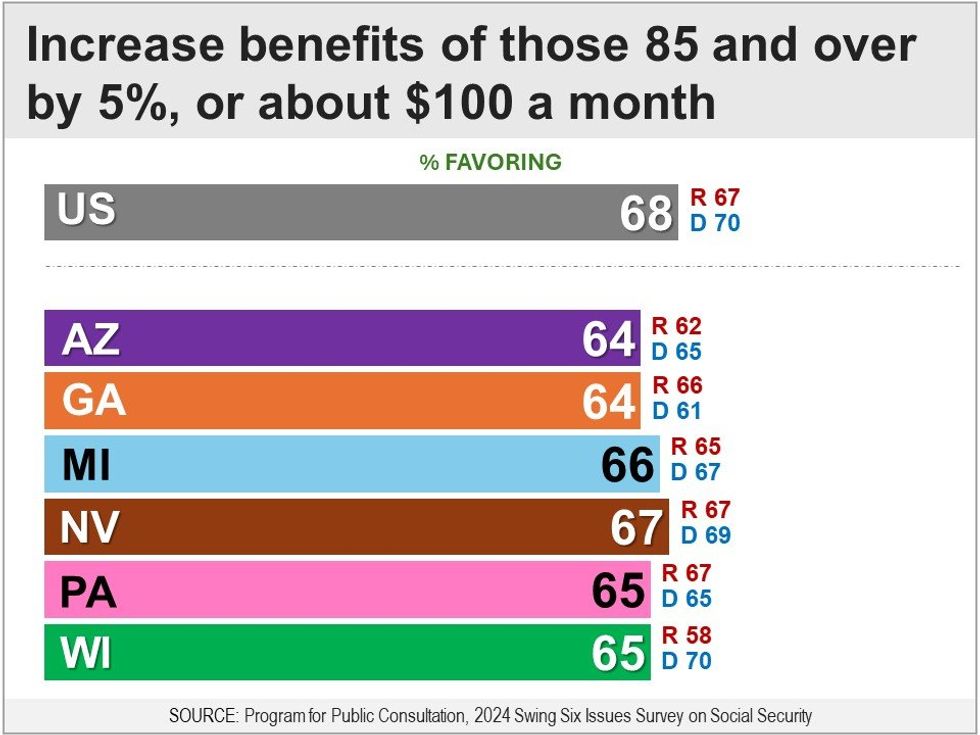

- Increasing benefits for those 85 and older: Raising benefits for those 85 and over by about $100 a month, which would increase the shortfall by 4 percent, is supported by 64 percent to 67 percent in the swing states. This includes majorities of Republicans (58 percent to 67 percent) and Democrats (61 percent to70 percent). Nationally, 68 percent are in support.

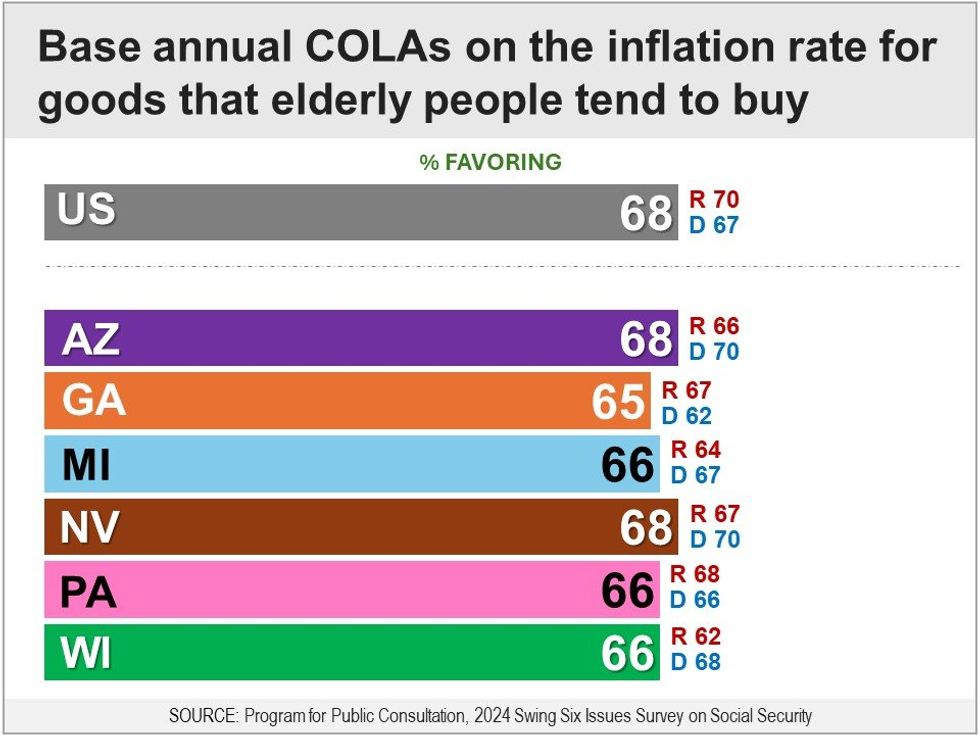

- Increasing cost of living adjustments: Changing the way COLAs are calculated by focusing on the goods and services that older adults tend to buy, which would increase the shortfall by 12 percent, is supported by 65 percent to 68 percent in the swing states. This includes majorities of Republicans (62 percent to 68 percent) and Democrats (62 percent to 70 percent). Nationally, 68 percent are in support.

Will Trump’s moves ever awaken conservatives?