On the campaign trail, Donald Trump promised to end taxes on Social Security benefits. Many seniors naturally responded positively to this idea, and he was rewarded with their votes. It’s easy to see why many would agree with this idea on the surface. After all, workers already pay taxes on their earnings throughout their careers. These taxes are used to fund future Social Security benefits. Retirees would be excused for thinking that they’re being taxed twice.

However, the reality is far more complicated — and potentially disastrous. By law, taxes on Social Security benefits are funneled back into the Social Security and Medicare trust funds. Ending this revenue stream would have serious financial consequences, accelerating the insolvency of both programs. This would put the benefits that millions of American seniors depend on at grave risk.

The numbers tell a bleak story. A Wall Street Journal piece notes the Committee for a Responsible Federal Budget found that ending taxes on Social Security benefits would reduce revenue to the Social Security and Medicare trust funds by between $1.6 trillion and $1.8 trillion over the next decade. This would accelerate the insolvency of Social Security by a full year, bringing its projected bankruptcy date to 2032. Medicare would fare even worse, facing insolvency in 2030 — six years earlier than current projections.

The consequences of these changes would be dire. Without enough funding, Social Security and Medicare would face catastrophic benefit cuts, forcing millions of seniors to suffer due to reduced incomes and limited access to health care. These programs were designed as safety nets, but Trump’s proposals would rip giant holes in that fabric, leaving some of America’s most vulnerable citizens exposed.

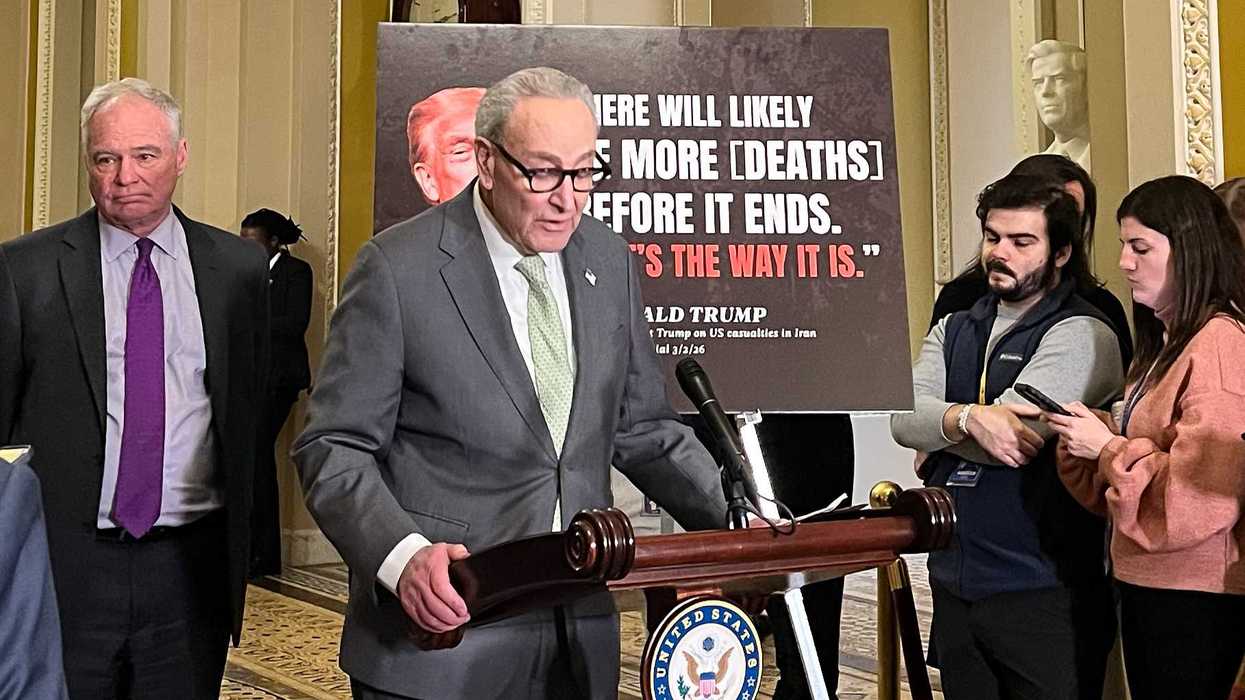

Trump’s promise to end taxes on Social Security benefits is just one piece of a broader campaign to reduce taxes on income such as tips and overtime pay. While these ideas may seem attractive to the average taxpayer, together they threaten to explode the federal deficit. These policies ignore the critical role tax revenue plays in sustaining essential programs and ensuring their long-term viability.

The short-term appeal of these proposals must be carefully balanced against their long-term consequences. While seniors might save a small amount initially, the financial foundation of Social Security and Medicare would crumble, creating a much greater economic burden in the future. Popular promises often carry hidden costs, and in this case, the cost would be the stability of the very programs that seniors rely on.

The debate over taxing Social Security benefits raises legitimate questions about fairness in the tax code. However, solutions that undermine the solvency of critical programs are plainly reckless. Instead of proposing policies that threaten Social Security and Medicare’s future, Trump should focus on strengthening these systems to ensure they can support current and future generations.

Trump’s plan played well on the campaign trail, but its implications are clear: His promises risk dismantling the foundations of America’s social safety net. For the millions of Americans who depend on these programs, that is a gamble they cannot afford.

Cropf is a professor of political science at Saint Louis University.