Howard's research focuses on the history and politics of U.S. social policy. He is the author of The Hidden Welfare State (1997) and The Welfare State Nobody Knows (2007), as well as numerous articles and book chapters. He was one of three co-editors for The Oxford Handbook of U.S. Social Policy (2015). His current book project is a comprehensive map of the social safety net, public and private. He is also a member of the Scholars Strategy Network.

A decent social safety net cannot rely solely on warm feelings toward those who need assistance. Unpaid caregiving by family members is crucial in meeting some basic needs but inadequate for others. The charitable sector has too few donors and volunteers to make a big impact on poverty-related problems. In short, kinship and compassion cannot make up for a lack of resources.

The core of the social safety net is provided by government, where warm feelings are welcome but not required. Government forces us, via taxes, to take care of each other. Much of that money funds inclusive social insurance programs that benefit the poor and non-poor. Much of the rest is used to pay a huge number of businesses to be caregivers. If we want to improve the social safety net, we must appreciate the importance of coercion, self-interest, and profit.

Caring About Poverty Is Unusual

Caring about some issue or group means paying close attention to it. By that standard, it is not easy to find prominent groups in this country that truly care much about poverty.

Consider the Democratic and Republican parties. Over the last two decades, references to poverty, hunger, homelessness, poor people, low-income people, and the safety net have been scarce in their national party platforms. The pattern in presidential State of the Union addresses has been similar. Elected officials have referred much more often to workers, working men and women, and working families.

With a few exceptions, leading business and labor organizations have said little about poverty. They are more concerned with jobs, profits, and paychecks. The most generous reading of their official statements is that business and labor leaders care more about preventing poverty than helping those who have been left behind.

Given all the attention to employment, perhaps Democrats, Republicans, business, and labor have paid attention to the “working poor”? In fact, that phrase too has seldom appeared in the most important statements issued by these groups.

Public opinion is ambiguous. Depending on how survey questions are worded, anywhere from a small fraction of Americans to a clear majority will say that poverty-related problems are important. People still care more about “poverty” and “poor people” than “welfare” and “welfare recipients.” Interestingly, Americans believe the size of the poverty population is three times larger than the official Census Bureau numbers. To the extent that ordinary citizens care about poverty, they think the problem is much bigger than elected officials do.

Churches and secular charities definitely do pay attention to poverty-related needs. But they also care about many other issues (e.g., abortion, climate change, racial justice) as well as their own survival as organizations.

Which Helps Explain Why We Need Coercion…

If we do not care much about a problem, it is less likely we will volunteer to pay for a remedy. Many individuals and companies donate to charities (encouraged partly by tax deductions). But many recipients of charity are universities, museums, and other organizations that are not part of the social safety net. Before the pandemic, roughly 150-200 billion dollars were being donated annually to charities that tried to serve the poor and near poor—but that sum represents less than half of Medicaid’s budget alone. It is simply not enough.

To finance the social safety net, government has to make people pay. Most workers are compelled to participate in social insurance programs, financed by payroll taxes. As for public assistance programs, the main revenues come from individual and corporate income taxes. Due to income inequality and progressive tax rates, much of that revenue comes from the most affluent Americans. Through our tax system, government forces the rich to take care of the poor.

Self-Interest…

With tax revenues in hand, the next question is how best to deliver benefits. Social Security offers one model: It lifts millions of Americans out of poverty every year; no other social program comes close. Eligibility for Social Security is not limited to people living in poverty. The program is designed to forge a broad, cross-class coalition among workers and retirees. Though the poorest among them have little political clout, they can count on other beneficiaries to protect Social Security. This type of program combines self-interest with concern for others.

And Profit

When it comes to income support, government helps people directly by cutting checks. This is true for Social Security as well as disability and unemployment benefits. But for other parts of the social safety net—food, housing, medical care, child care, long-term care—government typically pays someone else to provide assistance.

Caring for the disadvantaged can be big business. Think of all the hospitals, nursing homes, and medical professionals that are reimbursed by Medicaid. Think of all the grocery stores around the country that accept payments from SNAP (the Supplemental Nutrition Assistance Program, sometimes known as food stamps), or the landlords who supply housing to those with rental vouchers. Some of these organizations are nonprofits, but most are trying to make money. They, too, have political clout that the recipients of public assistance lack.

The Bottom Line

We often choose to care for relatives and friends, but most of us must be pushed into helping strangers. To paraphrase James Madison: Because few of us are angels, government is essential. Government forces taxpayers to take care of the needy, and government solidifies support for social programs by broadening eligibility or paying corporate caregivers. Safety net programs that lack one of these features will probably be small and politically weak (e.g., cash welfare, public housing).

The good news is, public officials do more about poverty than their rhetoric indicates. The bad news is, gaping holes in the social safety net remain. Millions of Americans are poor, food insecure, housing cost-burdened, or medically uninsured. We can cross our fingers and hope that more angels appear, or we can figure out how to use coercion, self-interest, and profit to help people who are struggling to make ends meet.

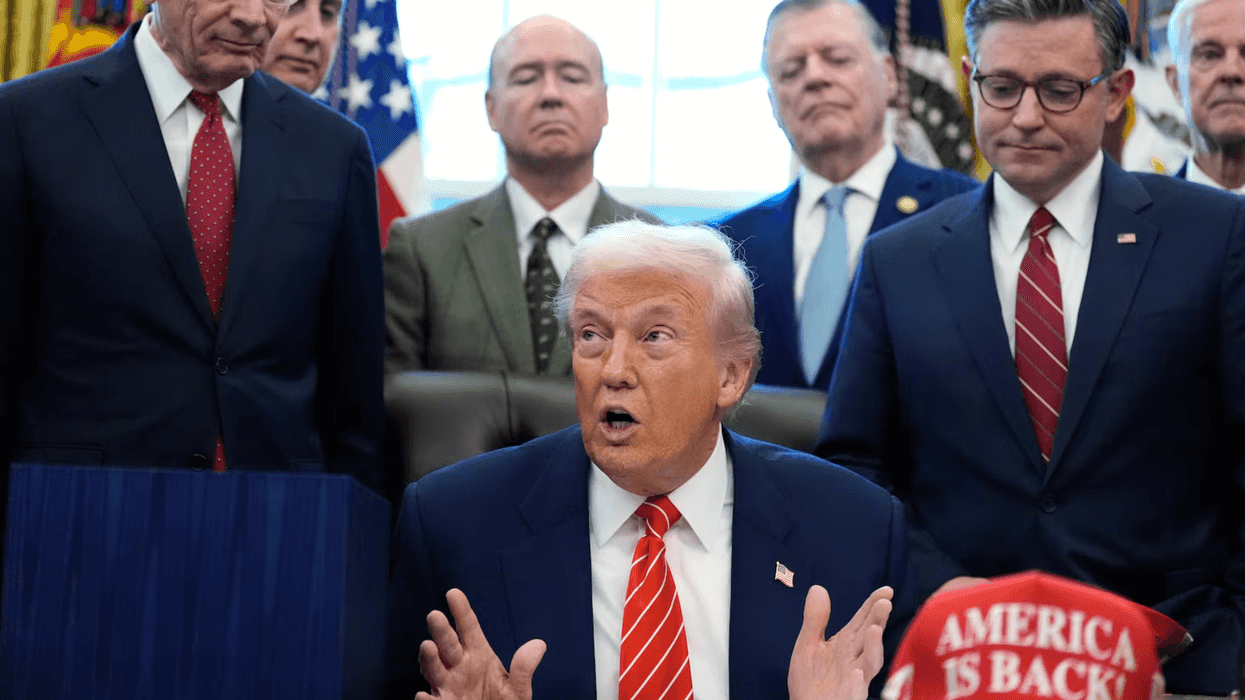

Marco Rubio is the only adult left in the room