Hill was policy director for the Center for Humane Technology, co-founder of FairVote and political reform director at New America.

Here comes Americans’ favorite day – April 15, Tax Day! In the land of “No taxation without representation,” we Americans throw a fit over how much we fork over to the government, which taps into related complaints over government waste, budget deficits and more.

Considering how much we focus on the amounts we pay in taxes, you would think more people would also shine a spotlight on what we get in return. A thorough tax analysis would need to create a two-sided ledger, in which all the support and services Americans receive are listed on one side, and the amount of taxes and any additional out-of-pocket expenses, fees and surcharges we pay are listed on the other.

Here’s the surprising thing: When you sum up the total balance sheet, it turns out that Americans pay out as much as those "high-taxed" Europeans — but we get a lot less for our money.

In return for their taxes, most Europeans receive a generous support system for families and workers — services for which Americans must often pay exorbitant out-of-pocket fees and surcharges.

That includes quality health care for every single person, the average cost of which is about half of what Americans pay, even as various studies show that most Europeans achieve better health metrics.

But that’s not all. In return for their taxes, most Europeans also receive affordable child care, a decent retirement pension, free or inexpensive university education, job retraining, paid sick leave, paid parental leave, ample paid vacations, affordable housing, senior care, efficient mass transportation and more.

In order to receive the same level of benefits as these Europeans, most Americans must fork out a ton of money in out-of-pocket payments in addition to the taxes we pay.

For example, most Americans are paying escalating health care premiums and deductibles, which reduces their effective net pay and acts like a steep tax on households. Moreover, 28 million Americans, nearly 9 percent of the population, have no health care at all, even though many are working and paying taxes. But most Europeans receive health care in return for a modest amount deducted from their paychecks.

Many parents in the United States are saving nearly $100,000 for their children’s college education, and most young Americans graduate with thousands of dollars of debt. But European students attend for free, or nearly so (depending on the country).

Child care in the U.S. costs over $18,000 annually – paid out of pocket – for a family with two children, but in Europe it costs about one-third to one-sixth that amount for a family, depending on the country, and the quality is far superior.

Millions of Americans are stuffing as much as possible into their IRAs and 401(k)s because Social Security only replaces about 40 percent of a worker’s income. Many European retirement systems are more generous and replace about 60 percent 75 percent (depending on the country) of workers’ income.

The U.S. also spends a lot less of public health dollars on elderly care, resulting in American families self-financing significant amounts for their own senior services, compared to most European countries.

Americans also pay various hidden taxes, such as $300 billion annually in federal tax breaks to businesses that provide health benefits to their employees. That means Americans with no health care are subsidizing those who do have health care.

When you sum up the total balance sheet, it turns out that Americans pay out just as much as many Europeans — we just end up receiving a lot less for our money. One Norwegian colleague – from a conservative party – remarked to me, “Americans like to talk about family values, but we have decided to do more than talk.” Europeans actually put their money on the barrel.

Certainly, European countries have their own vigorous debate about the right levels of taxation. Income taxes in Europe are high for some people, but the highest rates that generate alarmist headlines in the U.S. are paid only by those in the highest income brackets. Many middle class and low income Europeans don’t pay more taxes than their U.S. counterparts. Especially since Americans also tend to pay more in local and state taxes, as well as in property taxes.

Many U.S. politicians say, “The government should let you keep your own hard-earned money in your pocket,” and there’s something to be said for that. That has long been the American Way. But the European Way takes some of those taxes and designs more efficient and cost-effective support systems for health care, child care, education, senior care and more. Those are services that all families desperately need in today’s quickly shifting economic world to ensure healthy, productive, and happy families and workers.

Most Europeans can count on these forms of support, and for less money out of their own pockets, while most Americans cannot — unless we have the private means to self-pay out of our own bank accounts.

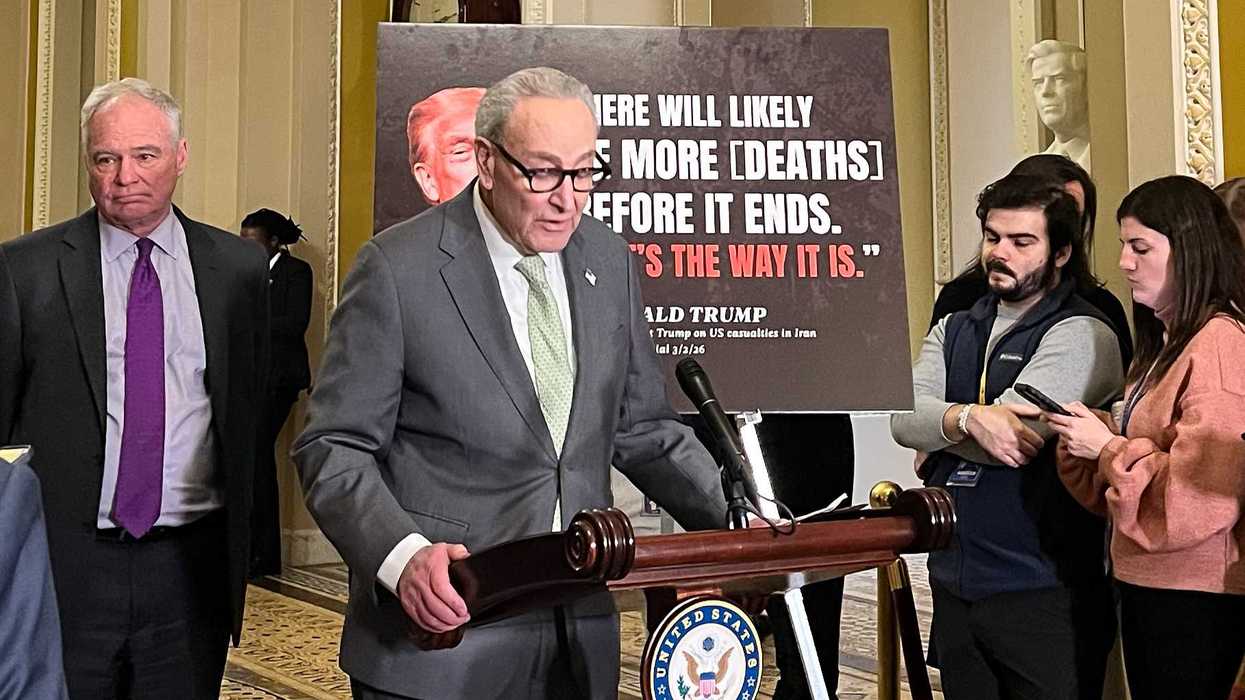

Or unless you are a member of Congress, which of course has made sure that its members’ families receive European levels of support.

Happy Tax Day.