Nevins is co-publisher of The Fulcrum and co-founder and board chairman of the Bridge Alliance Education Fund.

Last week, I wrote an op-ed in The Fulcrum entitled, “Learning to recognize political rhetoric.”

In that writing I spoke of how our elected representatives thrive on the red meat rhetoric they throw out to their base to score political points, rather than attempting to govern. Unfortunately, it is often much easier for them to make statements that generate a strong emotional response from voters instead of intelligently debating the difficult choices our country faces.

Well, our elected representatives certainly proved my proposed theory in their reaction to the collapse of Silicon Valley Bank (SVB).

And of course, those on the left played the same blame game as those on the right but approached it from opposite angles. I realized while writing this op-ed that if I started by criticizing a Democrat, I may be labeled as another right-winger protecting business interests and some people might not finish reading my writing. Alternatively, if I began by criticizing a Republican, I’d instead be considered a left-winger anti-business Woke capitalist.

Sort of heads you win and tails I lose, but what the heck…. I flipped a coin anyway to determine where to begin.

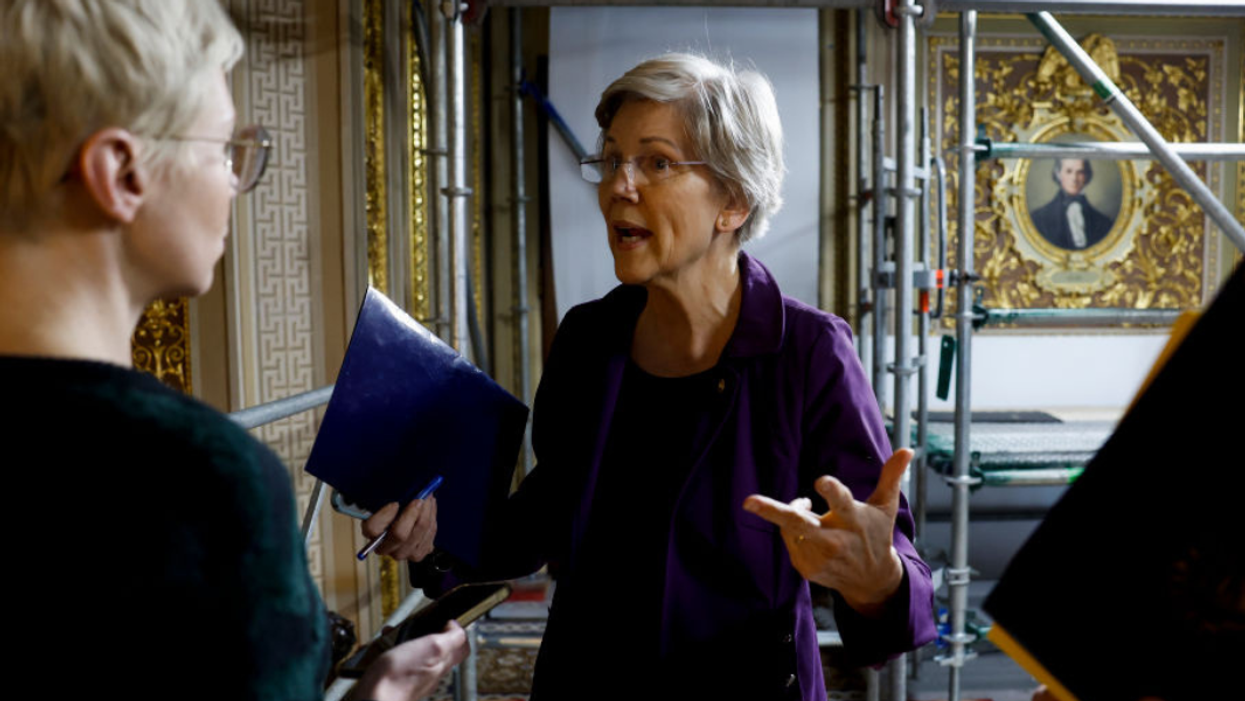

On the left before the dust had settled, Elizabeth Warren accused Jerome Powell of dangerous practices that helped to cause the bank's failure. Really? How come the failure at this juncture has been limited to one bank whose customer base and practices certainly don’t represent most regional banks in America?

Senator Warren followed up with writing an op-ed in The New York Times announcing that “We Know Who Is Responsible” by claiming that the “recent bank failures are the direct result of leaders in Washington weakening the financial rules.” Wait a minute–now I’m really confused. If Congress weakened the rules, why is Jerome Powell responsible? He’s not a member of Congress.

Oddly, Senator Warren in the same op-ed goes on to blame flawed management of risk by rich SVB executives which further confuses me as to who is responsible.

And not to be outdone, Republicans have added to the pejorative language using their recent favorite code word: “Woke” by blaming the entire failure on “Woke Capitalism.” Hey, why not use the term Woke and apply it to anything you don’t like since it seems to work in raising the emotions of their base to disparage and dismiss anything related to a civil discussion on justice, equity, diversity, and inclusion.

Florida Governor Ron DeSantis, the master of using culture wars to his political advantage, jumped into the fray immediately blaming diversity initiatives for the banks downfall and calling for renewed scrutiny of banks.

Desantis told Fox News’s Maria Bartiromo: “This bank, they’re so concerned with DEI and politics and all kinds of stuff, I think that really diverted from them focusing on their core mission.”

As a purely political move his unfounded comments make total sense to a political observer. Find an easy target like a bank located in Silicon Valley that happens to be located on the left coast (as he loves to say) who God forbid provides funding to innovative investing in Woke ESG, and is predominantly owned by entrepreneurs who are far more left leaning then right leaning and you have a perfect mix for meaningless blame game rhetoric.

Add to this the fact that DeSantis in 2017 strongly argued for easing restrictions on banks when it was politically convenient for him to do so. However, now that the given bank in question presents a political opportunity, why not totally change your previous position. Makes total political sense to me.

And by the way he went on to say. “Let's not politicize this.”

And of course Fox News has joined the frenzy:

"Like everything else in our age, the obsession is not to do with expertise. It is to do with this madness of the so-called D.E.I. project," Fox News contributor Douglas Murray said on "Fox & Friends" last Wednesday. "And if we don't learn from this, if banking sectors and others don't learn from this, I don't know when we will."

Unfortunately, sounder minds sometimes prevail and let’s hope that is the case now.

I have an MBA in Finance and consider myself well versed in complicated financial matters but my eyes glazed over as I investigated the cause of SLV’s collapse given the complexity of banking financial statements, government regulations, and duration risk analysis. So I understand that most Americans prefer to listen to sound bites they hear on the news or even worse through social media from people they may already agree with on other issues.

The fact is that businesses become insolvent all the time, but unlike most business banks hold your money. For this reason, and given the implications for the entire economy if Americans all rush to the exits simultaneously, the federal government insures all deposits up to $250,000. But what happens if a majority of depositors have more than $250,000 deposited? Should the Treasury Department make an exception? Should the Treasury Department use taxpayers dollars to save an institution who has bad business practices? And if they do so should they make sure that none of the stockholders profit from the collapse, and if so how do you do that? These are very complex questions indeed that call for our elected officials to stop the blame game and use some critical unbiased thinking to find the best solution for our economy, as well as the American public.

We will continue to have our share of crises in America but unfortunately one of our most looming is a leadership crisis. Unless something changes when the next crisis emerges so will the dishonesty, misleading statements, and the demonization of opponents that are all used to serve a political interest.

As the old adage says: “Never let a good crisis go to waste.”

This approach is totally understandable since it works so well and certainly much easier than seeking the truth by analyzing new information, allowing the data and circumstances to lead one to the proper conclusion.

It is up to us to see through the charade or nothing will ever change. The Greek philosopher Plato was so right when said many years ago:

Those who are too smart to engage in politics are punished by being governed by those who are dumber.

I’m tired of being punished. We must demand a new responsible political system focused on making the tough decisions regardless of whether it appeals to one's base or not.