West is a staff writer for GovTrack.

From news coverage, one might get the impression that Congress is incapable of passing any laws. Certainly congressional Republicans haven’t done themselves any favors on this front, with constant, public infighting and high-profile, mid-session resignations including that of former Speaker Kevin McCarthy, who was deposed by the fringe of his party. But is that impression entirely correct?

We at GovTrack analyzed our extensive database and organized the data to see if that impression was correct, and we discovered some compelling information. When we looked at the 56 most substantive bills that were voted on in Congress so far this year (53 of them in the House), nearly two-thirds were passed with bipartisan support.

First, ground rules that we followed: We excluded procedural votes, nomination votes, post office namings, voice/unanimous consent votes and government funding votes. That left us with 56 roll call votes to review. Then, we decided our categories would be party line, slightly bipartisan (some Democrats voting yes, but not many; a total “yes” count of under 300) and very bipartisan (total “yes” votes of over 300, usually by quite a bit).

Our impression that there were lots of very bipartisan votes was correct: 33 of the 56, or 59 percent. There were only 16 slightly bipartisan votes (28 percent) and the smallest category was party-line with only seven votes (12.5 percent).

So what’s going on? There are some areas (examples included) where there’s clearly a broad willingness to work together:

- Foreign policy ( H.R. 3202: Assad Regime Anti-Normalization Act of 2023).

- Government administration ( S. 3427: A bill to extend the authority to provide employees of the United States Secret Service with overtime pay beyond other statutory limitations; enacted in February).

- International trade ( H.R. 1836: Ocean Shipping Reform Implementation Act of 2023).

- Health care ( H.R. 3838: Preventing Maternal Deaths Reauthorization Act of 2023).

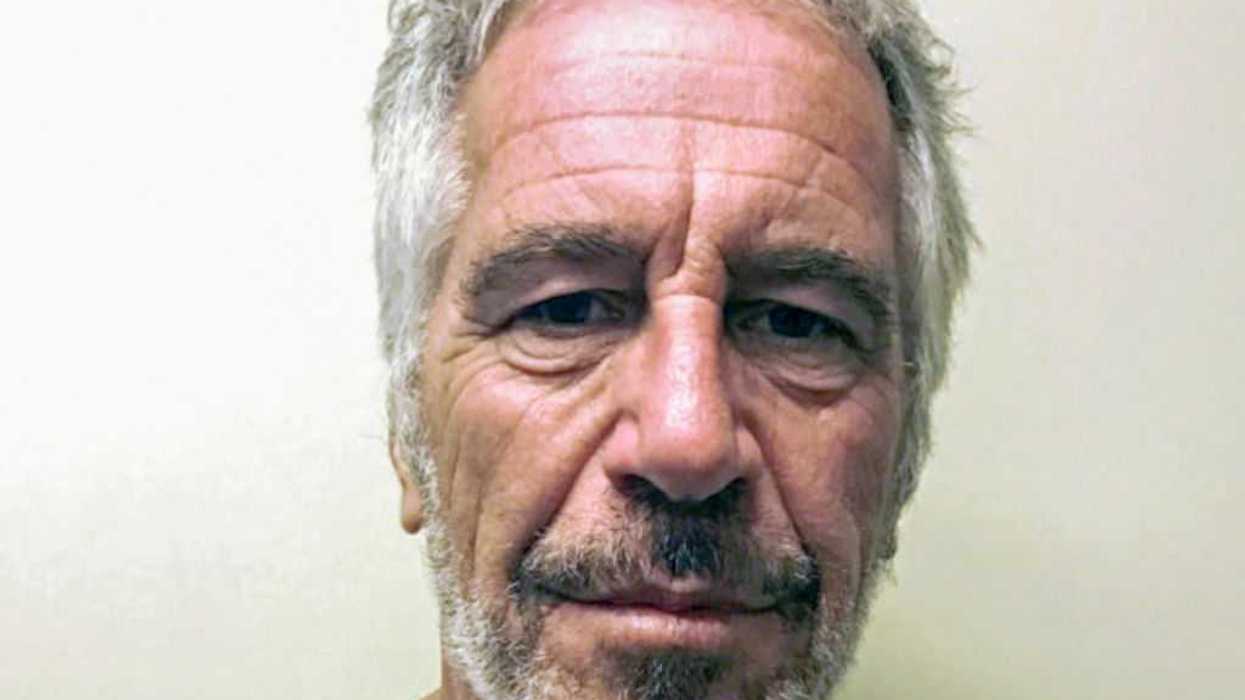

- Human trafficking ( H.Res. 149: Condemning the illegal abduction and forcible transfer of children from Ukraine to the Russian Federation).

And, surprisingly, the bipartisan list included some so-called authorization bills, which direct how federal agencies should spend money but not how much money they get.

Other bills that passed with significant House support tended to be one-offs: the bill to ban TikTok, a tax policy bill and a bill to allow victims and family of victims of the Pan Am bombing in 1988 to view the court proceedings remotely.

Most of these bills have yet to see Senate action even though many of them fall under traditional government work. Three of the 56 have been enacted:

- The Secret Service overtime bill.

- H.R. 2882: Udall Foundation Reauthorization Act of 2023 (via an appropriations bill).

- The Pan Am bombing bill.

It is quite possible, now that the government is funded through the end of September, that we’ll see some Senate votes on the other 53.

Even though they’re many fewer in number, what stands out about the bills passed along party lines or with slight bipartisan support is that they’re related to the top issues in the upcoming elections for president and Congress.

These votes include efforts to repeal environmental regulations, establish government funding for anti-abortion messaging on college campuses, increase punishments for immigrants in various ways and the impeachment of Homeland Security Secretary Alejandro Mayorkas.

While it’s unclear which of these categories will end up with the most bills becoming law, we can at least say that the impression that Congress is entirely dysfunctional is incorrect. It can and does function. How things will go from here is hard to predict, especially with House Republicans’ increasingly shrinking majority thanks to multiple resignations.