As many costs for families, especially those with children, continue to rise faster than wages, a new public consultation survey by the Program for Public Consultation finds bipartisan majorities of Americans in the six swing states of Arizona, Georgia, Michigan, Nevada, Pennsylvania and Wisconsin, as well as nationally, support federal government action.

The study found Republicans and Democrats are in favor of:

- Reinstating the higher pandemic-era child tax credit.

- Providing funding for free universal preschool.

- Subsidizing child care for low- and middle-income families.

- Creating a national 12-week paid family and medical leave program for all workers.

“There is strong bipartisan support for the Federal government taking a more active role in strengthening the support system for families, especially those with children,” said PPC Director Steven Kull.

This survey is the seventh entry in the Swing Six Issue Surveys being conducted in the run-up to the November election. It covers major policy issues across six swing states. Unlike traditional polls, respondents in a public consultation survey go through an online “policymaking simulation” in which they are provided briefings and arguments for and against each policy. Content is reviewed by experts on different sides to ensure accuracy and balance. All Americans are invited to go through the same policymaking simulation as the survey sample.

Reinstating higher child tax credit

The annual tax credit provided to parents with children under the age of 18 was temporarily increased by Congress during the Covid pandemic, from a maximum credit of $2,000 per child to a maximum of $3,600 per child. The higher tax credit was also made fully refundable, so parents who did not pay income taxes still got the full benefit. Those changes expired in 2022.

Bipartisan majorities in every swing state support reinstating this pandemic-era credit (69 percent to 77 percent), including majorities of Republicans (60 percent to 71 percent) and Democrats (80 percent to 85 percent). Nationally, 74 percent are in favor, including 64 percent of Republicans and 83 percent of Democrats.

Respondents were informed in advance that the pandemic-era tax credit both reduced child poverty by about a third and significantly reduced federal revenues, and would likely have the same effects if reinstated.

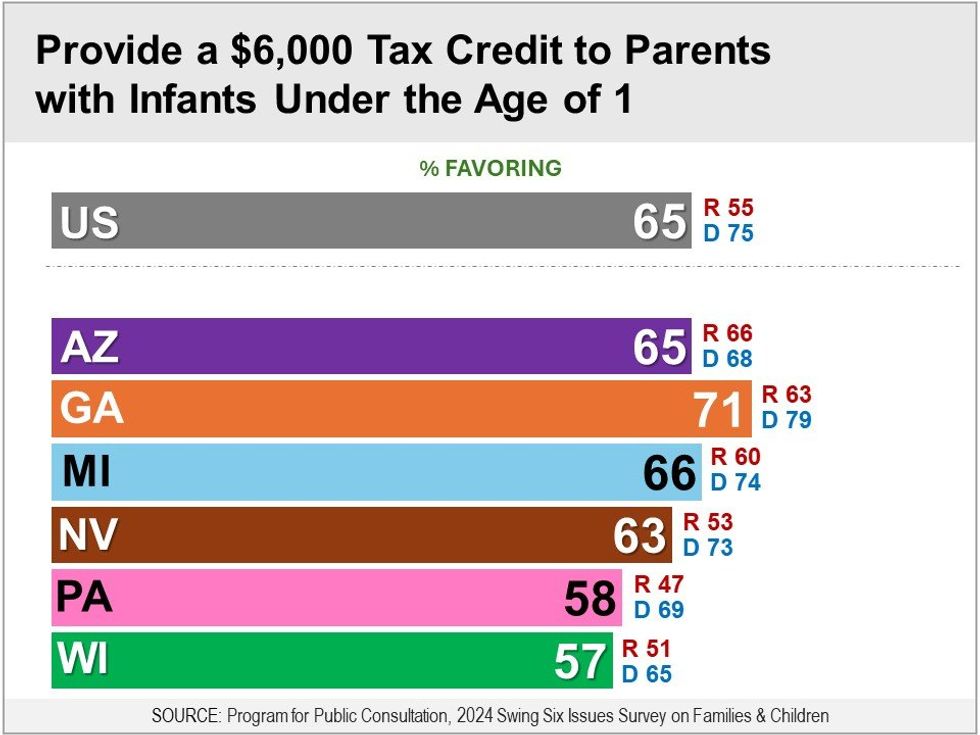

In addition, majorities in every swing state (57 percent to 71 percent) support providing a $6,000 tax credit per child to parents of children under age 1, including majorities of Democrats (65 percent to 79 percent). However, views are more mixed among Republicans. Majorities of Republicans are in support in Arizona, Georgia and Michigan (60 percent to 66 percent), and they are statistically divided in Nevada, Pennsylvania and Wisconsin (47 percent to 53 percent). Nationally, 65 percent are in favor, including a modest majority of Republicans (55 percent) and a large majority of Democrats (75 percent).

Federal funding to support free universal preschool

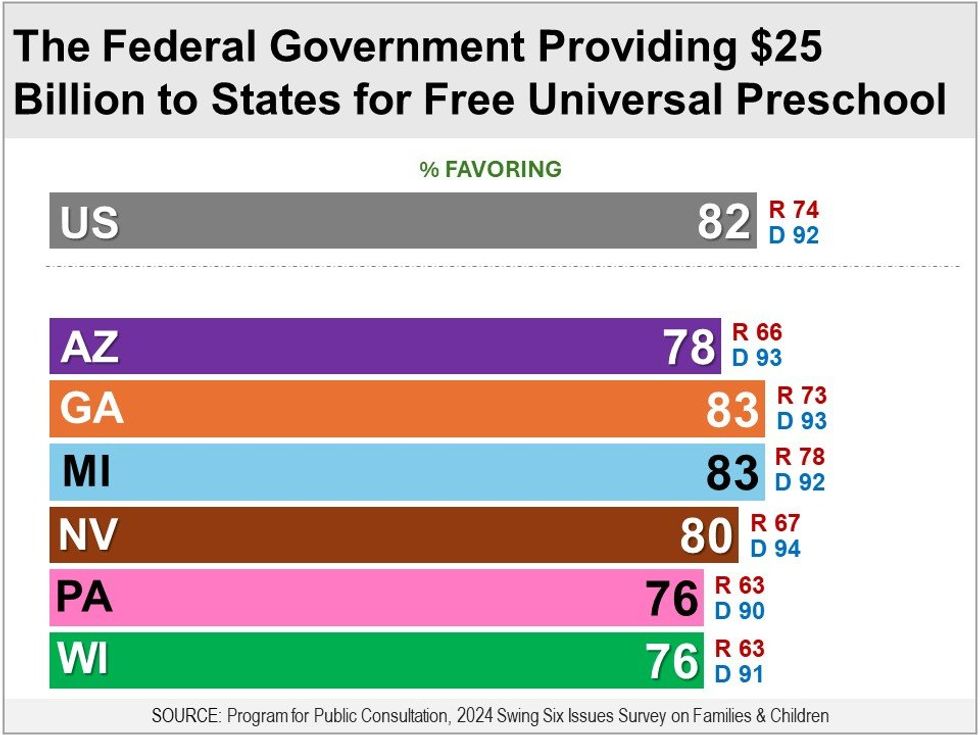

A proposal for the federal government to provide $25 billion to help states or local governments that want to set up or expand free preschool programs, available to all children ages 3 and 4, is favored by 76 percent to 83 percent in the swing states. This includes majorities of Republicans (63 percent to 78 percent) and Democrats (90 percent to 94 percent). Nationally, a bipartisan majority of 82 percent is in favor (Republicans 74 percent, Democrats 92 percent).

Subsidizing child care for low and middle-income families

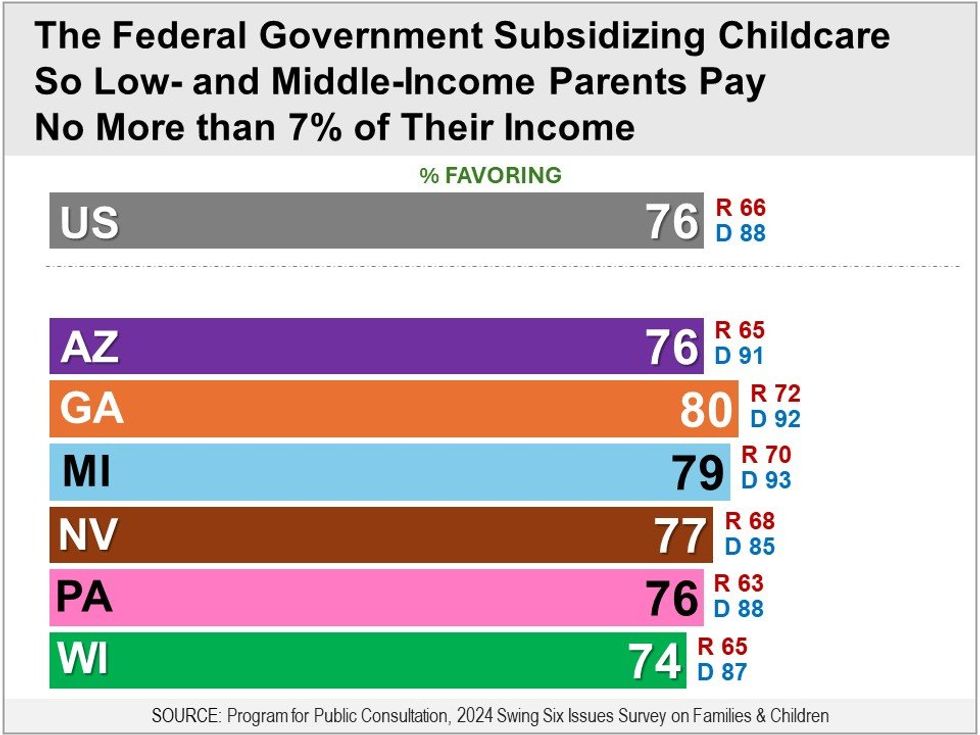

Bipartisan majorities in every swing state (74 percent to 80 percent) support the federal government providing funds to states that want it, to subsidize child care programs for young children so they are free for low-income parents. Middle-income parents would pay no more than 7 percent of their income. That support includes majorities of Republicans (63 percent to 72 percent) and Democrats (85 percent to 93 percent). Nationally, 76 percent are in favor (Republicans 66 percent, Democrats 88 percent).

Paid family and medical leave for all workers

Majorities in every swing state (68 percent to 75 percent) favor creating a national paid family and medical leave program that would:

- Require employers to allow all workers to take up to 12 weeks of leave.

- Provide workers on leave with two-thirds of their wages (up to $4,000 a month), with funds from a new 0.2 percent payroll tax on both employees and employers.

In the swing states, this proposal is favored by majorities of Republicans in Arizona, Georgia, Michigan, Pennsylvania and Wisconsin (55 percent to 67 percent), while Republicans are statistically divided in Nevada (52 percent). The proposal is favored by a majority of Democrats in all six states (81 percent to 86 percent). Nationally, 72 percent are in favor, including majorities of Republicans (61 percent) and Democrats (85 percent).

In advance, respondents were informed that current federal law requires most employers to allow most workers to take up to 12 weeks of family or medical leave, but this law does not apply to workers who are in small companies, are new to their job or work part-time. In addition, current law does not mandate that workers receive any pay while on leave. They were informed that, while not required, some employers provide paid family and medical leave to their workers. But currently, less than half of workers have access to such paid leave.

Will Trump’s moves ever awaken conservatives?