The Fulcrum introduces Congress Bill Spotlight, a weekly report by Jesse Rifkin, focusing on the noteworthy legislation of the thousands introduced in Congress. Rifkin has written about Congress for years, and now he's dissecting the most interesting bills you need to know about but that often don't get the right news coverage.

The U.S. already celebrates Washington’s birthday as a holiday. What about Trump’s?

What the Bill Does

President Donald Trump was born on June 14, 1946, making him 78 years old. (Fun fact: three different presidents were born that same summer: Trump, George W. Bush that July 6, and Bill Clinton that August 19.)

The Trump’s Birthday and Flag Day Holiday Establishment Act would add June 14 as an annual federal holiday. It was introduced on February 14 by Rep. Claudia Tenney (R-NY24).

Context

As it happens, June 14 is also Flag Day, marking the colonial-era Continental Congress approval of a national flag design in 1777.

While a 1949 law recognizes it as an annual “national observance,” that’s a lower designation than an actual holiday —for example, nobody really gets the day off. Some other official annual “national observances” that you probably didn’t even know existed include Leif Erikson Day, National Grandparents Day, and Wright Brothers Day.

One state, Pennsylvania, officially recognizes Flag Day as a state holiday.

The federal government recognizes 11 annual federal holidays: New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, and Christmas.

Juneteenth was the most recent addition, established by Congress in 2021 —though the day’s origins celebrating the abolition of slavery trace back to a Galveston, Texas celebration in 1865.

What Supporters Say

Supporters argue that both Trump and the Stars and Stripes are worthy of celebration.

“From brokering the historic Abraham Accords to championing the largest tax relief package in American history, his impact on the nation is undeniable,” Rep. Tenney said in a press release. “Just as George Washington’s birthday is codified as a federal holiday, this bill will add Trump’s birthday to this list, recognizing him as the founder of America’s golden age.”

“Additionally, as our nation prepares to celebrate its 250th anniversary, we should create a new federal holiday honoring the American flag and all that it represents,” Rep. Tenney continued. “By designating Trump’s birthday and Flag Day as a federal holiday, we can ensure President Trump’s contributions to American greatness and the importance of the American Flag are forever enshrined into law.”

What Opponents Say

While Democrats obviously oppose designating Trump’s birthday as a holiday, several other objections are more nonpartisan. Here are three:

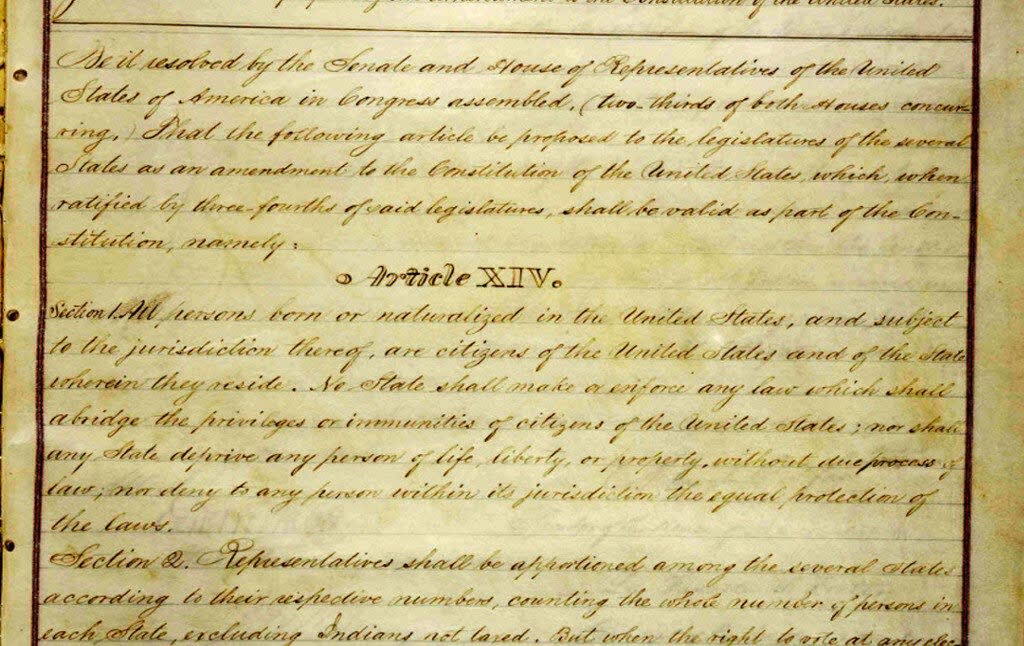

- Trump is still alive. All other federal holidays commemorating a specific person were designated after the person had died. These include Washington’s Birthday (later renamed Presidents’ Day) in 1885, Columbus Day, first by presidential decree in 1937 then later by Congress in 1968, and MLK Day in 1983.

- Timing. Some may also oppose placing two federal holidays spaced only five days apart: June 14 and June 19. (Federal holidays Christmas and New Year’s are seven days apart, but those both long pre-date the U.S. itself—they aren’t uniquely American celebrations, like Flag Day and Juneteenth.)

- No new holidays? Back in 1983, Sen. Pete Wilson (R-CA) introduced a bill capping the number of federal holidays at 10, as there were at the time. A new federal holiday could still be created but only if it replaced an existing one. The Senate actually passed the bill overwhelmingly, by 86-2, but it never received a House vote. The legislation does not appear to have received a vote in either chamber since.

Odds of Passage

Rep. Tenney’s bill has not yet attracted any cosponsors, not even any Republicans. It awaits a potential vote in the House Oversight and Government Reform Committee, controlled by Republicans. No Senate companion appears to be introduced yet.

Other notable people born on June 14: Argentine revolutionary Che Guevara, Uncle Tom’s Cabin novelist Harriet Beecher Stowe, British singer Boy George, and tennis champion Steffi Graf.

Jesse Rifkin is a freelance journalist with the Fulcrum. Don’t miss his weekly report, Congress Bill Spotlight, every Friday on the Fulcrum. Rifkin’s writings about politics and Congress have been published in the Washington Post, Politico, Roll Call, Los Angeles Times, CNN Opinion, GovTrack, and USA Today.

SUGGESTIONS:

Congress Bill Spotlight: adding Donald Trump’s face to Mount Rushmore

Congress Bill Spotlight: BAD DOGE Act

Congress Bill Spotlight: Repealing Trump’s National Energy Emergency

Congress Bill Spotlight: Smithsonian Italian American Museum

Congress Bill Spotlight: Impeaching Judges Who Rule Against Trump