Johnson and Vanderklipp are, respectively, the executive director and research fellow for the Election Reformers Network and the co-authors of “ Nonpartisanship Works: How Lessons from Canada Can Reestablish Trust in U.S. Election Administration.”

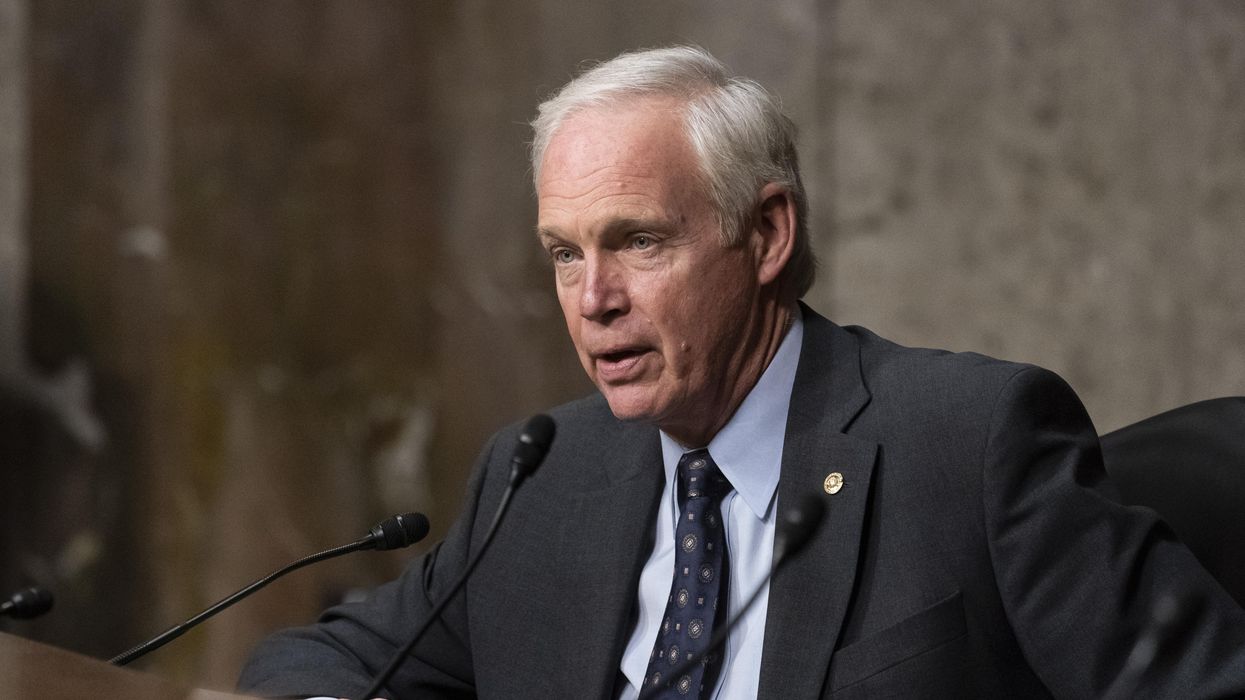

Wisconsin Sen. Ron Johnson has repeated the call for his state’s legislature to seize control of the Wisconsin Elections Commission. Although a takeover won’t happen with Democratic Gov. Tony Evers holding the veto pen, this proposal increases a dangerous trend of partisan legislative micromanagement of elections. This threat to fair elections needs to be spotlighted and nonpartisan alternatives pursued instead.

Fundamentally, state legislatures reflect the interests of the political party in the majority, so Johnson’s proposal is tantamount to control of elections by an organization fielding candidates, a blatant conflict of interest and a hugely unfair advantage for incumbents.

Many legislatures already exert far too much control over election administration and rule-making. In 2021, legislatures have passed election laws at an absurd level of controlling detail, limiting not only dropboxes and voting by mail, but also whether voters in line can receive a drink of water. Redistricting led by legislatures, rather than independent commissions, allows lawmakers to help themselves win re-election and help their party win a majority of seats without a majority of votes.

Yes, the Constitution gives legislatures (and Congress) the power to prescribe “the time, place and manner” of federal elections, but the Supreme Court has rightly ruled that setting the rules for elections, not running them, is a lawmaking function.

The Constitution also requires the federal government to guarantee a “republican form of government” in the states, and it is not an exaggeration to say a state with party-controlled elections has lost that status. A republic is defined by elections that reflect the will of the people, not the will of the people already in office.

The underlying dispute in Wisconsin arose when the Elections Commission issued voting rules to comply with Covid-related public health orders that conflicted with state law. Johnson and others argue any breach of the law must be punished. The real culprit, however, is tightly prescriptive lawmaking in a complex area of public administration. Police commissioners, housing authorities and school superintendents all need latitude to find the best means to achieve policy goals in an unpredictable world. The same is true of election administrators.

A study we released this week illustrates how this needed flexibility is working just across the border from Wisconsin, in Canada. There, top provincial and territorial election officials have wide discretion to amend election provisions to meet the exigencies of the situation. The election code of Yukon, for example, says “the chief electoral officer may extend the time for doing any act; increase the number of election officers or polling stations; or otherwise adapt any of the provisions of this Act to the extent the chief electoral officer considers necessary to ensure the execution of the intent of this Act."

Both liberal and conservative governments in Canada have supported provisions like this in the 13 provinces and territories, and at the federal level.

Where Canadian laws are less flexible is in requiring these officials to be nonpartisan. Chief electoral officers must not actively affiliate with or endorse a party or candidate, and in seven provinces they are not even allowed to vote. Our study finds that this nonpartisanship has created a kind of virtuous circle. Increasing recognition of the neutrality of these officials has led to increasing willingness of lawmakers to entrust them with greater authority.

In the United States, that circle is turning in the opposite, and more vicious, direction. No U.S. state has election leadership structured for nonpartisanship, and states like Texas, Georgia and Arizona are pulling back the limited decision-making allowed to secretaries of state and state election boards. The impact of this mistrust can be seen in the 500 lawsuits filed over election laws implemented for Covid; in Canada, there appear to have been only three.

Nonpartisan election administration came about in Canada not because everyone gets along — they don’t — but from an “enough is enough” reaction to a blatantly manipulated election in 1917. Canada’s parties disagree over election security and voter access, and the most recent conservative government enacted a national voter ID. But no one disputes the value of nonpartisans in charge, or proposes a political party takeover of elections.

“Enough is enough” probably sums up the thinking of many in Wisconsin as well. What’s needed there, and in all states, is election leadership constitutionally required to act in a nonpartisan manner and constitutionally protected from legislative overreach. That won't be easy to achieve, But the alternative, as proposed by Johnson, would wreck the republican form of government in the state. The only way left for Wisconsin out of its partisan death spiral is to recognize that nonpartisanship works in many other countries, and to put it in place here.

Trump & Hegseth gave Mark Kelly a huge 2028 gift