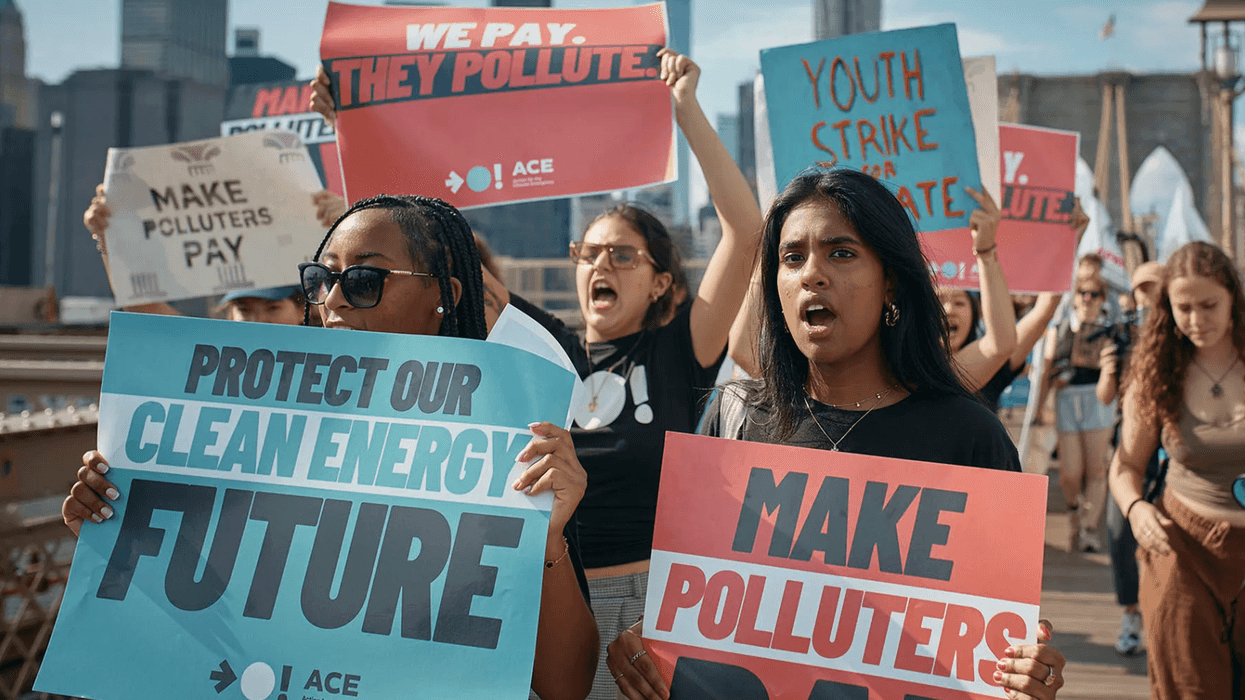

In 2016, Boyle Heights erupted in protests against a rising tide of gentrification and displacement that threatened the enduring character of the neighborhood. As in many communities across Los Angeles, residents—75 percent of whom were renters—faced skyrocketing housing costs that threatened to remove them from the city center. “Keep Beverly Hills out of Boyle Heights,” read protest signs.

In response, Inclusive Action for the City (IA), a small nonprofit that advocated for and extended microloans to street vendors, proposed that owning property was the best way for residents to avoid displacement. While IA had a bold vision, it lacked the financial resources to carry out its idea. So it teamed up with Genesis LA, a community development financial institution (CDFI), and two longtime community development organizations, East LA Community Corporation and Little Tokyo Service Center, which had experienced staff and additional financial resources.

Together, the four organizations created a new joint venture, the Community Owned Real Estate (CORE) program, whose long-term goal was to create a pathway for tenants to become owners. Their short-term approach was to purchase buildings, preserve existing businesses, offer commercial spaces to local entrepreneurs, and provide technical assistance and other resources to help tenants grow their businesses and organizations and, ultimately, purchase the buildings themselves.

New Markets Tax Credits (NMTCs), to which Genesis LA had access, were a critical element of CORE’s financial strategy. The tax credits, which incentivize private investment in projects that support commercial development and growth in low-income neighborhoods, act as a subsidy, allowing certified CDFIs to lend investment capital on more favorable terms to qualified borrowers like CORE while reducing risk for investors. The $10 million funding stack for CORE included about $3 million in NMTCs, which supported about $5.6 million in debt; the remaining $1.4 million was sourced from equity and grants from philanthropic partners.

Using short-term acquisition loans from Genesis LA, CORE identified and acquired five commercial properties in Boyle Heights and neighboring areas. In the fall of 2019, the deals closed and many tenants signed their leases. Weathering the COVID-19 pandemic certainly strained the effort. But today four buildings are fully occupied by flourishing small businesses and nonprofits. The fifth, which faced lengthy construction and permitting delays, is almost ready, and Inclusive Action’s board recently approved the purchase of a sixth.

Thus far, CORE’s investment has succeeded on many fronts: securing financing, surviving the pandemic, and sustaining businesses and the community. CORE recently began work on a capital campaign, securing support from local foundations to increase subsidies to ensure that the properties remain affordable when the NMTCs expire. They are moving their current properties toward community ownership and exploring possibilities for a mission-driven holding company that can quickly acquire properties while potential long-term owners raise funds. Cross-sector collaboration, creative financing, and tenant involvement will remain central as they continue to grow.

CORE’s success highlights an emerging and overdue paradigm shift in community development finance. In prior decades, an overreliance on markets to drive social solutions led to investment practices that too often mirrored market conservatism in prioritizing scale over social mission and devaluing customized, community-based solutions. The new paradigm, by contrast, prioritizes equity, flexible responses to local needs, and community voice.

It is long past time to rethink how community development finance operates. As leaders in community development and philanthropy, we aim to show why and how this crucial field needs to reframe the role of capital technicians and the market, rebalance power relationships, and prioritize community voice. In what follows, we urge community development financial institutions to expand their vision beyond making markets work in underserved places. We believe the field now has the strength and breadth to incorporate customized local solutions more assertively. We argue that the field should actively embrace power sharing with community development practitioners who are not financiers. Finally, we urge philanthropy to support these strategic shifts with patient, long-term capital that places trust in the communities it aims to serve.

The Fight Against Poverty and Racism

The history of US community development is rooted in the late 1960s and the war on poverty and Civil Rights Movement. Beginning in the late 1980s, and especially amid the rise of neoliberalism, community development financing sought to stimulate markets to reverse disinvestment in poor neighborhoods, kick-start economic growth, and undo decades of racial injustice. The idea was that economic growth would bring greater prosperity and, together with civil-rights activism, undo racism and its effects to create better lives for all. By scaling up these efforts and making markets work in these communities, community development would serve the greatest number of people with the most efficient use of public, private, and philanthropic resources. By improving the economies of poor communities at scale, the field would eventually transition to a self-sustaining community development investment model that paid for its basic operations.

This market-focused approach produced results, especially alongside tremendous growth in the United States and worldwide. The four decades since have seen intense growth: The US GDP has expanded from $2.9 trillion in 1980 to $28.8 trillion in 2024 (nominal dollars). Community development finance has achieved delivery at scale and is now a high-performing partner in American social policy, deploying billions of dollars in socially purposed capital each year to thousands of communities nationwide.

However, as robustly as this model of community development has grown, much remains to be done. The problems of poverty and racism persist. In fact, racial segregation has increased in a significant majority of the country’s metropolitan areas. Major cities, such as Detroit, Cleveland, and Chicago, have become more segregated, despite decades of community investments. Many community development practitioners, investors, and residents now question the limits of the market-driven approach underlying community development finance and wonder how to fashion a more inclusive model. And not only has the conventional market-driven approach disappointed hopes for addressing poverty and racism, it has also fallen short of achieving financial sustainability for community development organizations.

It is well past time for community development to rethink its fundamental assumptions and adjust to the latest evidence and its past 40 years of experience. We began to sketch our thoughts on how philanthropy can shift its operations in our 2022 report, “ People, Place, and Race: How Philanthropy Can Help Center People and Equity in Community Development.” Here, we argue more broadly that market-based solutions are limited and that the belief that markets can solve all social problems is wishful thinking. Instead, we call for a significant revision of the traditional community development finance principles of markets, scale, and self-sustainability and a rebalancing of the power relationships between community investment models and resident voice. And we urge philanthropy to support these changes with patient, long-term, trust-based capital and grantmaking.

Forty years ago, the dominant thinking held that capital investment was critical to development, and that community developers and financiers would succeed if they adopted disciplined business practices, created viable business models, achieved scale, and became self-sufficient. The approach reflected the double-bottom-line idea of doing good by doing well. The goal was to attract market capital, provide a return on investment, prove the work was viable, scale up, and build a platform for maximum mission achievement. The three main principles of this approach were:

- Markets, if effectively harnessed, will eliminate poverty and racism.

- Scale is the ultimate goal (to serve the largest number of people), and activating markets is the best way to achieve it.

- Self-sustainability, ideally within three to five years (a standard driven by the donor community), should be the goal of nonprofits addressing poverty and racism.

Philanthropy played a pivotal role in harnessing the power of markets to shape community development. Philanthropy sought to lift the economic status of urban and rural communities through program-related investments (PRIs) and mission-related investments (MRIs), building infrastructure, such as community development financial institutions (CDFIs), advocating for policy change, and leadership development—and it succeeded remarkably in many ways.

Today, CDFIs prize scale and attract large sums of private investment. They have mobilized billions of dollars in investment capital, adopted disciplined practices, achieved top-tier ratings from Standard & Poor’s and other rating agencies, created well-defined and repeatable loan products, issued 501(c)(3) bonds, substantially influenced public policy, and bridged mission-driven work and private capital markets. An Opportunity Finance Network membership survey of more than 400 CDFIs revealed that they deployed more than $10 billion to underinvested communities in 2022 alone.

These accomplishments are massive and important. Until the past decade, few people believed that community development finance could be more than a boutique industry. Few believed it could be brought to scale or that community loan funds could influence the behavior of market-oriented institutions. Few predicted the influential role the field could have in stimulating social-policy solutions. Yet creative and visionary leaders accomplished these Herculean tasks.

But each step in the direction of market replication, scale, and self-sufficiency squeezed flexibility and creativity out of community development. To achieve their own sustainable operations, CDFIs prioritized efficiency and (relatively) large operational platforms. Community development finance increasingly mirrored the private-capital industry, with the scale, volume, and discipline this implies. But, all too often, its approach sacrificed resident involvement and creative, customized responses to community challenges—and its vision of organizations and projects sustaining themselves through self-generating revenue streams rarely came to pass. Now the field has an opportunity to rebalance power dynamics between CDFIs and community organizations and to introduce flexible new approaches to capital.

Shifting From Scale to Systems Change

Taking community development impacts to scale requires high-volume capital deployment and the conservative risk thresholds that attract and retain private, public, and philanthropic investors. The result is a virtuous cycle of expanding capital, expanding deployment, and broader reach. Yet it is increasingly clear that to achieve the impacts it seeks, community investment needs to better address the roadblocks of structural and systemic racism, local complexities, and overly restrictive views of philanthropic leverage and investment. Fortunately, since 2010, developers and investors have been assembling the elements of a new approach to deploying capital. The dual elements of this new perspective are that systems change matters as much as scale and that community voice is critical to effective community development.

The core principle of social investing is that it is not only possible but imperative for investments to achieve social and environmental outcomes at scale. After all, the problems we are trying to address are enormous. In 2019, the Global Impact Investing Network surveyed 266 impact investors who reported a total of $239 billion in impact investing assets. To be sure, social investors recognize that the pursuit of both impact and scale presents trade-offs. Every investor sees those trade-offs differently and is willing to sacrifice for social impact. But for investments in low-income communities to avoid extractive outcomes, the balance needs to tilt strongly toward impact, flexibility, and voice.

Many leaders in community development and philanthropy have recognized and incorporated this focus on social outcomes into their practices and investments. But taking this step is not enough. Ultimately, if investors want to support low-income communities, residents of those communities must have a leadership role. Therefore, community development finance must do more to relinquish power and decision-making to community residents and organizations affected by capital and the ways in which technicians manage capital.

We are not alone in advocating this shift. Many parts of the United States are already beginning to adopt new practices. A rich body of practitioner experience is addressing the current shortcomings of the community development field and exploring new antiracist models and approaches to development. For example, a 2023 report by Cleveland-based community organizer ThirdSpace Action Lab, “ Anti-Racist Community Development Research Project,” highlights the increased skepticism of many practitioners and community residents about the idea that the market-driven development approach can solve the problem of racism; instead, the report recommends more race-explicit, community-driven, place-based approaches.

Drawing from ThirdSpace Action Lab’s work and our experience, we suggest that community development finance adopt three strategic shifts:

From markets to mission and community voice | As we have noted above, the reliance on a market-based theory of change often leads community finance toward projects that serve a business model as much as mission and bring about limited impact and community disempowerment. Also, getting past the scale threshold is functionally impossible in many low-income neighborhoods, where housing projects in particular cannot cover costs without significant subsidies. This realization has led many in the community finance world to redefine the rules of investment. The resulting growth of impact investing has led to larger pools of capital that prioritize people and racial, social, and environmental justice over return.

In addition, we are seeing increasing evidence that investing in people directly—as in universal basic income demonstrations and pandemic-era public investments in income and housing stabilization, childcare, and college loan relief—has a transformative impact. Decades of research on early-childhood education and care, for example, have shown durable and lifelong impacts on career trajectories and success. More recent research on social mobility, by economist Raj Chetty and political scientist Robert Putnam in particular, has also revealed the critical importance of social capital, which itself is the product of community cohesiveness, connectedness, and engagement, in overcoming generational poverty. New models of development should seek greater community benefit and direct investment in human capital as much as, if not more than, return. Engaging community residents and organizations in defining this benefit and directing this investment will be crucial to the success of these models.

From scale to systems change | Racial inequity and poverty are deeply and historically rooted in social structures, institutions, and systems. Scaled-up capital investments alone cannot dig out these roots. It is not hard to understand why scale became the de facto goal, especially since cities are woefully short of enough quality affordable housing. But the focus on production of units has overshadowed the human and social landscape of communities. Further, the long history of publicly sanctioned segregation and exclusion in the form of redlining and discriminatory neighborhood covenants has precluded generations of Black and Brown communities from traveling paths of opportunity. Alternative models that combine public, private, and philanthropic investment; focus on local context; and support authentic community collaboration have demonstrated how to achieve equity, as well as economic growth. Flexible community-inspired and community-led solutions show greater durability, increase the agency and trust of residents, and overcome the resistance of communities to top-down solutions. The result is true systems change.

From self-sustainability to long-term investment for social returns | The short-term funding cycles (typically three years) of many foundations and impact investors create unrealistic expectations. Lasting social change requires many more years of patient investment, as any long-term investor understands—and the change required to address deep-rooted causes of racial and economic inequity requires a long-term vision. Organizations and projects that achieve true sustainability are the unicorns, not the standard. Philanthropy must shift to a longer investment horizon that embraces patient capital.

In addition to adopting these overarching mind shifts, funders need to rethink their investment practices and move beyond the specific projects in which they choose to invest to also consider their impact on the community investment field as a whole. Specifically, we have two recommendations:

The investment expectation must shift from incremental to transformative. Since the 1960s, the community development system has often measured progress in units: number of houses built, square feet of commercial developments, jobs created, and so on. Certainly, these were, and are, important markers of progress. However, few would argue now that these discrete outcomes eliminated poverty or racial segregation. Impact investors seeking to address wicked problems, whether the threat of climate change or barriers to social mobility, are not content with incremental change. They are looking for transformative investments. Grants and investments in experiments such as universal basic income are not simply aiming for a successful welfare program but seeking a potentially revolutionary model for ending the cycle of poverty. New pooled-capital funds such as the Fair Food Fund and Potlikker Capital see themselves not just as small business or farmer loan programs but as vehicles to transform the food system itself. In the same way, community development investors need to look beyond discrete developments to the wholesale reformation of communities.

The investment horizon must shift from sustainability to generativity. Under the old paradigm, funders and investors sought to create financial self-sufficiency. But the new vision for investing is to generate a level or degree of change in which the initial investment has the potential to change people’s views of what is possible. This ideal does not necessarily entail a significant financial return or scale of replication. It means looking for investments that can unleash innovation, upend the status quo, and open fresher, more effective, more equitable, and more long-lasting solutions. The narrative about social determinants of health, for example, is that social and environmental contexts play a significant role in people’s health. Starting with seed projects, this idea has spread rapidly through the private and public health systems and has begun to fundamentally change how health care is delivered, including what insurance covers. Such generative social impacts ripple out far beyond the original investments. The new paradigm for community investing seeks a similar transformative arc.

Shifting the Balance of Power

It’s one thing to identify new core principles; it’s another to put them into practice. No single institution can rebuild a community.

Tomorrow, in the second of this three-part series, we will explore how this is not only possible — it is happening across the country. We began this article with the story of CORE’s work in the Boyle Heights neighborhood of Los Angeles. Tomorrow we will now turn to two more examples to flesh out the new community-driven model and demonstrate how these new principles are shaping community development for the better and transforming its work.

Fukuzawa is a strategic advisor and former managing director at the Kresge Foundation. Andrews is a fellow at Stanford University’s Distinguished Careers Institute and former president and CEO of the Low Income Investment Fund. Steinitz is a writer and a communications and learning consultant for schools and nonprofits, including the Center for Community Investment.

This article was first published in the Stanford Social Innovation Review. Read the original article.