America's tariff experiment, now nearly a year old, is proving more painful than its architects anticipated. What began as a bold stroke to shield domestic industries and force concessions from trading partners has instead delivered a slow-burning rise in prices, complicating the Federal Reserve's battle against inflation. As the policy grinds on, economists warn that the real damage lies ahead, with consumers and businesses absorbing costs that erode purchasing power and economic momentum. This is not the quick victory promised but a protracted burden that risks entrenching higher prices just as the economy seeks stability.

The tariffs, rolled out in phases since early March 2025, have jacked up the average import duty from 2 percent to around 17 percent. Imported goods prices have climbed 4 percent since then, outpacing the 2 percent rise in domestic equivalents. Items like coffee, which the United States cannot produce at scale, have seen the sharpest hikes, alongside products from heavily penalized countries such as China. Retailers and importers, far from passing all costs abroad as hoped, have shouldered much of the load initially, limiting immediate sticker shock. Yet daily pricing data from major chains reveal a creeping pass-through: imported goods up 5 percent overall, domestic up 2.5 percent. Cautious sellers absorb some hit to avoid losing market share, but this restraint is fading as tariffs are embedded in supply chains.

Academic tracking of over 350,000 products underscores the pattern. Prices for tariff-hit imports have risen, though below the full duty rates, indicating partial absorption by foreign exporters and U.S. firms. This near-complete pass-through to U.S. importers - who then relay it to buyers - is creating a tangible drag on households already strained by post-pandemic finances. By August, tariffs accounted for 0.5 percentage points of headline personal consumption expenditures inflation and 0.4 points of core, explaining nearly 11 percent of the year's headline rise. Small and medium-sized businesses, surveyed through mid-year, report doubling their effective tariff payments from 6.5 percent in January to 11.4 percent by July, with expectations of enduring 25 percent rates fueling plans for broader price adjustments.

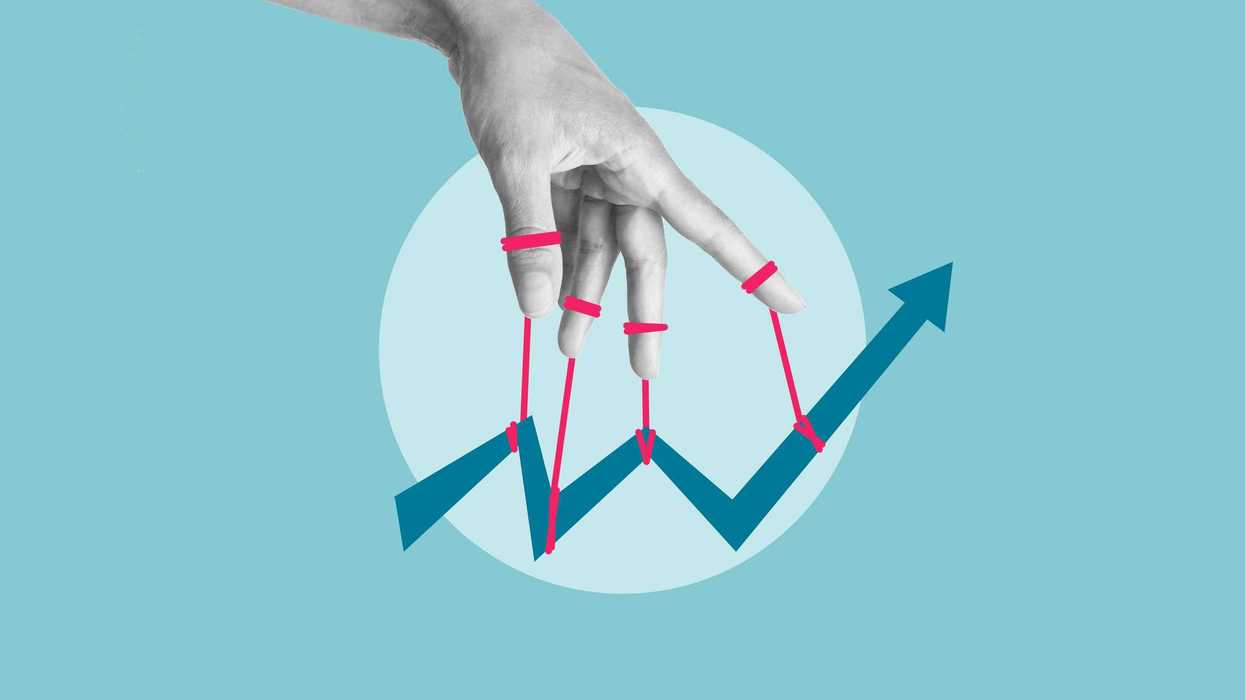

This domestic sting contrasts sharply with the White House narrative. Officials insist foreign producers will eat the costs to cling to America's vast market, preserving U.S. leverage without pain at home. Reality tells a different story. Total tariff costs could hit $1.2 trillion this year, with consumers footing $592 billion in higher prices. Goldman Sachs pegs the consumer share at 55 percent now, potentially climbing to 70 percent in 2026 as inventories deplete and contracts renegotiate.

The Federal Reserve finds itself caught in the crossfire. Tariffs complicate its dual mandate, injecting upside risks into inflation just as rate cuts aim to spur growth. Projections now see 2025 core personal consumption expenditures inflation at 3.1 percent, up 0.3 points from pre-tariff forecasts, with headline at 2.7 percent. Policymakers have paused easing, with one fewer cut eyed for 2026, as tariff-driven pressures on durables like appliances and electronics add 0.33 percentage points to core goods prices alone. A back-of-the-envelope calculation suggests a 0.75 percent bump in core consumer prices from direct import effects, excluding knock-on effects from input costs. Investment goods face steeper price increases: a 25 percent across-the-board tariff could lift their prices by 9.5 percent, compared with 2.2 percent for consumer items, curbing business spending and amplifying slowdowns.

Global ripples compound the trouble. Retaliatory measures from Canada, Mexico, and the European Union have trimmed China's growth forecast to 4.4 percent, dragging U.S. exports and supply chains. The dollar's 7 percent slide since December offers scant buffer, as it further raises import bills. Early dynamics mimic a demand shock, with pullbacks in spending temporarily easing inflation, but models predict a rebound: unemployment ticks up initially, then activity recovers amid stickier prices. For consumers, this means less variety on shelves, from apparel to electronics, as retailers prune options rather than absorb endless costs.

The irony runs deep. Tariffs were sold as a tool to revive manufacturing, yet they now fuel the very inflation they were meant to counter. To address this, we must move beyond rhetoric and toward concrete civic solutions. We need to mandate a bimonthly, non-partisan audit of the tariff’s costs to the American public. This audit should include an automatic "trigger" for Congressional review if the data shows the "sting" on consumers - measured by price pass-through and impact on the Fed's inflation mandate - has become too high.

Such reform would ensure that protectionism remains a calculated strategy rather than a blind burden. As 2026 looms, with pass-through accelerating, the policy's flaws stand exposed. Reversing course would be admitting defeat; doubling down invites a recession. Ultimately, these safeguards are necessary because, as the current data proves, protectionism's bill always arrives at the domestic door, paid in full by those least able to afford it.

Imran Khalid is a physician, geostrategic analyst, and freelance writer.