The latest fiscal disclosures from the US Treasury offer a stark reality check for a country that continues to see itself as the global lodestar of economic stability. Tariffs, once an auxiliary tool of industrial policy or bargaining chip in trade negotiations, have quietly morphed into the financial backbone of the Trump administration’s economic experiment. October’s revenue haul - an unprecedented thirty-four point two billion dollars, up more than threefold from a year earlier - has been heralded by the White House as vindication. It is, according to President Trump, not merely proof that tariffs are “working,” but a testament to a new era of American prosperity robust enough to fund direct cash transfers to households. A two-thousand-dollar bonus, he insists, is just the beginning.

The president has taken to social media to cast opponents of this approach as out-of-touch elites, blind to a transformed landscape in which the United States is, in his words, “the richest and most respected country in the world.” Record stock prices, swollen retirement accounts, and subdued inflation are deployed to sustain an alluring political narrative: that tariffs are no longer punitive, but emancipatory - a fiscal engine capable of generating national renewal.

Scratch beneath the slogans, however, and the numbers point to a far more sobering outcome. Even with this historic spike in tariff receipts, the federal government still ran a deficit of two hundred and eighty-four billion dollars in October alone - the highest opening-month deficit in US fiscal history. Calendar quirks softened the figure on paper, yet the adjusted deficit still stood at one hundred and eighty billion dollars. No serious policymaker can describe that as anything other than alarming.

International institutions are equally unconvinced. The International Monetary Fund cautions that far from reversing America’s fiscal descent, the administration’s strategy could accelerate it. By 2030, US public debt is projected to climb to one hundred and forty-three percent of GDP - fifteen points higher than previous estimates. The drivers are not mysteries: outsized spending promises dressed up as populism, from infrastructure to defense upgrades to cash giveaways, with no credible revenue path to support them.

The cost of carrying this burden is no longer an abstract line on a Treasury report. In October alone, the United States paid one hundred and four billion dollars in interest—the highest ever recorded for that month. Over the past year, interest payments totaled one trillion two hundred and forty billion dollars, a staggering quarter of all federal tax revenue. Each dollar spent on servicing past decisions is a dollar that cannot be used for housing, schools, transportation, or healthcare. Washington is mortgaging tomorrow to pay for yesterday.

Tariffs themselves, the supposed cure, are becoming part of the disease. They operate in practice as a stealth consumption tax. Import prices have climbed, eroding real wages by roughly two point three percent—a bitter irony for the manufacturing workers who were promised restoration. Business margins have tightened, investment has slowed, and the tax base has shrunk. What was sold as a patriotic duty increasingly resembles a self-defeating spiral.

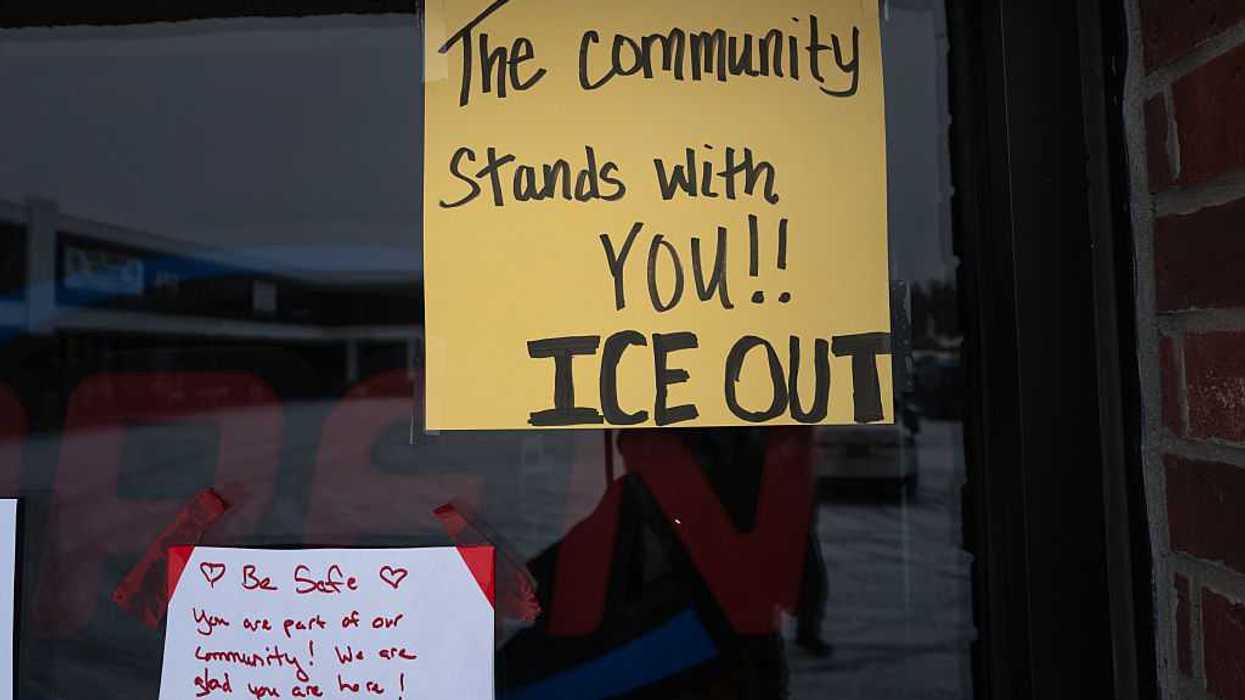

The political fallout is already visible. On November 25, several states sued the federal government, demanding restitution of more than three billion dollars previously earmarked for homelessness programs. Local officials warn that the cuts could deprive one hundred and seventy thousand Americans of housing assistance. It is an extraordinary moment: Washington proclaims a new era of tariff-funded grandeur while the states struggle with acute social crises.

These contradictions ripple far beyond domestic politics. The world’s financial architecture rests on confidence in US Treasury securities. That confidence is not inexhaustible. A sustained increase in borrowing costs could force Washington into painful austerity or curtail its geopolitical footprint - outcomes that would reshape global power dynamics in ways few Americans are prepared to confront.

Some optimists point to Japan, a wealthy nation that coexists with towering debt. The analogy is precarious. Japan’s liabilities are owned overwhelmingly by its own citizens. America relies on foreign creditors and the intangible asset of global trust. That trust endures only so long as the world believes the United States can, and will, rein in its liabilities.

The administration insists it is charting a revolution in economic philosophy. Yet revolutions are judged not by their slogans, but by the legacies they leave. Tariffs can fund political theatre, but they cannot substitute for a coherent fiscal doctrine. Deficits can be rationalized for a time, but not forever. Illusions can animate a movement, but they eventually collide with arithmetic.

The United States remains a country of immense capacity - capable of balancing ambition with discipline, prosperity with prudence. What it lacks is consensus. A nation that cannot agree on what government should do cannot agree on how to fund it. The current model of financing popularity through border taxes and ballooning deficits is not a strategy. It is a gamble with stakes that extend far beyond one election cycle.

This absence of consensus is not merely an economic failure; it is a profound crisis of governance and civic capacity. For decades, Americans have been deliberately shielded from the true cost of their government - borrowing trillions to finance tax cuts, wars, and entitlements without ever asking the public to pay the bill in real time. Safe congressional districts drawn through extreme gerrymandering have empowered the most ideological voices in both parties, turning compromise into betrayal and rewarding politicians who refuse to level with voters about trade-offs. Primary voters and polarized media ecosystems further punish any leader who dares acknowledge that every new benefit or tax cut must eventually be paid for. Until citizens themselves demand - and reward - politicians willing to make the hard choices, no amount of tariff revenue or budgetary gimmicks will arrest the slide. The fiscal crisis will not be solved in Washington alone; it must first be confronted in the mirror of public opinion.

The world expects leadership from Washington, not improvisation masquerading as innovation. The clock has not yet struck midnight, but it is no longer early evening. Debt, like time, accumulates quietly until it defines a nation’s choices. The question before America is no longer whether it can afford to change course. It is whether it can afford not to.

Imran Khalid is a physician, geostrategic analyst, and freelance writer.