In a speech in North Carolina, President Trump tried to persuade Americans that he is reducing costs and improving the economy. He also emphasized his hardball negotiating tactics. Behind the scenes, however, he may be using strong-arm tactics to deplete the U.S. Treasury at the expense of ordinary taxpayers. In a shameless move, he has demanded $230 million under the FTCA—a statute that waives the United States’ immunity from suit in very limited circumstances. Following Trump's example, a personal injury lawyer famous for brandishing weapons at protesters recently filed hundreds of Federal Tort Claims Act (FTCA) claims with the federal government. The claims seek compensation for individuals convicted of federal crimes related to the January 6, 2021, attack on the Capitol who were pardoned by President Trump. If Congress doesn’t act, the FTCA might become the latest vehicle for transferring money from the U.S. Treasury into the pockets of Trump’s political allies, with no genuine oversight.

Trump’s claims stem from his insistence that the investigation into Russian interference in the 2016 election, and the 2022 search of Mar-a-Lago in conjunction with allegations that he mishandled classified documents, were compensable torts. The January 6 claimants seek compensation for being charged and convicted of federal crimes. Ordinarily, such claims would be non-starters. But because Congress gave the executive branch authority to settle claims without a trial and with no further review, there is a serious risk that Trump’s own appointees will authorize paying out hundreds of millions of taxpayer dollars for claims that are far-fetched under applicable law.

Representatives Jamie Raskin and Robert Garcia have sought information from Trump on his demands as part of their Congressional oversight responsibilities. But to date, public outcry has not matched the stakes involved. This might be in part because the inner workings of the FTCA are known mostly to lawyers who specialize in suing and defending the government. It could also be a result of "corruption fatigue."

While Trump’s FTCA gambit is unprecedented, it might portend similar insider deals with people in Trump’s orbit, including the January 6 claimants. Department of Justice (DOJ) lawyers are reportedly in settlement talks with former National Security Advisor Michael Flynn over a $50 million FTCA lawsuit alleging that Flynn was wrongfully charged with making false statements to the FBI in 2017 (statements Flynn admitted were false). These numbers vastly exceed even record-breaking FTCA settlements, such as the $138.7 million global settlement in 2024 of 139 claims brought by Larry Nassar’s sexual abuse victims that allegedly could have been prevented had the FBI conducted a proper investigation.

To be sure, in the Nassar case and others, injured parties should be able to seek redress from the federal government. Under governing law, doing so is generally too hard, rather than too easy. But DOJ seems likely to settle Trump’s claims without regard to their legal merit, while simultaneously pursuing investigations of, and charges against, political opponents.

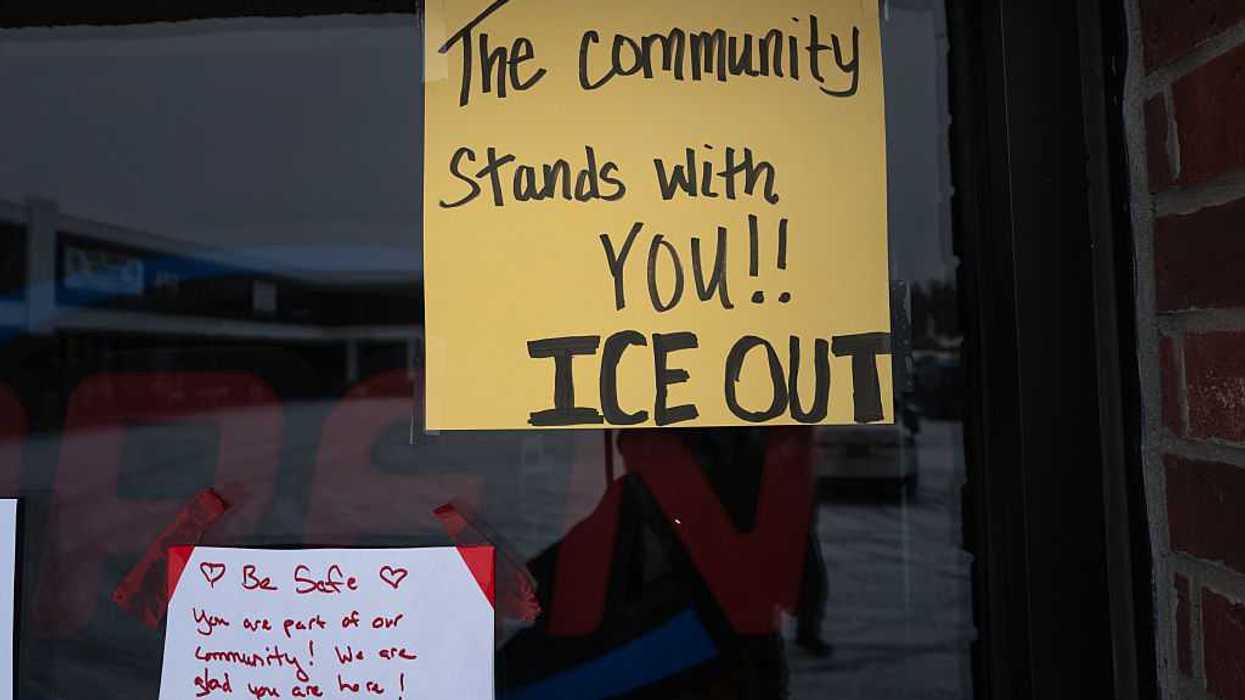

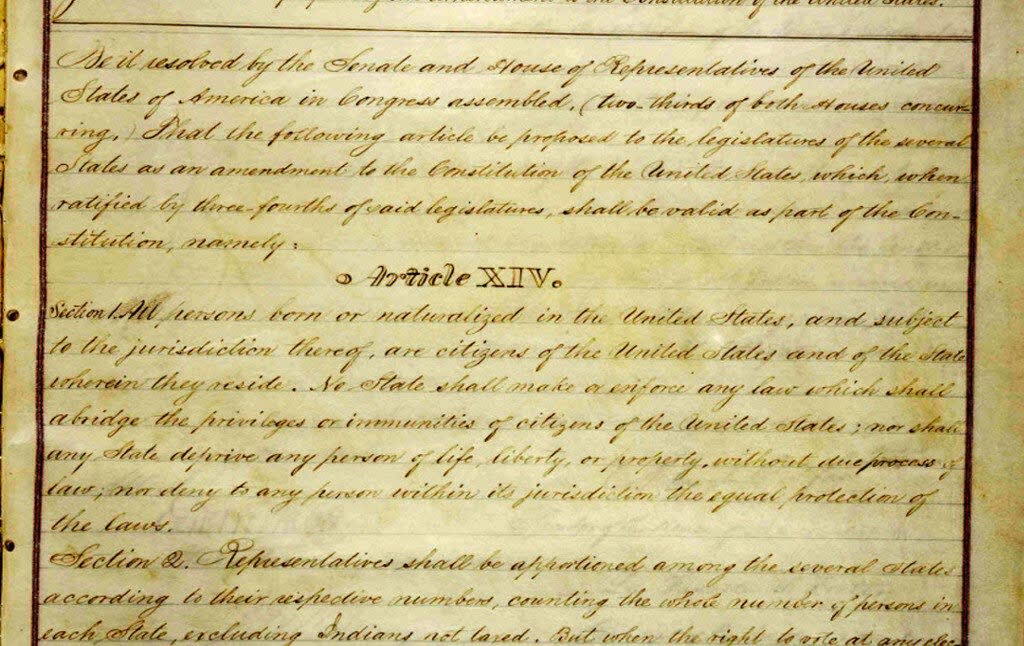

Unlike exonerations of wrongfully convicted people, pardons do not erase the underlying wrongdoing. Although most, if not all, of these FTCA claims would fail under applicable law because they involved discretionary charging decisions, the possibility of a negotiated settlement by the DOJ means Congress’s intent could be thwarted without any judicial review. Imagine Juan Orlando Hernàndez, who was convicted by a jury for trafficking cocaine into the United States and sentenced to 45 years in prison, receiving a huge payout of U.S. taxpayer dollars after being pardoned and freed by the President. Now multiply that by hundreds of claimants.

Congress can intervene to block this worrying trend. Before Thanksgiving, the House voted 426–0 to repeal a heavily criticized provision in the legislation that ended the government shutdown. That provision creates new notification requirements for law enforcement access to certain types of Senate data and applies these retroactively to 2022. It also lets senators sue the federal government for $500,000 per violation, including past occurrences that were not violations at the time they happened. Although a few senators have said they will not sue, the law could direct millions in taxpayer dollars to eight senators’ pockets—including Senator Lindsey Graham, who blocked a vote to repeal the provision. The House's unanimous vote shows that Republicans and Democrats can unite against self-dealing.

Senators Mazie Hirono and Adam Schiff, together with several colleagues, have introduced legislation to prevent a sitting president from bringing tort claims against the U.S. government. They should update the bill to block FTCA claims by individuals convicted of federal crimes who have subsequently received presidential pardons. They should also rename it, since the “No Torts for Trump” act makes the legislation sound partisan and overly personal. The broader principle that a sitting president shouldn’t be able to negotiate a financial settlement with his own political appointees, and that a presidential pardon shouldn’t unlock the keys to the country’s coffers without the publicity and reviewability of a court proceeding, applies across administrations.

Senator Graham defended his self-serving vote by saying that “If the government can get away with this, they’ll keep doing it.” The same can be said of Trump’s FTCA claim. If Graham and his colleagues truly want to stop governmental abuses and promote fiscal responsibility, they can start by passing legislation to prevent sitting presidents and recipients of presidential pardons from misusing the FTCA to loot the U.S. Treasury.

Chimène Keitner is a professor of law at the University of California, Davis School of Law and a Public Voices Fellow of the Op-Ed Project.