Barker is a program officer at the Charles F. Kettering Foundation and the lead editor of the foundation’s blog series “From Many, We.”

This is part of a series offering a nonpartisan counter to Project 2025, a conservative guideline to reforming government and policymaking during the first 180 days of a second Trump administration. The Fulcrum's cross partisan analysis of Project 2025 relies on unbiased critical thinking, reexamines outdated assumptions, and uses reason, scientific evidence, and data in analyzing and critiquing Project 2025.

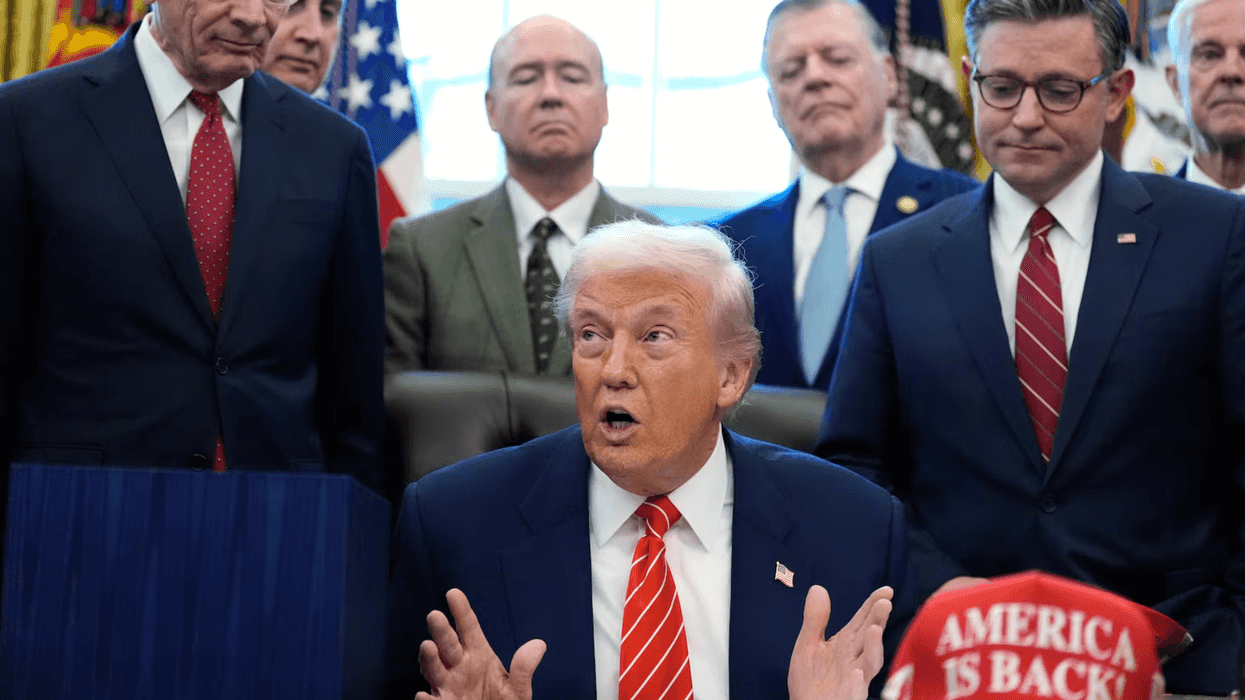

One small change to the rules classifying federal employees could significantly advance the U.S. toward authoritarianism. Project 2025, the Heritage Foundation’s plan to staff the government with far-right movement activists, hinges on an executive order that could be implemented with surprising ease.

While much attention has been paid to the initiative’s extremist policy agenda, a rules change called Schedule F would massively expand presidential power and fundamentally change the character of the federal government. Understanding the Schedule F threat is critical to stopping it.

What is Schedule F?

Schedule F is an executive order that former President Donald Trump issued in October 2020 to remove the employment protections that prevent career government employees from being replaced for partisan reasons. It was rescinded by President Joe Biden as soon as he took office in January 2021. If Schedule F were to be reinstated, the president would be virtually free to fire dedicated civil servants and replace them with loyalists and ideologues.

Although the Project 2025 website does not specifically refer to Schedule F, this obscure rule change is essentially synonymous with the Heritage Foundation’s initiative to install as many as 50,000 conservative movement activists in the government. The reinstatement of Schedule F on “day one” is also the first step of Trump’s campaign platform, Agenda47, under which he plans to “dismantle the deep state. ”

How does Schedule F threaten democracy?

By politicizing the civil service, Schedule F could have numerous, far-reaching implications for American democracy.

- Abuse of power. Under Schedule F, presidents would be free to reward cronies and even family members with jobs or use law enforcement agencies to punish enemies and shut down protests, creating endless opportunities for corruption. Independent agencies that currently provide oversight and accountability, such as the Department of Justice, would be rendered useless.

- Expansion of executive power. Schedule F, which was itself issued by executive order rather than legislation, would enable the president to effectively make policy without Congress. By invoking Schedule F, a president could also refuse to enforce existing legislation. The plan to expand executive power is informed by the “unitary executive theory,” which essentially removes any limits to presidential authority and is championed by conservative legal scholars.

- A chilling effect. In a climate where any expression contrary to the president’s ideology could result in termination, government employees would be strongly discouraged from speaking out. Agencies obligated to tell the truth to the American people could be incentivized to suppress the truth and spread misinformation.

- Trust in government. Trust in government is already historically low. By further politicizing the government and creating chaos within it, Schedule F could contribute to further polarization and mistrust, both of which could lead to further democratic backsliding.

According to scholar Don Moynihan, “ Schedule F would be the most profound change to the civil service system since its creation in 1883.” Schedule F demands urgent attention from every pro-democracy citizen and organization. Now is the time to raise awareness of this critical threat to American democracy.

Schedule F Resources

- Protect Democracy distinguishes Schedule F from legitimate reform efforts.

- Leading policy scholars and former government executives have signed the Working Group to Protect and Reform the US Civil Service Statement voicing their concerns.

- Schedule F would have a significant impact on government performance and accountability, according to Moynihan.

- Finally, Moynihan’s short paper provides a more detailed overview of Schedule F and its intellectual underpinnings.

This article was initially published by the Charles F. Kettering Foundation.

More in The Fulcrum about Project 2025

- A cross-partisan approach

- An Introduction

- Rumors of Project 2025’s Demise are Greatly Exaggerated

- Department of Education

- Managing the bureaucracy

- Department of Defense

- Department of Energy

- The Environmental Protection Agency

- Education Savings Accounts

- Department of Veterans Affairs

- The Department of Homeland Security

- U.S. Agency for International Development

- Affirmative action

- A federal Parents' Bill of Rights

- Department of Labor

- Intelligence community

- Department of State

- Department of the Interior

- Federal Communications Commission

- A perspective from Europe

- Department of Health and Human Services

- Voting Rights Act

- Another look at the Federal Communications Commission

- A Christo-fascist manifesto designing a theocracy

Trump & Hegseth gave Mark Kelly a huge 2028 gift