Democrats Look Past Trump as Old Economic Answers Beckon

Robert Cropf, Professor of Political Science, Saint Louis University

For a decade, Democrats have defined themselves largely by their opposition to Donald Trump, a posture taken in response to institutional crises and a sustained effort to defend democratic norms from erosion. Whatever Trump may claim, he will not be on the 2028 presidential ballot. This moment offers Democrats an opportunity to do something they have postponed for years: move beyond resistance politics and articulate a serious, forward-looking strategy for governing. Notably, at least one emerging Democratic policy group has begun studying what governing might look like in a post-Trump era, signaling an early attempt to think beyond opposition alone.

While Democrats’ growing willingness to look past Trump is a welcome development, there is a real danger in relying too heavily on familiar policy approaches. Established frameworks offer comfort and coherence, but they also carry risks, especially when the conditions that once made them successful no longer hold.

Turning to an Old Playbook

The immediate vehicle for this shift is a newly formed centrist Democratic policy group, made up largely of lawmakers associated with the party’s moderate, pro-business wing and overlapping with the New Democrat Coalition, a long-standing caucus of center-left House Democrats that promotes market-oriented growth, fiscal moderation, and bipartisan deal-making. Framing itself as an answer to voter anxiety over prices and cost-of-living pressures, the group emphasizes affordability, economic growth, and pragmatic reform. It presents itself as a governing corrective, an effort to replace permanent resistance politics with something that looks more like a governing agenda.

In practice, the emergence of this group reflects a little of both: a genuine attempt to move beyond Trump-centered politics and a reflexive return to ideas Democrats once believed worked. In that sense, it represents change shaped by institutional habit. Its aims also align broadly with the party’s emerging “Abundance” school of thought, associated with writers such as Ezra Klein, which argues that Democrats should focus less on redistribution alone and more on removing bottlenecks that constrain growth, from housing supply and infrastructure to energy and building permits. The economic framework behind much of this effort remains neoliberalism, an emphasis on market-friendly growth, fiscal restraint, and incremental reform that aims to smooth capitalism’s rough edges rather than confront its power dynamics.

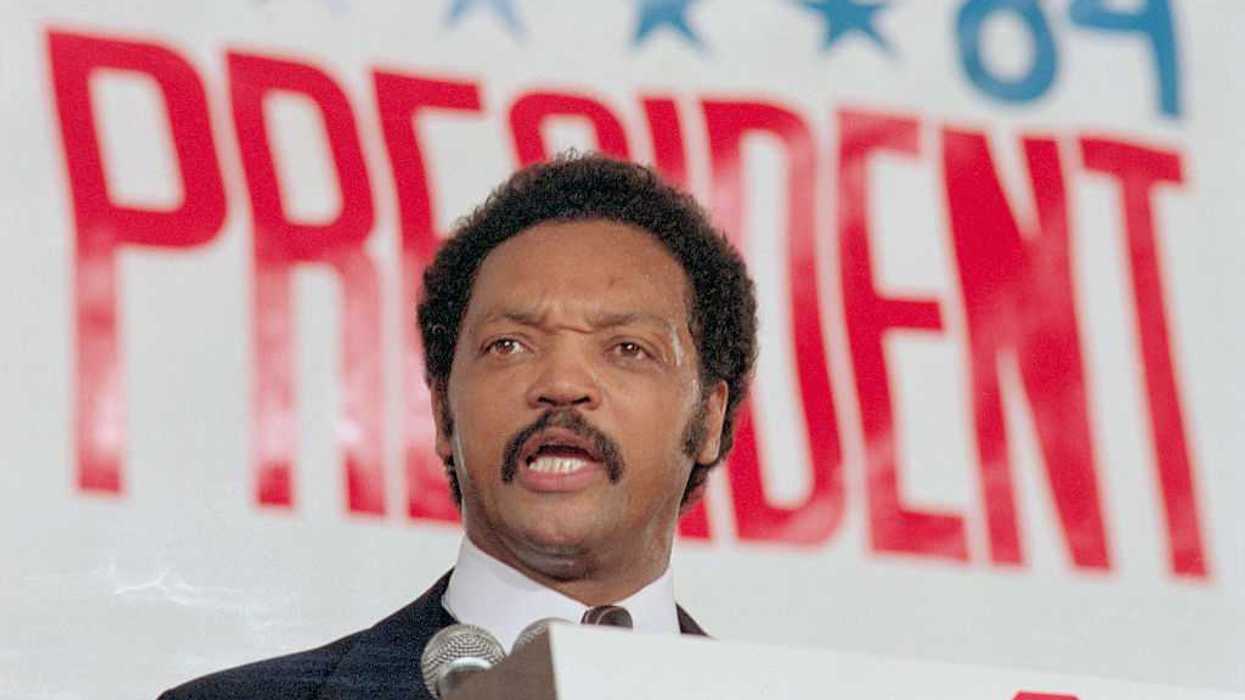

This governing philosophy was most clearly embraced by leaders like Bill Clinton in the United States and Tony Blair in the United Kingdom, whose electoral successes helped normalize neoliberalism as the default governing ideology for center-left parties. In both cases, neoliberalism helped their parties reclaim power and preside over periods of economic stability and political dominance. But that success proved contingent and temporary. Over time, the same model widened inequality, weakened labor, and left large segments of the electorate feeling exposed and disposable. Those unresolved grievances did not fade; they hardened, helping to pave the way for the populist backlash that followed, from the Tea Party to MAGA. The risk Democrats face is simpler: without a strong alternative framework, familiar policy approaches can seem more flexible than they really are. That makes it easier to mistake past electoral success for a solution to today’s deeper discontent.

Affordability and Its Limits

On the substance, the group is right about one thing: affordability is a real and growing problem for many ordinary Americans. Despite Trump’s rosy declarations about the economy, middle- and lower-income families continue to feel the squeeze from high prices, stagnant wages, and persistent economic uncertainty. For younger Americans in particular, the costs of housing, childcare, and education have pushed once-routine milestones, such as buying a home or starting a family, further out of reach. Wall Street may be up, but for many Americans, the rest of the economy feels stubbornly out of sync with that optimism.

Recognizing the affordability crisis, however, is not the same as being able to solve it. Neoliberalism has always been more comfortable diagnosing price pressures than confronting the deeper structural forces that produce them. Its preferred tools, market incentives, modest tax adjustments, and supply-side nudges, rest on the assumption that if growth resumes and inflation cools, affordability will eventually follow.

Today’s affordability crisis is not an accidental byproduct of otherwise healthy markets. It is rooted in structural imbalances that neoliberal governance not only failed to correct, but actively helped create. Decades of deregulation and consolidation enabled highly concentrated corporate power. The financialization of housing transformed shelter into an investment vehicle, constraining supply while driving up prices. Labor’s bargaining power was weakened by policy choices that prioritized employer flexibility, leaving workers with less leverage over wages, fewer protections on the job, and greater exposure to economic risk. And essential goods—healthcare, education, and childcare—were increasingly treated as market commodities, allowing their costs to detach from wage growth altogether.

Taken together, these dynamics show that neoliberalism does more than fall short of the moment; it helps explain what gave rise to it. By privileging efficiency, capital mobility, and market discipline over wage growth, job security, and public investment, it created an economy that appears strong on paper while leaving large portions of the population permanently exposed. When Democrats lean on this framework to address affordability, they risk offering remedies that treat symptoms while leaving the underlying conditions intact.

Why the Model Persists

At this point, my analysis shifts from outcomes to institutions. If neoliberalism no longer delivers broad economic security, the obvious question is why it continues to exert such a powerful pull on Democratic policymakers. The answer is not simply ideological inertia. Neoliberalism persists because it remains understandable to the institutions that translate economic conditions into policy and to the elites who operate within them.

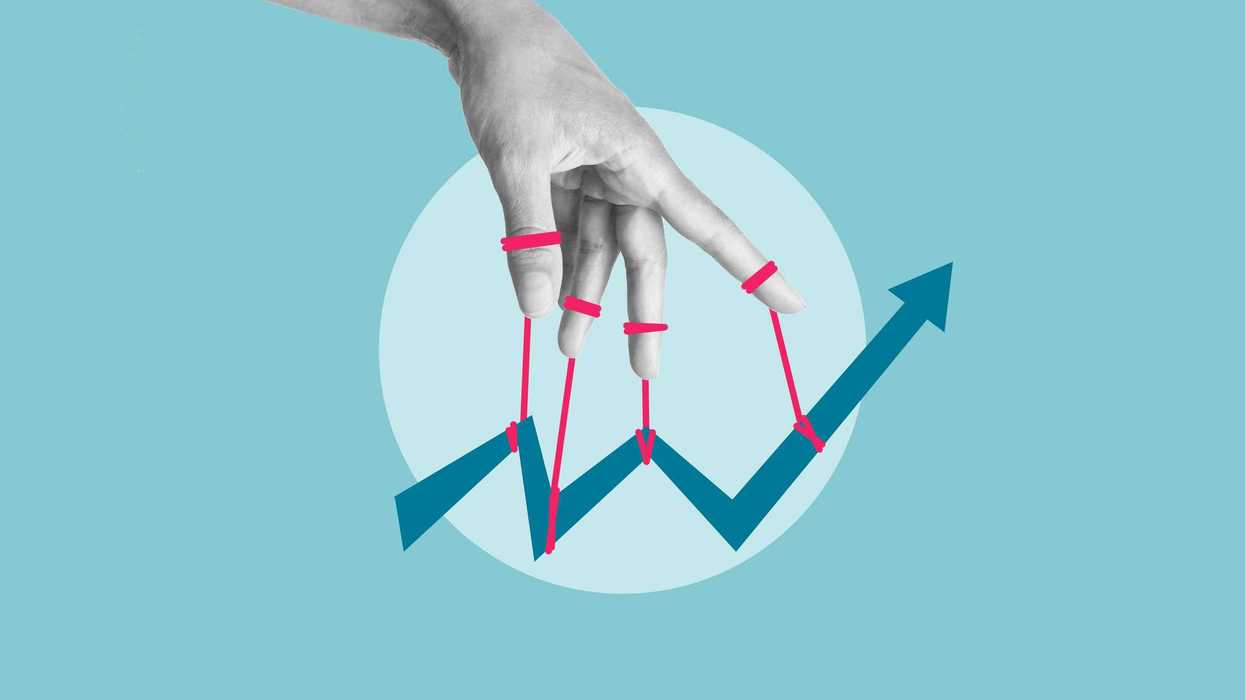

Those assumptions align neatly with the metrics policymakers are trained to trust: GDP growth, stock market performance, and inflation targets. It fits comfortably within existing budget processes, regulatory frameworks, and media narratives that treat economic health as something measurable from above rather than lived from below. It produces charts, benchmarks, and talking points that signal competence, even when those signals no longer correspond to everyday experience.

This is where the deeper political danger emerges. When official indicators point upward while lived reality does not, the basic understanding between institutions and citizens about what economic success actually means erodes. Voters do not simply disagree with policymakers; they stop believing them. “The economy is strong” sounds less like reassurance and more like dismissal of valid claims. Over time, that gap fuels cynicism, resentment, and a growing susceptibility to populist narratives that promise emotional recognition rather than factual accuracy. By returning to a framework that prioritizes ideological consistency and elite consensus over how people actually experience the economy, Democrats risk reinforcing the very disconnect that helped produce the backlash they are now trying to move beyond.

What a Post-Neoliberal Governing Agenda Would Require

If Democrats are serious about moving beyond resistance politics, they will eventually have to move beyond neoliberalism as well. That does not mean abandoning markets or pursuing rigid, ideological policy agendas. It means recognizing that affordability cannot be restored through marginal adjustments alone when the underlying economic structure remains tilted against ordinary households. A post-neoliberal governing agenda would have to confront power as well as prices, rebuilding labor’s bargaining position, treating housing as shelter rather than a speculative asset, reasserting antitrust authority, and investing in public capacity where markets have repeatedly failed to deliver stability.

Just as importantly, it would require a different conception of economic success. Instead of relying on aggregate indicators that signal health from a distance, Democrats would need to ground policy in outcomes that people actually experience: secure housing, predictable costs, and a sense that personal effort still leads somewhere. That shift is less about ideology than about alignment, bringing institutional measures of success back into line with lived economic reality.

The Choice Ahead

The temptation to return to familiar economic answers is understandable. Neoliberalism offers clarity, legibility, and a comforting sense of control. It fits existing institutions and reassures donors, markets, and policymakers alike. But comfort is not the same as adequacy, and legibility is not the same as legitimacy.

As Democrats look past Trump, they face a choice that is ultimately less about tactics than about diagnosis. They can treat today’s economic anxiety as a temporary mismatch between perception and performance, or they can acknowledge it as a signal that the governing model itself needs revision. The former offers reassurance. The latter demands imagination.

Trump may be leaving the ballot, but the conditions that made his politics possible are not disappearing on their own. If Democrats want to govern in the post-Trump era rather than simply survive it, they will need to do more than revive old answers. They will need to build an economic narrative and an institutional response that people can once again recognize as their own.