Affordability has become a political issue because the cost of basic necessities - food, health and child care, transportation, and housing - for 43% of families today outruns their wages.

Inflation is one factor. But the affordability issue exists primarily because inflation-adjusted (real) wages for 80% of working- and middle-class men and women have been essentially frozen for the past 46 years.

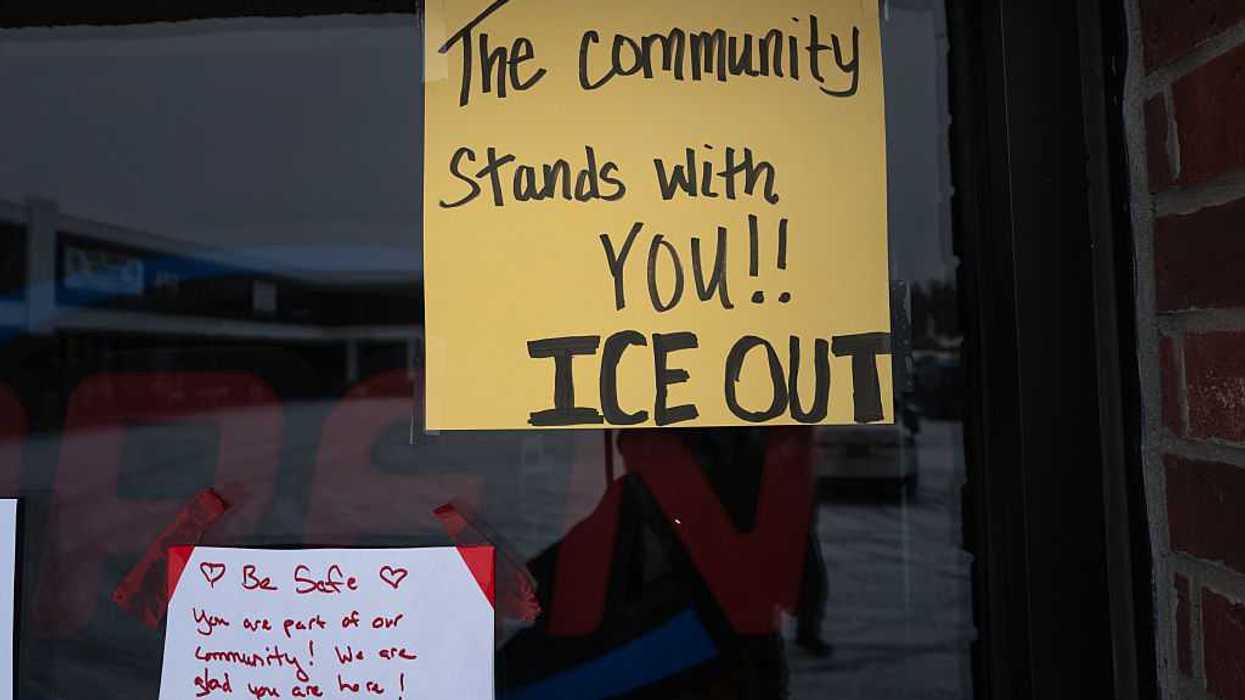

Most men and women are frustrated and hamstrung by wage stagnation: 59% of workers across all sectors would now welcome unionization. They hunger for an economy that works for them, not billionaires, and are eagerly challenging antiunion elites like Elon Musk and Jeff Bezos, who habitually suppress wages.

Working men and women will base their votes on facts if they have them. So Democrats need a compelling factual message for 2026 centered on unfreezing wages – a message replete with heroes and villains.

The Heroes: FDR’s New Deal Made America the Land of Opportunity

Even some economists are unaware that the Bureau of Labor Statistics (BLS) has long maintained an extensive database on America’s working- and middle-class men and women. BLS describes them as “production, nonsupervisory” employees, and they comprise the lowest-earning 80% (111 million) of all private-sector nonfarm workers. From 1948-1979, as New Deal union organizing and collective bargaining strengthened, their real average hourly compensation (wages and benefits) rose an unprecedented 2.1% annually. The formula was simple: government-supported collective bargaining and stringent financial and antitrust regulations raised employee wages at the expense of profits.

That is why the share of national income accruing to the wealthiest 1% during this period fell by half from 21.6% in 1941 to 10.4% in 1980.

This was a stunning, unprecedented event. Throughout global history, wages had stagnated, with an average of half or fewer children out-earning their parents. Rising wages during the New Deal changed that: a huge majority (>90%) of U.S. children born in 1940 earned higher real household incomes at age 30 than their parents had at that age. The transformational New Deal formula created the gigantic American middle class, the fortunate generation of working-class men and women who realized the American Dream.

The Villains: Reaganomics Turned the American Dream into a Pipedream

America’s wealthiest conservatives and the deeply cynical Ronald Reagan put a stop to that, freezing wages over the 46 years since.

Billionaires Joseph Coors and Richard Mellon Scaife financed the 1981 Reagan economic blueprint called Reaganomics – directing Reagan and the Republicans to reverse the decline in their share of income. Reagan complied, empowering employers to break labor unions while enacting trade laws that incentivized job offshoring (Reagan’s maquiladora factories and later Trump’s 2017 tax law). The real Federal minimum wage was frozen below $10/hour, and Republican-led states adopted laws kneecapping collective bargaining.

Moreover, in the decades that followed, Wall Street Democrats Clinton and Obama offered only tepid support for unions or wages, and enacted their own trade laws (Clinton’s NAFTA, Obama’s Trans-Pacific Partnership) that further encouraged job offshoring and suppressed wages.

Since 1981, billionaires have continued to demand wage suppression. For example, six wealthy, conservative billionaire family fortunes funded Project 2025 giving directions to the Trump administration - the $100 billion Koch family (oil and gas), the huge Scaife Family Foundations (Mellon banking, aluminum, oil), and the Bradley (industrial parts), Uihlein (electronics, office supplies), Coors (brewing), and Seid (electronics) families.

Reaganomic policies have essentially frozen real average hourly compensation for the two generations from 1979 to 2025 for the vast “production, nonsupervisory” workforce - inching up a minuscule 0.6% annually.

That has enabled the national income share of the top 1% to double to 20.7%.

Consequently, U.S. children born in 1980 – with the misfortune of living their entire lives under Reaganomics – had earned on average at age 30 no more than their parents had at that age. As Isabel Sawhill of Brookings summarized, for “those born after about 1970 … absolute mobility has declined.”

This wage freeze, documented by BLS experts, was inevitable once Reagan embraced billionaires. For non-economists, the underlying explanatory economic theory – documented by a recent Nobel Prize – is that oligarchs routinely manipulate politics to maximize their own incomes. They create pantomime democracies like the U.S., called functional oligarchies. In contrast, that means democracy is a precondition for widespread prosperity - vibrant democracies like Denmark or Sweden see working- and middle-class men and women setting economic policy. The stark evidence: unlike northern Europe, U.S. income inequality is even greater than Russia's.

You have just read why Trump and the Republicans are hostile to democracy. They reject the economic principles of Founders like Thomas Jefferson and Thomas Paine, which hold that a vibrant democracy must corral oligarchs to realize inclusive, broadly based prosperity.

America is a Functional Oligarchy

Their real compensation frozen by elites since Reagan, 69% of Americans now view the American Dream as a pipedream – dismissing as myth the notion that grit and schooling alone will enable them to prosper. And a stunning 72% believe that America is no longer a democracy – with 87% of independents (and even 68% of Republicans) believing “the rich have too much political power.” They are angry with America’s functional oligarchy, a predatory system where families are daily fleeced - “bled dry by landlords, hospital administrators, university bursars and child-care centers” - an economic system that feels “downright terrible,” reports the Atlantic.

That reality is why many voters have difficulty distinguishing between the two political parties: neither Democrats nor Republicans are viewed as prioritizing the economic concerns of ordinary people.

Democratic Party Retooling: Populism and Anger at Republican Billionaires

Democratic centrists want the Party to retool in 2026 – move toward populist themes and away from cultural issues. “The Democratic Party must now run on the most populist economic platform since the Great Depression,” urges James Carville.

That starts with dramatizing the stunning BLS evidence that working- and middle-class wages have been frozen for two generations

And it means reprising Obama’s 2012 campaign of political conflict against the private equity CEO Mitt Romney. Mindful that 62% of independents believe the economy unfairly favors the wealthy, Democrats should channel voter economic frustration toward billionaire Republicans. They and Trump should be called out for their hostility and disdain for unions and working men and women.

This strategy upgrade would especially appeal to swing voters, disproportionately working-class men and women under economic pressure. And its populist foundation matches the profile of moderate Democrats like Kentucky Governor Beshear and Arizona Senator Gallego, who have overperformed recently with swing voters.

George Tyler is a former deputy assistant treasury secretary and World Bank official. He is the author of books including Billionaire Democracy and What Went Wrong.

Trump & Hegseth gave Mark Kelly a huge 2028 gift