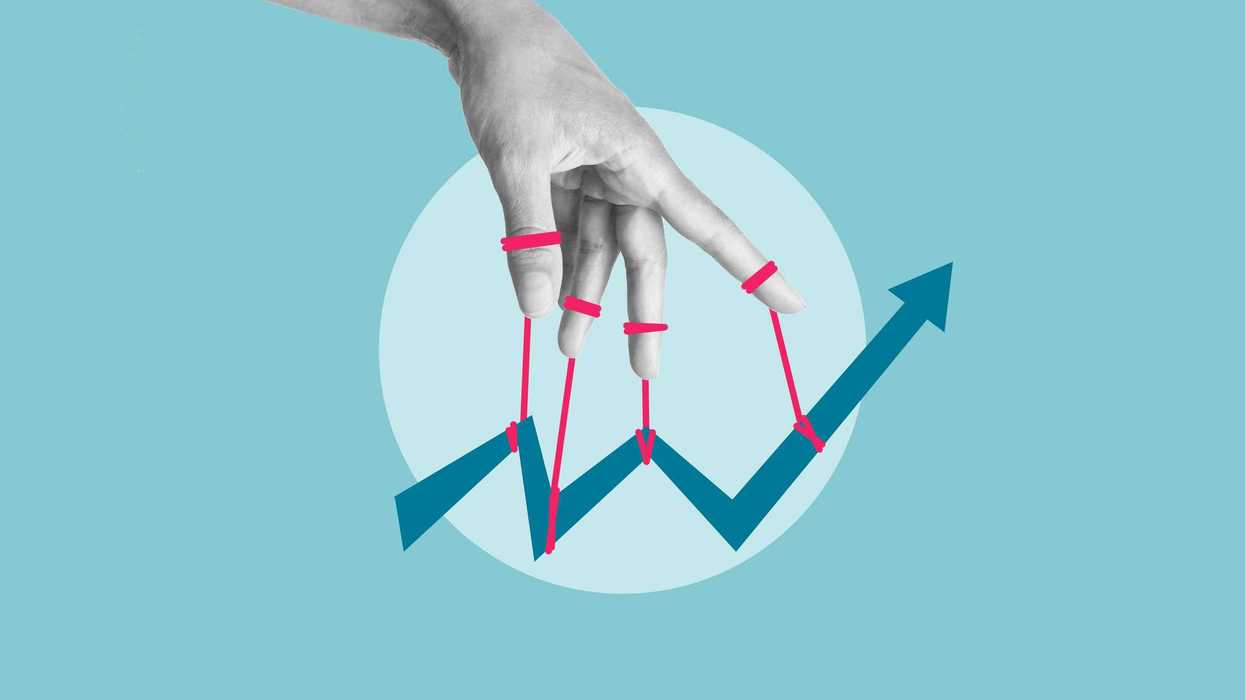

The Fed Is the Economy’s Thermostat

The Federal Reserve functions as the thermostat of the U.S. economy, insulated from short-term political and electoral pressure. When inflation heats up, it turns the dial down. When growth falters, it eases conditions. The goal is not to keep politicians comfortable in the moment, but to maintain stability over time.

Think of Jerome Powell as the technician in charge of that thermostat. He and the other board members are responsible for reading the economy’s temperature and adjusting based on economic data, not on the demands of political actors in the room.

Threaten the technician with criminal prosecution to force compliance and pressure meant to secure compliance instead destabilizes the entire system. The thermostat loses credibility. The readings become unreliable. Everyone inside the building starts wondering whether the heat is being controlled by climate or by fear.

By using the threat of a Justice Department investigation to pressure the Fed’s chair, the Trump administration has crossed a line that goes beyond long-standing norms of U.S. governance. It uses legal intimidation to coerce economic policymaking, injecting political risk directly into the machinery of monetary policy itself.

To be clear, this is no mere disagreement over interest rates. It is a test of whether the institutions designed to stabilize the U.S. economy can function when independence invites personal risk, and whether markets can continue to trust decisions made under the shadow of political coercion.

Why the Fed Is Independent

The Federal Reserve’s independence reflects lessons learned the hard way, including during the inflation shock of the 1970s, when sustained political pressure on the Federal Reserve under President Nixon produced short-term relief but long-term economic damage. Congress designed the Fed this way to protect the economy from those short-term pressures.

Lawmakers insulated the Fed to separate monetary policy from electoral timelines. By granting long terms, limiting removal, and spreading authority across a committee rather than concentrating it in a single official, Congress sought to ensure that interest-rate decisions reflected economic conditions, not campaign calendars. Independence does not remove monetary policy from democracy; it prevents it from being hijacked by the pressures of the next election.

Credibility Is the Fed’s Real Power

If independence is the Fed’s insulation, credibility is its calibration. It is the invisible setting that ensures the thermostat responds to real economic conditions rather than outside pressure.

The Federal Reserve does not command markets; it persuades them. Its influence rests on credibility: the belief that policy decisions are grounded in data, judgment, and long-term economic goals rather than political convenience. That trust allows businesses to plan, investors to price risk, and households to borrow with some confidence about the future.

Once credibility erodes, monetary policy begins to fail, even if the formal structures remain intact. Markets do not wait for proof of political interference; they respond to its possibility. If investors believe interest-rate decisions reflect coercion rather than actual conditions, risk premiums rise, volatility increases, and the Fed’s guidance loses force. Trust, once damaged, is difficult to restore.

Why Presidential Pressure Isn’t Always Wrong

Critics of Fed independence often argue that interest rates are too important to be left entirely to unelected officials. Monetary policy affects wages, housing, employment, and investment, and presidents bear the political consequences when the economy falters.

That concern is not unwarranted. But accountability is not the same as control. Congress already provides democratic oversight through appointments, confirmation, statutory mandates, and regular testimony. What independence removes is the ability to impose short-term political demands on decisions meant to serve long-term economic stability.

When Pressure Becomes Coercion

Presidents have complained about the Federal Reserve before, as was true during Trump’s first term. What makes the current situation different is not criticism, but employing legal force. The use of a criminal investigation, or the threat of one, as leverage against a sitting Fed chair fundamentally alters the incentives surrounding monetary policy.

Once personal legal risk enters the picture, markets must ask not only what the Fed should do, but what it is free to do. That uncertainty does not require a conviction or a removal to have an effect. The mere possibility that interest-rate decisions are being shaped by intimidation rather than data is enough to weaken confidence, increase volatility, and raise the cost of capital.

What Congress Can Do to Protect the Fed

Restoring the Fed’s independence will not happen through good intentions or appeals to tradition. It will require action from a new Congress willing to reassert its constitutional role. A new Congress is necessary because the current leadership has shown little interest in checking executive overreach in this administration.

First, lawmakers should clarify and tighten the legal standard for removing Federal Reserve governors and the chair. The statutory definition of “cause” should be explicit and narrow, limited to clear misconduct or incapacity, not policy disagreement or politically motivated investigations. Ambiguity invites pressure.

Second, Congress should strengthen firewalls between monetary policy and the Justice Department. While no official is above the law, criminal investigations involving sitting Fed officials should trigger heightened review or independent oversight, reducing the risk that prosecutorial tools are used as leverage in policy disputes.

Third, Congress should reinforce transparency when the Fed’s independence is threatened. Requiring prompt public disclosure of executive-branch actions that bear on monetary autonomy would make coercion harder to apply quietly and easier for markets to assess.

Finally, Congress must reclaim its own economic authority. Regular budgeting, clearer fiscal signals, and a willingness to check presidential overreach would reduce the temptation for the White House to pressure the Fed to compensate for legislative dysfunction.

Conclusion: Independence as Economic Infrastructure

What happens to the Federal Reserve rarely stays confined to the Federal Reserve.

The Fed’s independence is a form of economic infrastructure: quiet, often invisible, but essential. Undermining it does not trigger an immediate crisis. Instead, it slowly erodes trust, raises risk, and makes the economy more vulnerable to political shocks.

The danger is not that the Fed might defy a president. It is that future Fed chairs may hesitate to do so, knowing that independence now carries personal risk. When that happens, there may still be a thermostat on the wall, but it will no longer control the temperature.

Robert Cropf is a Professor of Political Science at Saint Louis University.

Trump & Hegseth gave Mark Kelly a huge 2028 gift